Multi-Currency Payments: The Complete Guide for Global Businesses

Learn how to expand globally, boost conversions, and deliver superior customer experiences with multi-currency payment solutions.

Introduction to Multi-Currency Payments

In today’s interconnected global economy, businesses are no longer confined to their local markets. E-commerce has opened doors to customers worldwide, creating unprecedented opportunities for growth and expansion. However, with these opportunities come challenges, particularly in how businesses handle payments across different currencies and regions.

Multi-currency payment solutions have emerged as a critical tool for businesses looking to succeed in the international marketplace. These systems allow companies to accept payments in various currencies, providing customers with a seamless, localized shopping experience regardless of their location. For global businesses, implementing effective multi-currency payment strategies isn’t just a convenience—it’s a competitive necessity.

Research consistently shows that customers prefer to shop in their local currency. According to recent studies, 93% of global consumers say that seeing prices in their local currency significantly impacts their purchasing decisions, and 13% abandon their carts when faced with foreign currencies. These statistics highlight the importance of offering multi-currency payment options to maximize conversion rates and customer satisfaction.

This comprehensive guide explores everything businesses need to know about multi-currency payments—from understanding the fundamentals and benefits to implementing effective strategies and overcoming common challenges. Whether you’re just beginning your global expansion or looking to optimize your existing international payment infrastructure, this resource will provide valuable insights to help your business thrive in the global marketplace.

Enhance Your Multi-Currency Strategy with Geo Targetly

Improve customer experience and boost conversions by automatically displaying prices in your visitors’ local currencies.

Get Started with Geo Targetly

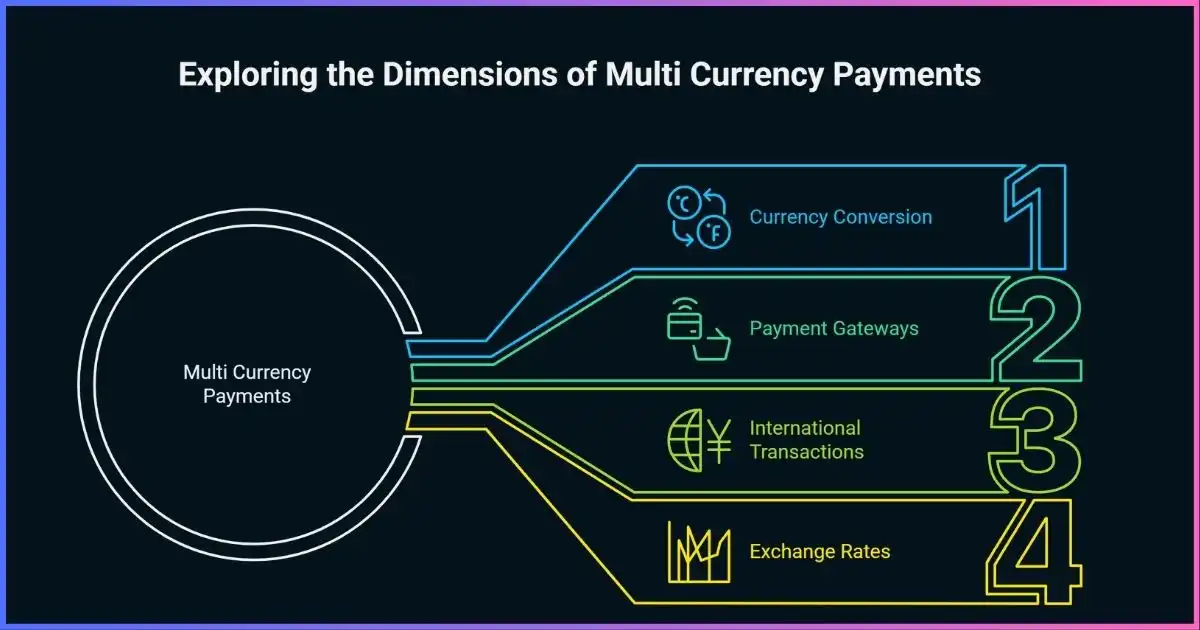

Understanding Multi-Currency Payments

Multi-currency payment processing enables businesses to accept and process transactions in multiple currencies, allowing customers to pay in their preferred local currency while the business receives funds in their chosen currency. This system bridges the gap between global commerce and local customer expectations.

How Multi-Currency Payments Work

At its core, multi-currency payment processing involves several key components working together:

- Currency Detection: The payment system detects a customer’s location through IP geolocation or allows them to manually select their preferred currency.

- Price Conversion: Product prices are dynamically converted from the business’s base currency to the customer’s local currency using current exchange rates.

- Payment Processing: When a customer makes a purchase, the payment is processed in their local currency through a payment gateway that supports multi-currency transactions.

- Currency Conversion: The payment is then converted to the merchant’s preferred currency for settlement, either immediately or at a later time depending on the system configuration.

- Settlement: Funds are deposited into the merchant’s account in their preferred currency, completing the transaction cycle.

