How to Form a US LLC from Burkina Faso

Are you an entrepreneur in Burkina Faso looking to expand your business horizons? Forming a Limited Liability Company (LLC) in the United States can open up a world of opportunities. This guide will walk you through the process of how to form a US LLC from Burkina Faso using Northwest Registered Agent as your formation service.

Why Form a US LLC from Burkina Faso?

Before diving into the process of how to form a US LLC from Burkina Faso, let’s explore the benefits:

- Access to the vast US market

- Enhanced credibility with international clients

- Asset protection

- Potential tax benefits

- Easier access to US financial services and payment processors

Prerequisites for Forming a US LLC from Burkina Faso

Before starting the process of how to form a US LLC from Burkina Faso, ensure you have:

- A valid Burkinabè passport

- Proof of address in Burkina Faso

- Funds for LLC formation fees and registered agent services

- A basic understanding of your business goals in the US

Related: How to Form a US LLC from Botswana

Step-by-Step Guide: How to Form a US LLC from Burkina Faso

1. Choose a Registered Agent Service

As a non-US resident learning how to form a US LLC from Burkina Faso, you’ll need a reliable registered agent service. We recommend Northwest Registered Agent for their comprehensive services tailored to international clients.

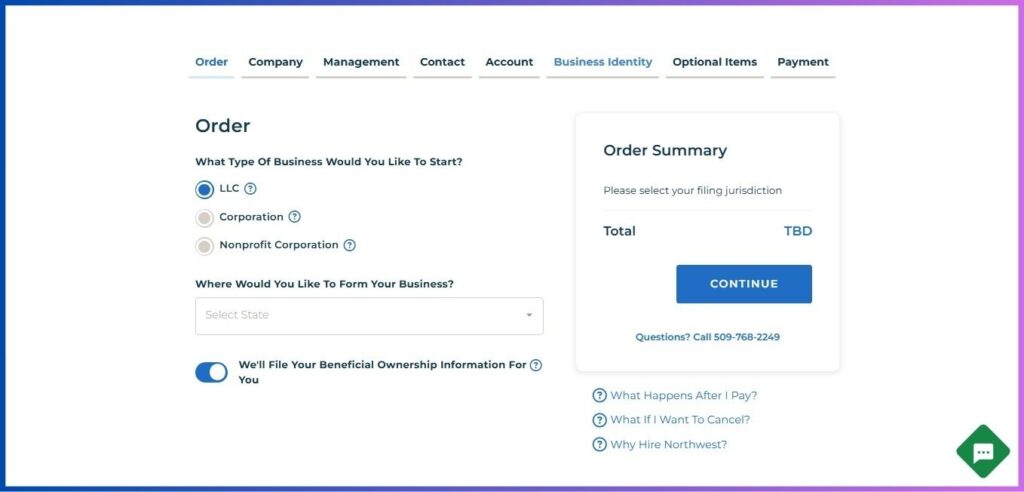

2. Begin the LLC Formation Process

- Visit the Northwest Registered Agent website

- Click on “Start Your Business”

- Select “LLC” as your business type

- Choose the state where you want to form your LLC (research which state best suits your business needs)

