How to Form a US LLC from Lesotho

Are you a visionary entrepreneur from the Mountain Kingdom of Lesotho looking to scale new heights in the business world? Forming a US LLC could be your gateway to global markets. This comprehensive guide will walk you through how to form a US LLC from Lesotho, opening up a world of opportunities for your business ventures.

Why Lesotho Entrepreneurs Should Consider Forming a US LLC

Before we dive into the process of how to form a US LLC from Lesotho, let’s explore the benefits:

- Access to the world’s largest economy

- Enhanced credibility with international partners

- Asset protection that spans continents

- Potential tax advantages

- Easier access to US financial systems and global payment processors

Prerequisites for Forming a US LLC from Lesotho

Before embarking on your journey to form a US LLC from Lesotho, ensure you have:

- A valid Lesotho passport

- Proof of address in Lesotho (utility bill or bank statement)

- Funds for LLC formation fees and ongoing services

- A clear vision of your US business goals

Related: How to Form a US LLC from Liberia

Step-by-Step Guide: How to Form a US LLC from Lesotho

1. Choose Your Trusted Guide: Northwest Registered Agent

Just as the mountains of Lesotho need experienced guides, you need a reliable registered agent. Northwest Registered Agent is your ideal partner in learning how to form a US LLC from Lesotho.

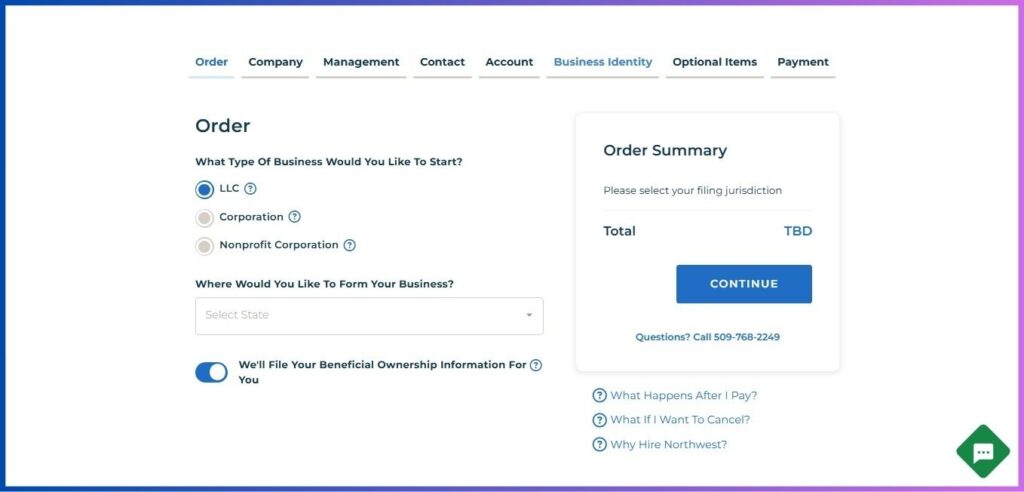

2. Begin Your US LLC Formation Journey

- Visit the Northwest Registered Agent website

- Click “Start Your Business”

- Select “LLC” as your business type

- Choose your preferred state (research which state aligns with your business needs)

- Opt for Northwest to handle your Beneficial Ownership Information filing

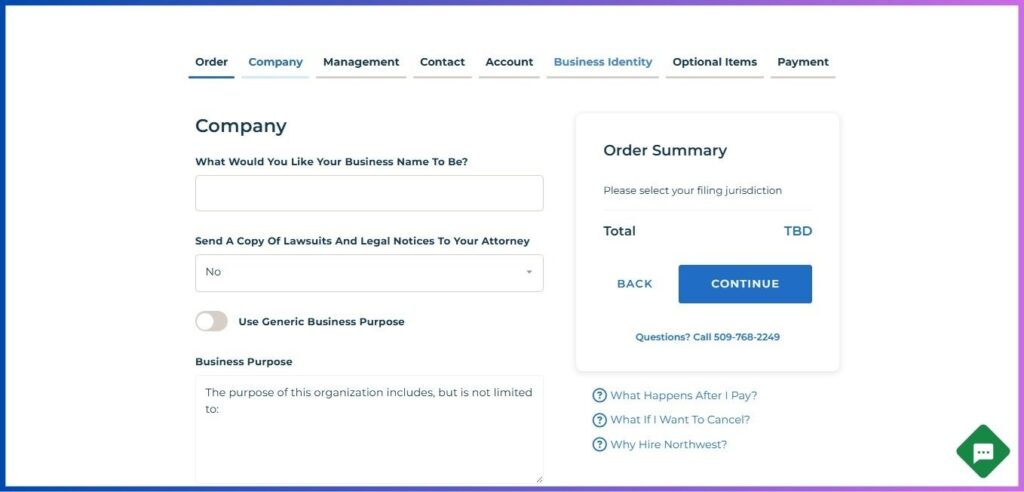

3. Name Your US LLC

- Choose a unique name that reflects your Lesotho roots and US ambitions

- Ensure it ends with “LLC” or “Limited Liability Company”