Key Components of Multi-Currency Payment Systems

Currency Conversion Engine

Manages real-time exchange rates and applies them to transactions, ensuring accurate conversions between different currencies based on current market rates.

Payment Gateway Integration

Connects to payment processors that support multi-currency transactions and provides the technical infrastructure to securely process payments in different currencies.

Geolocation Technology

Automatically detects customer location to display prices in the appropriate local currency, creating a personalized shopping experience.

Fraud Prevention Systems

Specialized tools that identify and prevent fraudulent transactions across multiple currencies and regions, protecting both merchants and customers.

Settlement Models for Multi-Currency Payments

Businesses typically have two primary options for settling multi-currency transactions:

Immediate Conversion

In this model, customer payments are converted to the merchant’s base currency at the time of transaction. This approach offers simplicity and predictability but may result in less favorable exchange rates and additional fees for each transaction.

Multi-Currency Account

With this approach, businesses maintain balances in multiple currencies, allowing them to receive and hold funds in the original transaction currency. This provides greater flexibility in managing exchange rate risks and can reduce conversion costs when paying international suppliers or expenses in those same currencies.

Understanding these fundamentals provides the foundation for implementing an effective multi-currency payment strategy that aligns with your business goals and customer expectations.

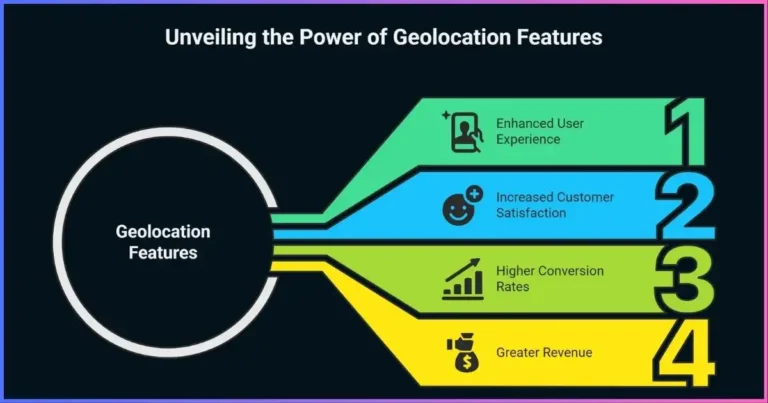

Benefits of Multi-Currency Payment Solutions

Implementing multi-currency payment capabilities offers numerous strategic advantages for businesses operating in the global marketplace. From improved customer experience to increased sales and operational efficiencies, the benefits extend throughout your business ecosystem.

Enhanced Customer Experience

Allowing customers to browse and pay in their preferred currency eliminates confusion and builds trust. When shoppers see familiar currency symbols and don’t need to calculate exchange rates, they’re more likely to complete their purchase.

Increased Conversion Rates

Studies show that displaying prices in local currencies can increase conversion rates by 7% or more. By removing currency barriers, businesses can significantly reduce cart abandonment rates and boost sales.

Expanded Global Reach

Multi-currency support opens doors to new markets and customer segments that might otherwise be inaccessible. This capability signals to international customers that your business is prepared to serve their needs.

Competitive Advantage

In markets where competitors may not offer multi-currency options, providing this feature can be a significant differentiator that drives consumer preference and loyalty.

Streamlined Operations

Modern multi-currency systems automate conversion processes, reducing manual work and the potential for human error in currency calculations and accounting.

Better Cash Flow Management

Multi-currency accounts allow businesses to hold funds in different currencies, providing flexibility to pay international suppliers, employees, or partners without additional currency conversion fees.

Impact on Customer Satisfaction and Sales

The data clearly demonstrates the significant impact of multi-currency support on business outcomes. Research indicates that 93% of global consumers say pricing in their local currency affects their purchase decision. When businesses implement localized pricing strategies, they create a more transparent and trustworthy shopping environment.

Additionally, customers who use one-click checkout features with localized currency options increase their spending by an average of 28.5% and their purchase frequency by 43%. These metrics highlight how removing currency barriers and friction points can dramatically improve customer engagement and loyalty.

Cart Abandonment Reduction

13%

When showing local currency prices

Increase in International Sales

30-40%

With multi-currency capabilities

Consumers Preferring Local Currency

93%

Say it affects purchase decisions

Enhance Your Multi-Currency Strategy with Geo Targetly

Improve customer experience and boost conversions by automatically displaying prices in your visitors’ local currencies.

Get Started with Geo TargetlyChallenges and Considerations

While multi-currency payment solutions offer significant benefits, they also present unique challenges that businesses must address to ensure successful implementation. Understanding and planning for these challenges is essential for maximizing the return on your multi-currency investment.

Currency Fluctuation Risks

One of the most significant challenges in handling multiple currencies is managing the risk associated with exchange rate volatility. Currency values can fluctuate rapidly due to economic events, political changes, or market conditions, potentially affecting your profit margins and pricing strategy.

Risk Management Strategies

- Hedging: Use forward contracts or currency options to lock in exchange rates for future transactions, protecting against adverse rate movements.