- Opt in for Northwest to file your Beneficial Ownership Information

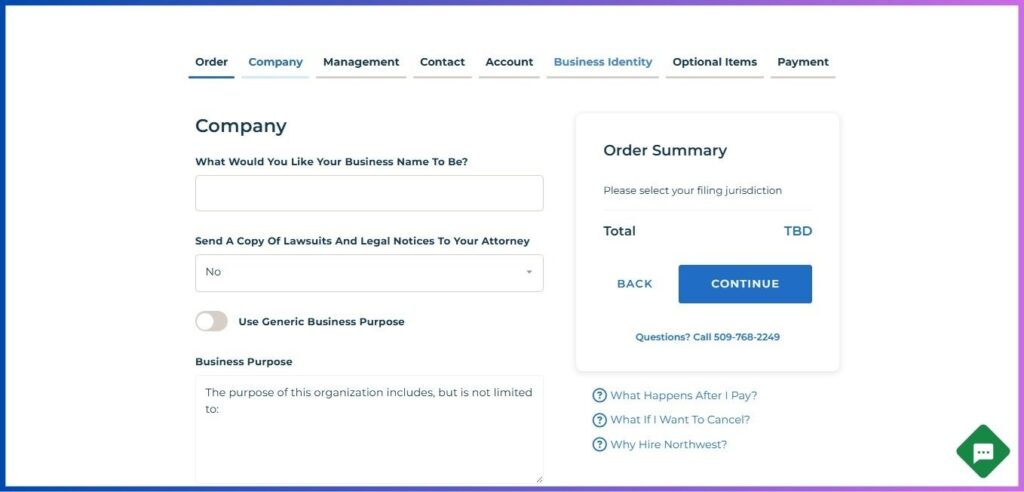

3. Provide Company Information

- Enter your desired LLC name (ensure it’s unique and includes “LLC” or “Limited Liability Company”)

- Decide on whether to use a generic business purpose or specify your own

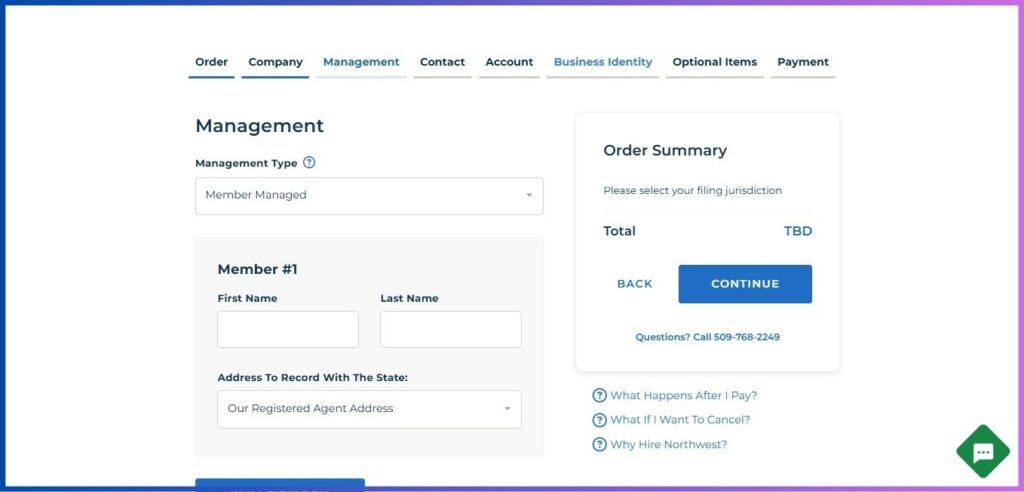

4. Set Up Management Structure

- Choose “Member Managed” (typical for small LLCs)

- Enter your details as the primary member:

- Use your Burkinabè name as it appears on your passport

- You can use Northwest’s US address for state filings to maintain privacy

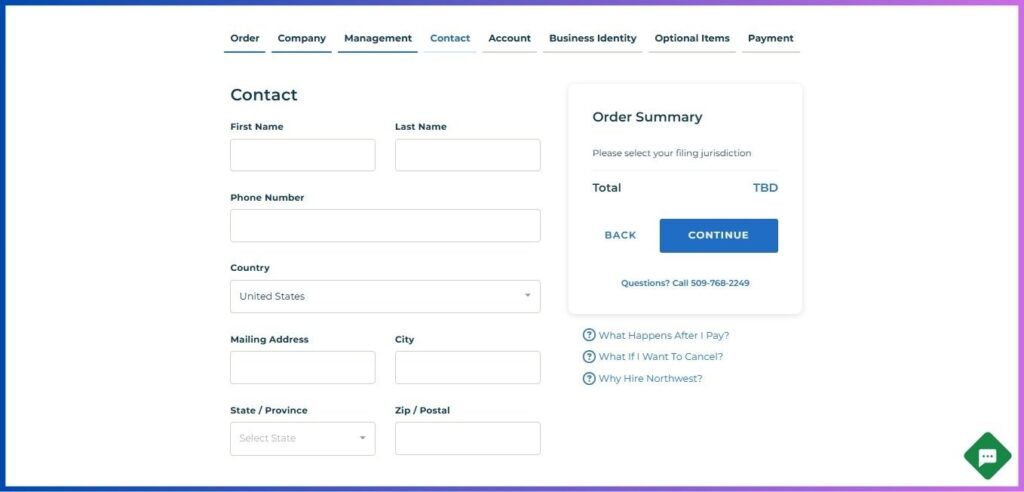

5. Enter Contact Information

Provide your Burkinabè contact details:

- Full name

- Email address

- Phone number (including country code)

- Your physical address in Burkina Faso

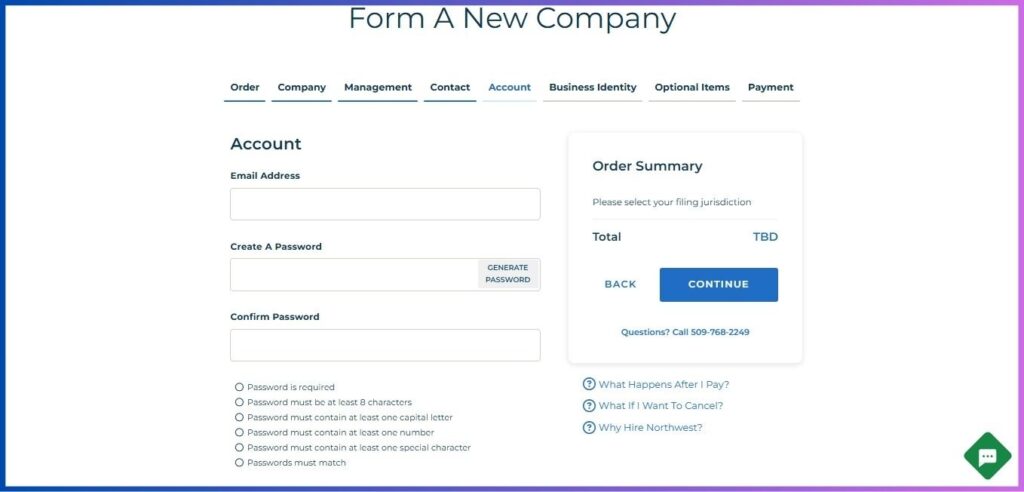

6. Create Your Account

- Enter your email address in the provided field

- Create a strong password that meets the following requirements:

- At least 8 characters long

- Contains at least one capital letter

- Contains at least one number

- Contains at least one special character

- Confirm your password by entering it again

- Click “Generate Password” if you need assistance creating a secure password

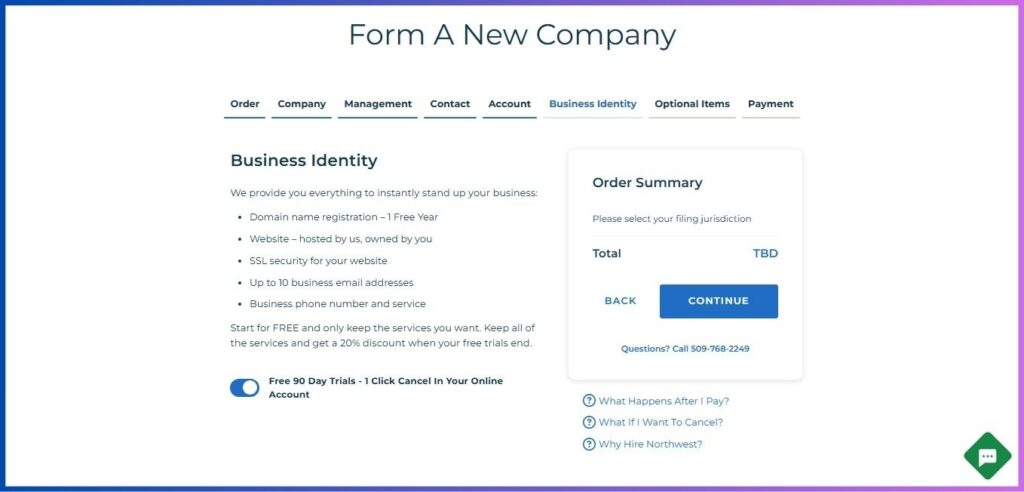

7. Choose Business Identity Services

Northwest offers a comprehensive Business Identity package to help establish your US presence:

- Domain name registration – 1 Free Year

- Website – hosted by Northwest, owned by you

- SSL security for your website

- Up to 10 business email addresses

- Business phone number and service

These services start for FREE, and you can keep only the ones you want. If you decide to keep all services, you’ll receive a 20% discount when the free trials end.