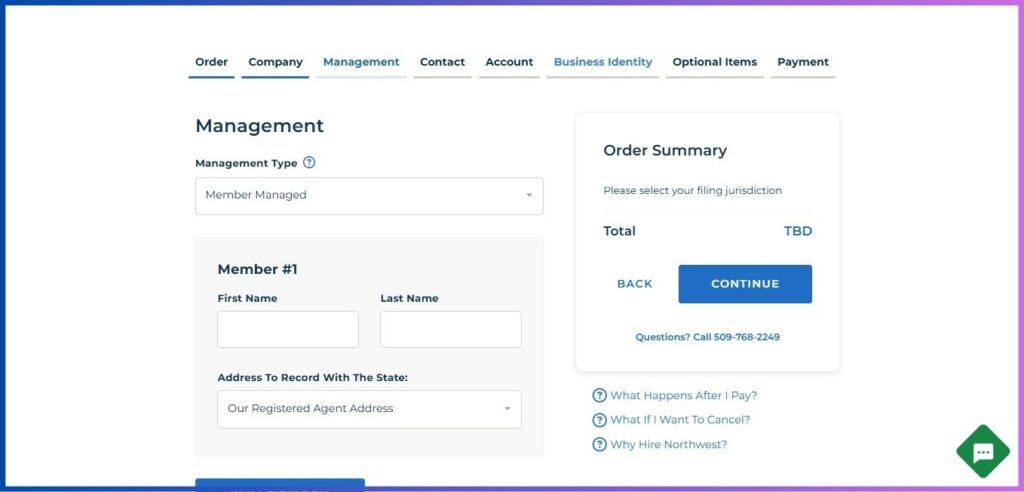

4. Establish Your LLC’s Structure

- Select “Member Managed” (ideal for most small LLCs)

- Enter your details as the primary member:

- Use your name as it appears on your Lesotho passport

- Opt for Northwest’s US address to maintain privacy

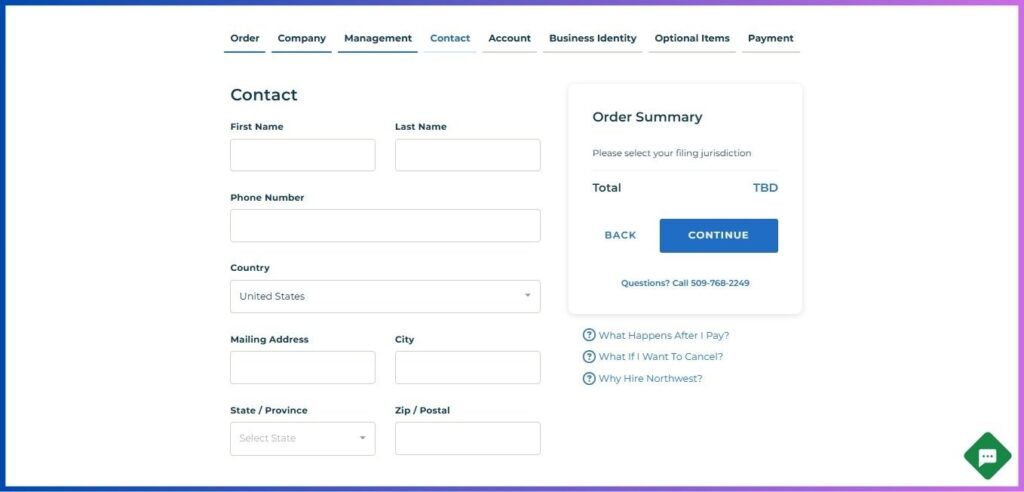

5. Provide Your Lesotho Contact Information

- Full name

- Email address

- Phone number (including Lesotho’s country code +266)