- Natural Hedging: Match revenues and expenses in the same currency where possible to reduce exposure to exchange rate fluctuations.

- Dynamic Pricing: Implement systems that automatically adjust prices based on exchange rate changes to maintain consistent profit margins.

- Rate Buffers: Add a small percentage markup to cover potential currency fluctuations between when an order is placed and when it’s settled.

Technical Implementation Challenges

Setting up multi-currency payment systems requires careful technical planning and integration. Some common technical challenges include:

Integration Complexity

Integrating multi-currency capabilities with existing systems like ERP, accounting software, and e-commerce platforms can be complex and may require custom development work.

Real-Time Rate Updates

Ensuring currency rates are updated in real-time to provide accurate pricing can strain website performance and requires reliable exchange rate data sources.

Payment Gateway Compatibility

Not all payment gateways offer equal multi-currency support, and businesses may need to work with multiple providers to cover all desired currencies.

Testing Requirements

Thorough testing is needed across different currencies, payment methods, and scenarios to ensure the system handles all transaction types correctly.

Regulatory and Compliance Considerations

Operating across multiple currencies often means navigating complex regulatory environments. Businesses must be aware of:

- Tax Implications: Each country has different rules for sales tax, VAT, or GST on international transactions. With over 19,000 tax jurisdictions worldwide, compliance can be extremely complex.

- Anti-Money Laundering (AML) Regulations: International payments require compliance with various AML laws that differ by country, often requiring enhanced customer verification.

- Data Protection Laws: Processing payments across borders involves handling customer data that may be subject to regulations like GDPR in Europe or various state and national laws in other regions.

- Banking Regulations: Some countries have restrictions on currency movements or require specific licenses to process certain types of transactions.

Cost Considerations

Multi-currency payment processing typically involves several types of costs that businesses should account for:

| Cost Type | Description | Typical Range |

|---|---|---|

| Currency Conversion Fees | Charged when converting from one currency to another | 1-4% above the mid-market rate |

| Cross-Border Transaction Fees | Additional fees for international payments | 0.5-2% per transaction |

| Payment Gateway Fees | Charges for processing multi-currency payments | 2-5% + fixed fee per transaction |

| Multi-Currency Account Fees | Costs for maintaining balances in multiple currencies | $0-50 monthly per currency |

| Implementation Costs | One-time setup and integration expenses | Varies widely by solution |

Despite these challenges, the benefits of multi-currency payments typically outweigh the costs for businesses serious about international expansion. With proper planning and the right partners, these obstacles can be effectively managed to create a seamless global payment experience.

Market Trends and Statistics

The global payment landscape is evolving rapidly, with cross-border commerce and multi-currency transactions growing at an unprecedented rate. Understanding these trends can help businesses anticipate changes and position themselves strategically in the international marketplace.

Growth of Cross-Border Payments

$392B

Projected market size by 2033

The global cross-border payments market is expected to grow from $190.2 billion in 2023 to $392.01 billion by 2033, reflecting a compound annual growth rate (CAGR) of 7.5%.

$250T

Transaction value by 2027

The value of cross-border payments is projected to increase from $150 trillion in 2017 to over $250 trillion by 2027, showing the massive scale of international money movement.

Consumer Preferences and Behavior

Research consistently shows that customers strongly prefer shopping in their local currency. Key statistics include:

93%

of consumers say pricing in their local currency impacts purchasing decisions

13%

of shoppers abandon carts when prices are shown in foreign currencies

76%

prefer purchasing products with information in their own language and currency

Payment Method Preferences by Region

Payment preferences vary significantly by region, highlighting the importance of offering localized payment options alongside multi-currency support:

- North America: Credit cards dominate (65%), with digital wallets growing rapidly (27%)

- Europe: Strong preference for bank transfers in Germany (46%), credit cards in the UK (55%), and digital wallets increasingly popular across the region

- Asia: Digital wallets lead in China (78%), with QR code payments particularly popular

- Latin America: Cash and local payment methods remain important, with installment payments (“buy now, pay later”) gaining significant traction

Emerging Technologies and Innovations

Several technological advancements are reshaping the multi-currency payment landscape:

Artificial Intelligence

AI implementation in financial services is expected to increase revenue by $44.68 billion for UK firms alone. AI automation has made compliance with financial regulations easier for 58% of companies and can reduce fraud detection costs by 30%.

CBDCs and Digital Currencies

Over 60 central banks are researching Central Bank Digital Currencies (CBDCs), which could revolutionize cross-border payments by providing faster, more secure transaction methods with lower fees.

Real-Time Payments

92% of businesses anticipate investing in real-time payment solutions over the next 24 to 36 months. Real-time payment systems are expected to generate an additional $173 billion in economic output by 2026.

Digital Wallets

Digital and mobile wallet payments are projected to reach 39% of total transactions in physical stores by the end of 2024, with over 4.8 billion people expected to use mobile wallets by 2025.

These statistics and trends underline the growing importance of multi-currency payment capabilities for businesses with global ambitions. As international commerce continues to expand and customer expectations evolve, having robust multi-currency capabilities will become increasingly essential for competitive success.