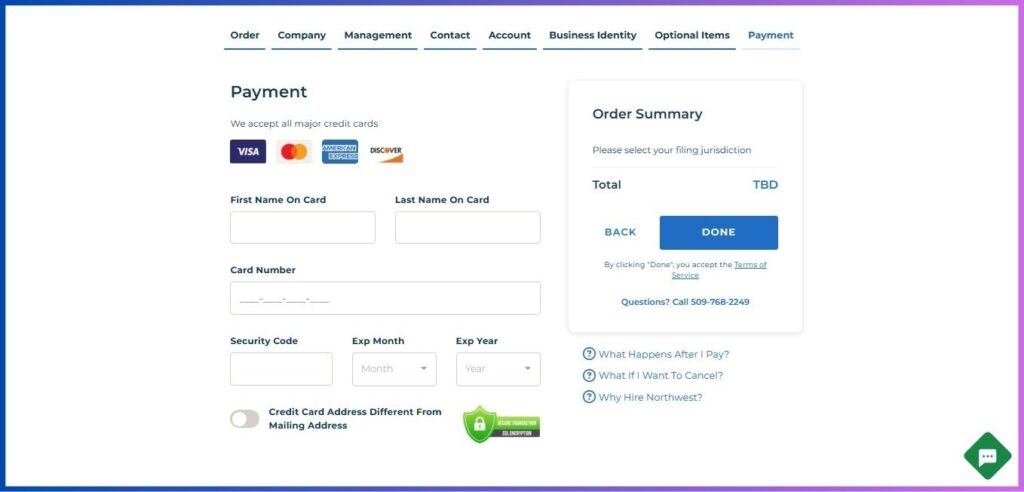

8. Review and Pay

- Double-check all entered information

- Pay for the service using an international credit card or wire transfer

Post-Formation Steps: Completing Your US LLC Formation from Burkina Faso

After Northwest files your LLC formation documents, follow these steps to complete the process of how to form a US LLC from Burkina Faso:

1. Obtain an EIN

As a non-US resident, you’ll need an Employer Identification Number (EIN):

- Northwest can handle this for you if you selected their EIN service

- Otherwise, you’ll need to file Form SS-4 by mail or fax

2. Draft an Operating Agreement

While not mandatory in all states, an Operating Agreement is crucial for defining your LLC’s structure and operations, especially for international owners from Burkina Faso.

3. Open a US Bank Account

This can be challenging for non-residents but is essential for operating your US business:

- Research banks that offer services to non-resident LLC owners

- Be prepared to provide:

- LLC formation documents

- EIN

- Passport

- Proof of address in Burkina Faso

- Possibly a notarized proof of identity

4. Understand Tax Obligations

As a Burkinabè owning a US LLC:

- Your LLC may need to file an annual tax return (Form 1065)

- You may need to file Form 5472 and Form 1120 if you’re the sole owner

- Consult with a tax professional familiar with both US and Burkinabè tax laws

5. File a Beneficial Ownership Information Report

From January 1, 2024:

- Most LLCs must file a BOI Report with FinCEN

- Northwest can handle this for you as part of their service

6. Maintain Compliance

Stay on top of ongoing requirements:

- Annual reports

- Franchise taxes (if applicable)

- Maintaining a registered agent

Considerations for Burkinabè LLC Owners

When learning how to form a US LLC from Burkina Faso, keep in mind:

- Time zone differences: Be prepared for communication delays with US-based clients or services

- Currency exchange: Factor in exchange rates when budgeting for US operations

- Travel: You may occasionally need to visit the US for business purposes (ensure you have appropriate visas)

- Local laws: Ensure your US LLC operations don’t conflict with Burkinabè business regulations

Related: How to Form a US LLC from Burundi

Conclusion

Learning how to form a US LLC from Burkina Faso may seem daunting, but it’s an achievable goal that can significantly expand your business opportunities. While the process involves several steps, using a service like Northwest Registered Agent can simplify much of the complexity.

Remember, creating an LLC doesn’t automatically grant you work authorization in the US – always ensure you’re complying with both US and Burkinabè laws in your business operations.

By following this guide on how to form a US LLC from Burkina Faso, you’ll be well on your way to establishing your US business presence while managing operations from Burkina Faso. This strategic move can open doors to new markets, enhance your global credibility, and potentially increase your business’s profitability.

Disclosure: We may earn commission for purchases that are made by visitors on this site at no additional cost on your end. All information is for educational purposes and is not intended for financial advice. Read our affiliate disclosure.