- Your physical address in Lesotho

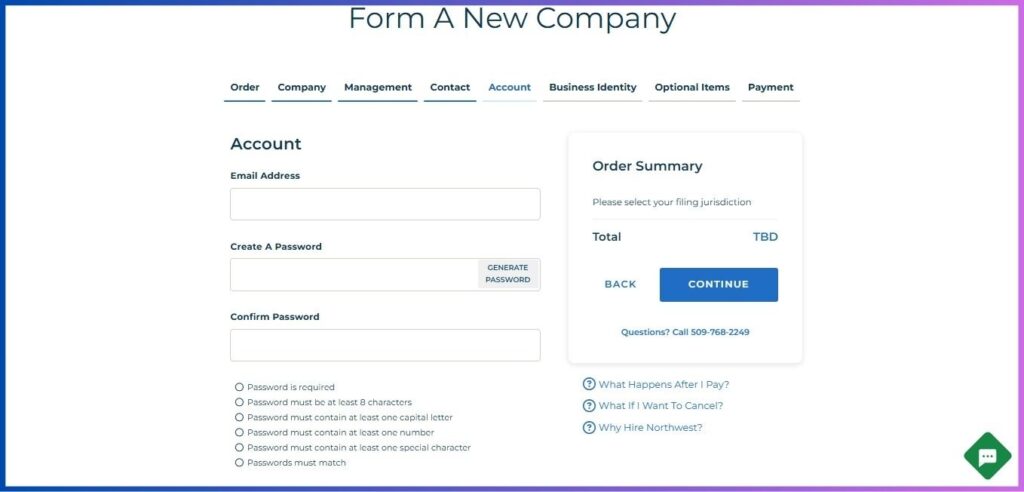

6. Create Your Northwest Account

- Enter a valid email address

- Create a strong password:

- At least 8 characters

- Include uppercase and lowercase letters

- Add numbers and special characters

- Confirm your password

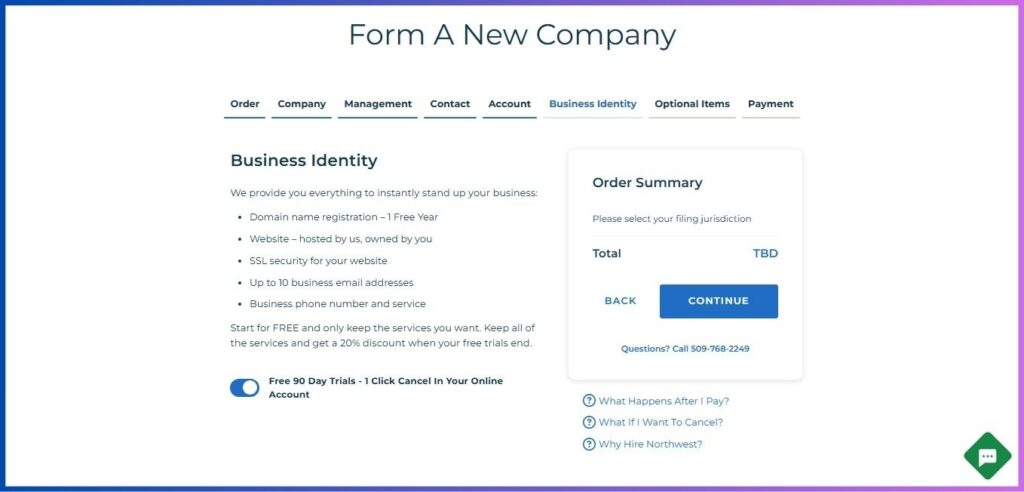

7. Establish Your US Business Identity

Northwest offers a comprehensive package to help you form a US LLC from Lesotho:

- Free domain name registration for 1 year

- Website hosting

- SSL security

- Up to 10 business email addresses

- US business phone number and service

Start with a free trial and keep the services that best suit your Lesotho-based business needs.

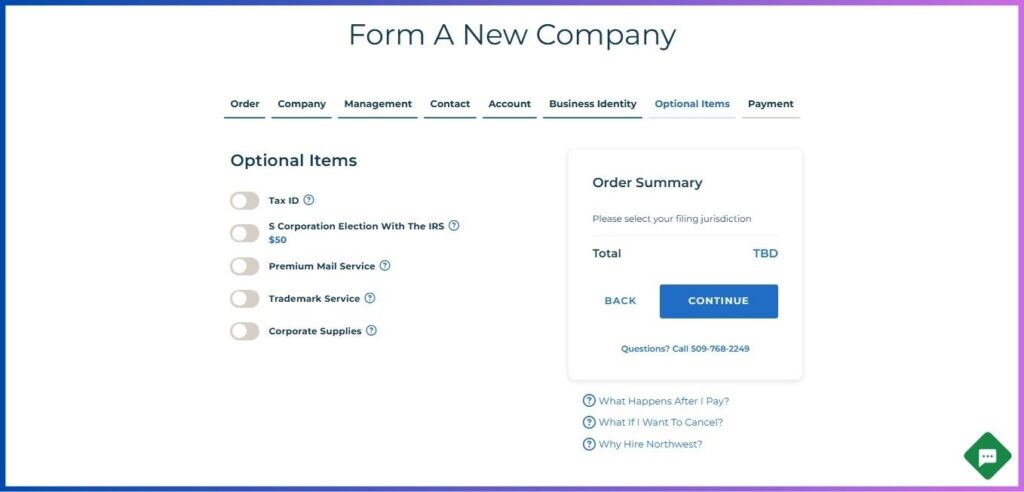

8. Select Additional Services

Consider these valuable add-ons as you form a US LLC from Lesotho:

- US virtual phone number

- EIN obtainment service

- LLC Operating Agreement template

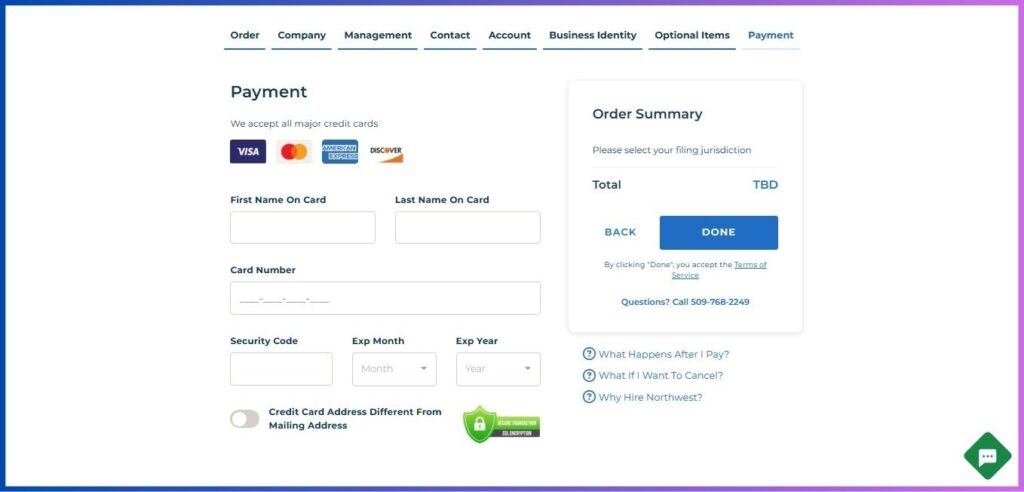

9. Review and Make Payment

- Double-check all information

- Pay using an international credit card or wire transfer

After Forming Your US LLC from Lesotho

1. Obtain an EIN

As a Lesotho resident, you’ll need an Employer Identification Number (EIN):

- Use Northwest’s EIN service, or

- File Form SS-4 by mail or fax

2. Create an Operating Agreement

While optional, an Operating Agreement is crucial for Lesotho-based owners to define LLC operations.

3. Open a US Bank Account

This can be challenging but is essential:

- Research banks serving non-resident LLC owners

- Prepare necessary documents:

- LLC formation documents

- EIN

- Lesotho passport

- Proof of Lesotho address

- Notarized identification

4. Understand Your Tax Obligations

As a Lesotho resident owning a US LLC:

- Your LLC may need to file an annual US tax return

- Consult with tax professionals familiar with US and Lesotho tax laws

5. File Beneficial Ownership Information

From January 1, 2024:

- Most LLCs must file a BOI Report with FinCEN

- Northwest can handle this for you

6. Maintain Compliance

Stay compliant with:

- Annual reports

- Franchise taxes (if applicable)

- Keeping a registered agent

Special Considerations When Forming a US LLC from Lesotho

- Time Zones: Plan for time differences between Lesotho and the US

- Currency Exchange: Consider fluctuations between Lesotho Loti and US Dollar

- Travel Planning: Prepare for potential US visits (check visa requirements)

- Local Regulations: Ensure your US LLC complies with Lesotho’s business laws

Conclusion: Your Lesotho-US Business Adventure Awaits

Learning how to form a US LLC from Lesotho might seem as challenging as scaling Thabana Ntlenyana, but with this guide and Northwest Registered Agent, you’re well-equipped for the journey. By forming a US LLC from Lesotho, you’re not just starting a business; you’re building a bridge between the Mountain Kingdom and the land of opportunity.

Related: How to Form a US LLC from Guinea

Remember, while this guide provides a comprehensive overview of how to form a US LLC from Lesotho, it’s always wise to consult with legal and tax professionals to ensure your international business venture starts on solid ground.

Take the first step today in forming your US LLC from Lesotho, and watch your business soar to new heights!

Disclosure: We may earn commission for purchases that are made by visitors on this site at no additional cost on your end. All information is for educational purposes and is not intended for financial advice. Read our affiliate disclosure.