Implementation Strategies for Multi-Currency Payments

Successfully implementing a multi-currency payment system requires careful planning and strategic decision-making. This section outlines a step-by-step approach to help businesses effectively integrate multi-currency capabilities into their operations.

Assess Your Business Needs and Goals

Begin by evaluating your specific requirements and objectives for implementing multi-currency payments:

- Identify target markets and the currencies most relevant to your customer base

- Determine your transaction volume and average order value in each currency

- Decide whether you need immediate currency conversion or multi-currency holdings

- Consider your reporting and accounting requirements for handling multiple currencies

Choose the Right Multi-Currency Payment Solution

Select a payment provider or platform that aligns with your business needs:

- Compare currency coverage across providers to ensure they support your target markets

- Evaluate pricing structures, including conversion fees, transaction costs, and monthly charges

- Assess technical capabilities and integration options with your existing systems

- Consider the provider’s reputation, reliability, and customer support

Plan Your Currency Strategy

Develop a comprehensive approach to managing multiple currencies:

- Define your pricing strategy for different markets (direct conversion vs. market-specific pricing)

- Establish policies for handling exchange rate fluctuations

- Decide on currency display formats and rounding rules

- Create a strategy for currency risk management

Integrate with Your E-commerce Platform

Implement the technical aspects of your multi-currency solution:

- Set up currency detection and selection options on your website

- Configure checkout flows to handle multiple currencies

- Implement real-time exchange rate updates

- Test the system thoroughly across different scenarios and edge cases

Update Accounting and Financial Processes

Ensure your back-office systems can handle multi-currency transactions:

- Configure your accounting software for multi-currency reporting

- Establish procedures for reconciliation across different currencies

- Set up tax calculation and reporting for international transactions

- Create processes for handling currency gains and losses

Train Your Team

Prepare your staff to work with the new multi-currency system:

- Educate customer service representatives on handling multi-currency inquiries

- Train finance and accounting staff on multi-currency procedures

- Ensure technical teams understand the integration points and troubleshooting processes

- Develop internal documentation and resources for ongoing reference

Launch and Monitor

Roll out your multi-currency capabilities and measure their impact:

- Implement the solution in phases, starting with key markets

- Monitor transaction success rates and customer feedback

- Track key metrics like international conversion rates and average order values

- Make adjustments based on performance data and customer responses

Integration Considerations for Different Platforms

WooCommerce

Integration options include:

- WooCommerce Multi-Currency plugin

- Currency Switcher for WooCommerce

- Direct payment gateway integrations with multi-currency support

These tools allow automatic currency detection and offer customization options for currency conversion rates and display formats.

Shopify

Multi-currency capabilities through:

- Shopify Payments (available in select countries)

- Third-party apps like Bold Multi-Currency

- Shopify Markets feature for international selling

Shopify’s built-in tools provide automatic exchange rate updates and can display prices in the customer’s local currency.

Magento

Implementation approaches include:

- Built-in multi-store functionality for currency-specific storefronts

- Currency Switcher extensions

- Custom development for specific requirements

Magento offers robust multi-currency capabilities for businesses with complex international requirements.

Enhance Your Multi-Currency Strategy with Geo Targetly

Improve customer experience and boost conversions by automatically displaying prices in your visitors’ local currencies.

Get Started with Geo TargetlyBest Practices for Multi-Currency Payments

Implementing multi-currency payments effectively requires more than just technical integration. Following these best practices will help maximize the benefits while minimizing potential issues and challenges.

Transparent Pricing and Fee Disclosure

Building Customer Trust

Transparency in multi-currency transactions is essential for building customer trust and satisfaction. Research shows that unexpected fees or exchange rates are a major reason for cart abandonment in cross-border shopping.

- Clearly display all fees: Make any conversion fees, international transaction charges, or other costs visible before checkout.

- Show exchange rates: Let customers know what exchange rate is being used for their transaction.

- Explain the conversion process: Provide information about how and when currency conversion occurs.

- Avoid hidden markups: If you apply a markup to standard exchange rates, be transparent about this practice.

Regular Exchange Rate Updates

Currency values fluctuate constantly. Keeping your exchange rates current is critical for accurate pricing and financial management:

Automated Updates

Implement systems that automatically update exchange rates at regular intervals (daily or more frequently) to maintain pricing accuracy.

Reliable Data Sources

Use reputable exchange rate data sources like central banks, established financial institutions, or specialized currency API services.

Consider implementing a “rate buffer” strategy, adding a small percentage to protect against short-term fluctuations between order time and processing. This can help maintain profit margins while still offering competitive rates to customers.

Localized Payment Methods

Multi-currency support works best when combined with localized payment methods that customers in each market prefer:

- Research local preferences: Understand the most popular payment methods in each target market.

- Offer relevant options: Integrate popular local payment methods alongside international options like credit cards.

- Consider regional variations: Payment preferences can vary significantly even within regions (e.g., iDEAL in the Netherlands, Sofort in Germany).

- Display familiar logos: Show recognizable payment method logos to build trust and confidence.

Mobile Optimization

With mobile commerce growing rapidly, ensuring your multi-currency experience works seamlessly on mobile devices is essential:

72.9%

of e-commerce purchases will be made on mobile devices by 2025

4.8B

people projected to use mobile wallets by 2025

39%

of store transactions will be via digital/mobile wallets by 2024

Ensure your multi-currency displays are responsive and easy to read on smaller screens. Test the mobile checkout experience thoroughly across different devices and currencies to identify and address any usability issues.

Tax and Compliance Management

Handling taxes correctly across multiple jurisdictions is complex but essential:

Key Compliance Areas

- VAT/GST calculation: Implement systems that correctly calculate and display tax amounts based on customer location and local regulations.

- Invoice compliance: Ensure invoices meet local requirements for currency display, tax information, and other mandated elements.

- Record-keeping: Maintain detailed transaction records in both the original transaction currency and your base accounting currency.

- Regulatory updates: Stay informed about changing tax laws and payment regulations in your target markets.

Consider using specialized tax compliance software that integrates with your payment system to automate these complex calculations and reduce compliance risks.

Comprehensive Testing

Before fully launching your multi-currency capabilities, conduct thorough testing across different scenarios:

Testing Checklist

- Test the full customer journey in each supported currency

- Verify accurate tax calculation across different regions

- Confirm proper handling of refunds in various currencies

- Check display formatting for different currency symbols and decimal conventions

- Test currency detection and selection functionality

- Verify integration with accounting and reporting systems

- Test performance under various load conditions

- Conduct user acceptance testing with international customers if possible

Ongoing Monitoring and Optimization

Implementing multi-currency payments is not a one-time project but an ongoing process that requires regular attention:

Performance Tracking

Monitor key metrics like currency-specific conversion rates, average order values, and cart abandonment rates to identify opportunities for improvement.

Customer Feedback

Actively seek input from international customers about their experience with your multi-currency capabilities and use this feedback to guide enhancements.

By following these best practices, businesses can create a more effective, customer-friendly multi-currency payment experience that supports international growth while minimizing operational challenges.

Enhance Your Multi-Currency Strategy with Geo Targetly

Improve customer experience and boost conversions by automatically displaying prices in your visitors’ local currencies.

Get Started with Geo TargetlyLeading Multi-Currency Payment Providers

Choosing the right payment provider is critical for successful multi-currency implementation. This comparison highlights some of the leading solutions in the market, their features, and how they might fit different business needs.

| Provider | Currencies Supported | Key Features | Best For | Pricing |

|---|---|---|---|---|

| Stripe | 135+ |

| Tech-driven companies that want control over payment flows | 3.9% + fixed fee for international cards |

| PayPal | 100+ |

| Small to medium businesses seeking simplicity | 3.4-5.4% + fixed fee for cross-border transactions |

| Adyen | 120+ |

| Large enterprises with complex payment needs | Custom pricing based on volume and business model |

| Rapyd | 150+ |

| Businesses seeking comprehensive global coverage | Varies by payment method and region |

| Airwallex | 11 major |

| Companies managing global teams or suppliers | 3.6% + fixed fee for international cards |

| Worldpay | 120+ |

| Retailers with both online and in-person sales | Custom pricing based on business size and industry |

Selecting the Right Provider for Your Business

When evaluating multi-currency payment providers, consider these key factors:

Geographic Coverage

Ensure the provider supports the currencies and payment methods popular in your target markets. Look for providers with direct acquiring capabilities in your key regions for better authorization rates.

Integration Capabilities

Evaluate how well the solution integrates with your existing systems, including your e-commerce platform, accounting software, and inventory management tools.

Pricing Structure

Compare total costs, including transaction fees, currency conversion charges, monthly fees, and any additional costs for features you need.

Security and Compliance

Verify the provider’s security certifications, fraud prevention capabilities, and compliance with relevant regulations in your target markets.

Support Quality

Assess the level and availability of customer support, especially if you operate across multiple time zones. Look for providers with 24/7 support and dedicated account management.

Scalability

Choose a provider that can accommodate your current needs but also scale with your business as you expand into new markets and increase transaction volumes.

The ideal provider will vary depending on your specific business needs, target markets, and growth plans. Many businesses find that using a combination of providers may offer the best coverage and capabilities for different regions or customer segments.

Geo Targetly: Enhancing Multi-Currency Experience

In addition to selecting the right payment processor, businesses can further optimize their multi-currency strategy with specialized tools that enhance the customer experience. Geo Targetly is a powerful solution that helps businesses personalize their websites and payment experiences based on visitor location.

What is Geo Targetly?

Geo Targetly is an all-in-one geo-targeting platform that allows businesses to customize content, including currency displays, based on a visitor’s location. Its suite of tools helps businesses create more relevant experiences for international customers, which can significantly improve conversion rates and customer satisfaction.

Key Features for Multi-Currency Implementation

- Geo Currency: Automatically converts and displays prices in the visitor’s local currency based on their location, creating a personalized shopping experience.

- Automatic Geolocation Detection: Identifies a visitor’s location in real-time to display the most relevant currency and content.

- Real-Time Exchange Rates: Provides up-to-date exchange rates from trusted sources for accurate price conversion.

- Seamless Integration: Works with major e-commerce platforms like Shopify and WooCommerce through simple HTML elements.

- Customization Options: Allows businesses to set preferences for rounding, currency symbols, and other display elements.

Customer Success Story

“Geo Targetly allows us to redirect our international customers to specific pages and make sure that they can get the right UX. It is very helpful when you have different currencies to manage. Also, it is very easy to implement on your website.”

— William D., Small Business Owner

“As the backbone of our emerging global approach, Geo Targetly has been holding our back. It’s hassle-free, they transform your website in the most appropriate ways for different countries, tribes, localities. Besides top-notch features, customer support is amazing.”

— Mainak G., Business Owner

Benefits of Using Geo Targetly for Multi-Currency Support

Improved User Experience

Displaying native currency builds trust and improves the browsing experience, leading to higher conversions and customer satisfaction.

Boosted Global Sales

By tailoring pricing to your audience and overcoming currency-related barriers, you can ensure smoother international transactions and higher conversion rates.

Time and Effort Savings

Automatic updates and seamless integration eliminate manual work, allowing you to focus on scaling your business rather than managing currency displays.

How Geo Targetly Works with Payment Processors

Geo Targetly complements your existing payment processing solution by enhancing the front-end experience for customers:

- Pre-Purchase Experience: Geo Targetly displays product prices in the customer’s local currency throughout their shopping experience, from product pages to cart.

- Seamless Handoff: When the customer proceeds to checkout, the displayed currency information is passed to your payment processor.

- Payment Processing: Your payment gateway handles the actual transaction in the customer’s currency or converts it to your settlement currency.

- Post-Purchase Consistency: Order confirmations and receipts can maintain the customer’s preferred currency display for a consistent experience.

This combination of specialized geo-targeting with robust payment processing creates a comprehensive multi-currency solution that addresses both customer experience and transaction processing needs.

Enhance Your Multi-Currency Strategy with Geo Targetly

Improve customer experience and boost conversions by automatically displaying prices in your visitors’ local currencies.

Get Started with Geo TargetlyCase Studies and Success Stories

Examining real-world examples of successful multi-currency implementations can provide valuable insights and inspiration. These case studies highlight different approaches and the results businesses have achieved by optimizing their multi-currency strategies.

Global Fashion Retailer

Challenge:

A mid-sized fashion retailer wanted to expand from serving primarily North American customers to reaching European and Asian markets. They were experiencing high cart abandonment rates from international visitors (over 80%) and receiving customer complaints about unclear pricing.

Solution:

The retailer implemented a comprehensive multi-currency strategy that included:

- Automatic currency detection based on IP location

- Support for 8 major currencies with localized pricing

- Integration with local payment methods in key markets

- Currency selection option in the site header

Results:

- International cart abandonment decreased by 34%

- Average order value from international customers increased by 27%

- International sales grew by 65% within six months

- Customer service inquiries about pricing dropped by 82%

B2B Software Provider

Challenge:

A SaaS company offering business productivity tools wanted to expand globally but struggled with pricing their subscription plans appropriately for different markets. They needed a solution that would balance competitive local pricing with consistent profit margins.

Solution:

The company developed a sophisticated multi-currency approach that included:

- Market-specific pricing strategies rather than direct currency conversion

- Multi-currency billing system for recurring subscriptions

- Geo Targetly implementation to display localized pricing

- Regional pricing tiers based on market conditions

Results:

- 42% increase in trial conversions from international users

- Expansion into 12 new markets within one year

- Reduced subscription cancellation rate by 18%

- Maintained consistent profit margins across markets despite price differences

Global Marketplace Platform

Challenge:

A growing online marketplace connecting buyers and sellers worldwide faced complex multi-currency challenges. They needed to allow sellers to set prices in their preferred currency while letting buyers view and pay in their local currency. Additionally, they needed to manage currency conversion risk and ensure transparent fee structures.

Solution:

The marketplace implemented a comprehensive multi-currency infrastructure:

- Multi-currency accounts allowing sellers to receive funds in multiple currencies

- Dynamic currency conversion at checkout with transparent fee disclosure

- Automated hedging strategies to manage currency risk

- Real-time reporting tools showing transaction values in both original and converted currencies

Results:

- Seller onboarding increased by 58% in international markets

- Cross-border transactions grew to represent 47% of total platform volume

- Buyer satisfaction scores for international purchases improved by 29 points

- Platform commission revenue increased by 36% through optimized currency conversion

Key Lessons from Successful Implementations

Strategic Market Selection

The most successful businesses prioritize markets strategically rather than trying to support every currency at once. They focus resources on high-potential regions with careful planning and phased rollouts.

Integrated Approach

Multi-currency success requires more than just payment processing. The best implementations integrate currency solutions with localized content, regional pricing strategies, and local payment methods.

Data-Driven Decisions

Leading companies closely monitor performance metrics for each currency and market, continuously optimizing their approach based on conversion rates, average order values, and customer feedback.

These case studies demonstrate that successful multi-currency implementation goes beyond technical integration. It requires thoughtful strategy, careful market research, and ongoing optimization to deliver strong results. By learning from these examples, businesses can develop more effective approaches to their own multi-currency challenges.

The Future of Multi-Currency Payments

The landscape of multi-currency payments is rapidly evolving, driven by technological innovation, changing consumer expectations, and global economic shifts. Understanding these emerging trends can help businesses prepare for the future and stay ahead of the competition.

Emerging Technologies Shaping Multi-Currency Payments

Artificial Intelligence and Machine Learning

AI is transforming multi-currency payments through:

- Predictive currency fluctuation models that optimize conversion timing

- Intelligent fraud detection that reduces false positives across different currencies

- Personalized pricing strategies based on location and customer behavior

- Automated compliance checks for international transactions

These capabilities are expected to reduce fraud detection costs by 30% while increasing revenue through better conversion optimization.

Central Bank Digital Currencies (CBDCs)

CBDCs represent a significant evolution in the payment landscape:

- Over 60 central banks are actively researching or developing CBDCs

- Cross-border CBDC projects aim to reduce settlement times and costs

- Potential for programmable money with automated currency conversion

- Enhanced transparency and reduced counterparty risk

These digital currencies could revolutionize how businesses handle multi-currency transactions by providing near-instant settlement and reduced intermediary costs.

Real-Time Payment Networks

The global push toward real-time payments is accelerating:

- 92% of businesses plan to invest in real-time payment solutions

- Projected to generate $173 billion in additional economic output by 2026

- Cross-border real-time payment corridors are expanding rapidly

- Integration with multi-currency capabilities for instant global transactions

These systems are transforming expectations around payment speed and transparency, requiring businesses to adapt their multi-currency strategies accordingly.

Blockchain and Distributed Ledger Technology

Blockchain continues to mature with implications for multi-currency payments:

- New protocols designed specifically for cross-border payments

- Stablecoins as an alternative for multi-currency management

- Smart contracts automating currency conversion and settlement

- Reduced reconciliation needs across different currencies

These technologies promise to reduce the complexity and cost of managing multiple currencies while increasing transaction speed and transparency.

Changing Regulatory Landscape

Regulatory changes will significantly impact multi-currency payment strategies in the coming years:

- Harmonization Efforts: Initiatives like the EU’s Payment Services Directive (PSD3) aim to standardize payment regulations across regions, potentially simplifying multi-currency compliance.

- Data Localization Laws: Increasing requirements to store payment data within specific countries may complicate multi-currency architectures.

- Open Banking Expansion: Open banking regulations are extending to cross-border and multi-currency scenarios, creating new opportunities for innovation.

- Digital Currency Regulations: New frameworks for CBDCs and stablecoins will shape how these can be used in multi-currency contexts.

Consumer Expectations and Market Trends

Future multi-currency strategies will need to address evolving consumer demands:

70%

of global consumers expect to use digital wallets by 2025

60%

of consumers desire seamless currency conversion in mobile apps

85%

of Gen Z and Millennials prefer shopping in their local currency

The future of multi-currency payments will be characterized by greater automation, transparency, and integration. Businesses that stay informed about these trends and adapt their strategies accordingly will be well-positioned to capitalize on the growing opportunities in global commerce.

Enhance Your Multi-Currency Strategy with Geo Targetly

Improve customer experience and boost conversions by automatically displaying prices in your visitors’ local currencies.

Get Started with Geo TargetlyFrequently Asked Questions

What is a multi-currency payment system?

A multi-currency payment system is a solution that allows businesses to accept, process, and manage payments in multiple currencies. These systems typically include features for currency detection, automatic price conversion, and settlement options in different currencies. They enable businesses to provide a localized payment experience for international customers while managing currency exchange efficiently.

How do multi-currency payments benefit my business?

Multi-currency payment capabilities offer numerous benefits:

- Improved customer experience by allowing shoppers to pay in their preferred currency

- Reduced cart abandonment rates (studies show 13% of customers abandon carts when faced with foreign currencies)

- Expanded global market reach and increased international sales

- Enhanced competitive advantage in international markets

- Better cash flow management through multi-currency accounts

- Increased customer trust and confidence in your business

Research indicates that businesses implementing multi-currency support can see international sales increase by 30-40% and conversion rates improve by 7% or more.

What challenges might I face when implementing multi-currency payments?

Common challenges in multi-currency implementation include:

- Managing exchange rate fluctuations and associated financial risks

- Ensuring accurate tax calculation across different jurisdictions

- Integrating multi-currency capabilities with existing systems

- Navigating complex regulatory requirements in different countries

- Maintaining accurate financial reporting with transactions in multiple currencies

- Managing conversion fees and other costs associated with multi-currency processing

These challenges can be addressed through careful planning, selecting the right payment partners, and implementing appropriate risk management strategies.

How do I choose the right currencies to support?

When deciding which currencies to support, consider:

- Your current and target market locations (analyze website traffic by country)

- The currencies used in your highest-potential international markets

- Customer demand and preferences based on feedback or research

- The stability and convertibility of different currencies

- The cost and complexity of supporting each additional currency

Most businesses start with major global currencies (USD, EUR, GBP, JPY, etc.) and gradually add others based on market opportunity and customer needs. Prioritize currencies where you expect the highest transaction volumes or growth potential.

How do exchange rates work in multi-currency payments?

Exchange rates in multi-currency payment systems typically work as follows:

- Base rates are usually sourced from major financial institutions or currency data providers

- Payment providers often add a markup (typically 1-4%) to the mid-market rate

- Rates may be updated in real-time or at regular intervals (daily, hourly)

- Some systems allow businesses to set custom exchange rates or add their own markup

- Settlement exchange rates (when converting to your base currency) may differ from display rates shown to customers

It’s important to understand how your payment provider determines exchange rates, how often they’re updated, and what markups are applied, as these factors can significantly impact your margins and pricing strategy.

Do I need to have bank accounts in different countries to accept multiple currencies?

No, you don’t necessarily need bank accounts in different countries to accept multiple currencies. There are several approaches:

- Immediate conversion: Accept payments in multiple currencies but convert them immediately to your base currency for deposit in a single account.

- Multi-currency accounts: Use services like Airwallex, Wise Business, or Revolut Business that provide virtual accounts in multiple currencies without requiring physical presence in those countries.

- Payment processor settlement: Some payment processors can hold funds in multiple currencies and transfer them to your account in your preferred currency.

The best approach depends on your business model, volume of international transactions, and how you plan to use the funds (e.g., paying suppliers in their local currency vs. converting everything to your home currency).

How can I protect my business from currency fluctuations?

To protect your business from currency fluctuation risks:

- Hedging strategies: Use forward contracts or options to lock in exchange rates for future transactions.

- Natural hedging: Balance revenues and expenses in the same currency where possible.

- Price buffers: Build small margins into your pricing to account for potential currency movements.

- Dynamic pricing: Implement systems that automatically adjust prices based on current exchange rates.

- Regular monitoring: Watch currency trends closely and adjust strategies accordingly.

- Multi-currency accounts: Hold funds in foreign currencies when rates are favorable or when you have upcoming expenses in those currencies.

Working with financial advisors who specialize in currency risk management can help develop strategies tailored to your specific business needs.

How does Geo Targetly enhance multi-currency payment systems?

Geo Targetly works alongside multi-currency payment processors to enhance the customer experience in several ways:

- Automatically detects a visitor’s location and displays prices in their local currency throughout their browsing experience

- Provides real-time currency conversion using up-to-date exchange rates

- Allows for customization of currency displays, including rounding rules and symbol placement

- Integrates seamlessly with major e-commerce platforms through simple HTML elements

- Enables targeted content and promotions based on a customer’s location in addition to currency display

By implementing Geo Targetly alongside your payment processor, you create a more cohesive and localized shopping experience that can significantly improve conversion rates for international customers.

What are the tax implications of accepting multiple currencies?

Accepting payments in multiple currencies introduces several tax considerations:

- Value-Added Tax (VAT) or Sales Tax: Different countries have varying requirements for collecting and remitting taxes on international sales.

- Currency Gains and Losses: Fluctuations in exchange rates between when a payment is received and when it’s converted can create taxable gains or losses.

- Reporting Requirements: Transactions in foreign currencies typically need to be converted to your base currency for tax reporting purposes.

- Permanent Establishment Risk: Having significant operations in foreign markets might create tax obligations in those countries.

It’s advisable to consult with tax professionals who specialize in international commerce to ensure compliance with all applicable regulations and to optimize your tax strategy for multi-currency operations.

How can I measure the success of my multi-currency implementation?

To evaluate the effectiveness of your multi-currency strategy, track these key metrics:

- Conversion Rate by Currency: Compare conversion rates before and after implementation, and between different currencies.

- Cart Abandonment Rate: Monitor changes in abandonment rates for international customers.

- Average Order Value: Track whether customers spend more when viewing prices in their local currency.

- International Revenue Growth: Measure the increase in sales from international markets.

- Customer Feedback and Satisfaction: Collect feedback specifically about the payment experience.

- Currency Exchange Costs: Calculate the total cost of currency conversions and compare against the benefits.

- Support Inquiries: Track whether payment-related customer service requests decrease.

Regularly reviewing these metrics will help you refine your multi-currency strategy and identify opportunities for further optimization.

Ready to Go Global with Multi-Currency Payments?

Implement a powerful multi-currency strategy to boost your international sales and deliver exceptional customer experiences.

Disclosure: We may earn commission for purchases that are made by visitors on this site at no additional cost on your end. All information is for educational purposes and is not intended for financial advice. Read our affiliate disclosure.