How to Form a US LLC from Ethiopia

Learning how to form a US LLC from Ethiopia has become increasingly important for Ethiopian entrepreneurs looking to expand their business horizons. As Ethiopia’s digital economy grows, many business owners are discovering the advantages of establishing a US-based LLC while operating from Addis Ababa or other Ethiopian cities.

This comprehensive guide will walk you through the process of creating your US LLC from Ethiopia using Northwest Registered Agent.

Benefits of Forming a US LLC from Ethiopia

For Ethiopian entrepreneurs, a US LLC offers several distinct advantages:

- Access to Global Markets: Bridge the gap between Ethiopian and US markets

- Payment Processing: Easier access to international payment systems and US-based processors

- Business Credibility: Enhanced reputation with both US and international clients

- Asset Protection: Shield personal assets from business liabilities

- Currency Stability: Operate in US dollars, reducing exposure to currency fluctuations

Prerequisites for Ethiopian Business Owners

Before starting your US LLC formation journey, ensure you have:

- A valid Ethiopian passport

- Proof of address in Ethiopia

- Funds for formation fees (in USD)

- International payment method (credit card or wire transfer capability)

- Basic understanding of US business operations

Related: How to Form a US LLC from Gabon

Step-by-Step Guide to Forming Your US LLC from Ethiopia

1. Select Your Registered Agent

Northwest Registered Agent is recommended for Ethiopian entrepreneurs due to their experience with international clients and comprehensive service offerings.

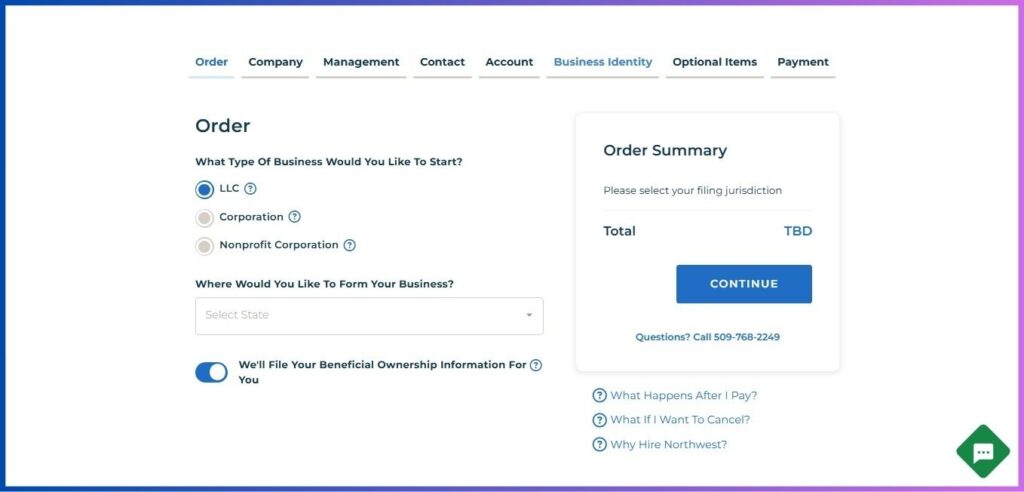

2. Begin the Formation Process

- Navigate to Northwest Registered Agent’s website

- Select “Start Your Business”

- Choose “LLC” as your business structure

- Select your preferred state for formation

- Opt in for BOI filing assistance

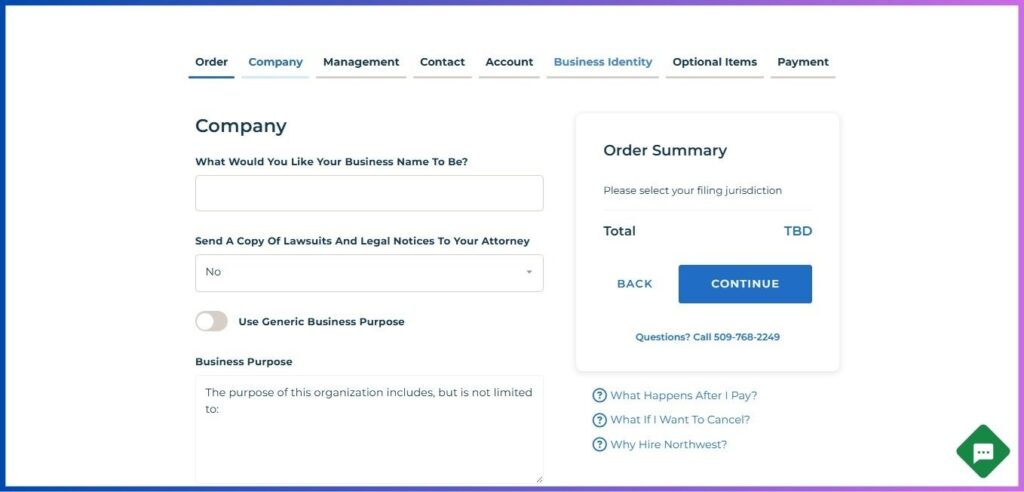

3. Company Information

- Choose a unique LLC name

- Must include “LLC” or “Limited Liability Company”

- Check availability in your chosen state

- Specify your business purpose or use the generic option

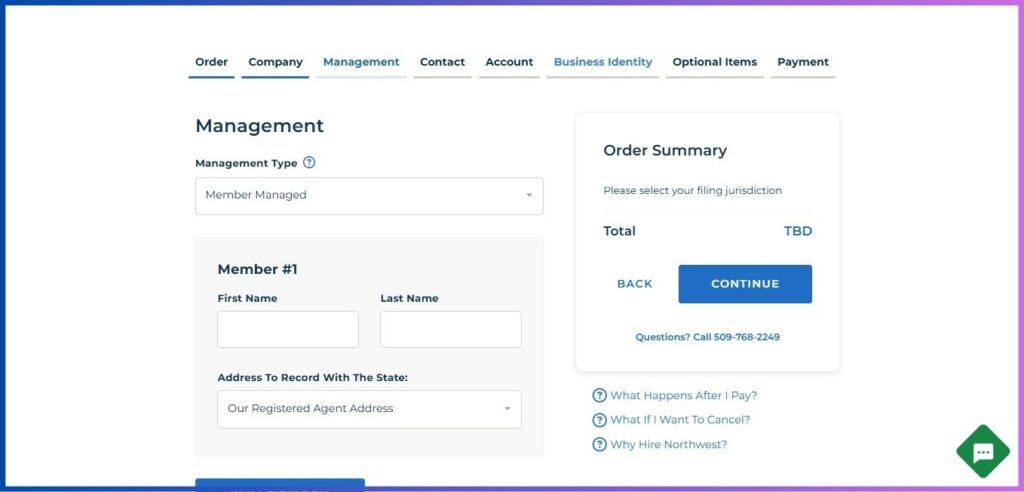

4. Management Structure Setup

- Select “Member Managed” (recommended for most Ethiopian-owned LLCs)

- Enter member information:

- Your name as shown on Ethiopian passport

- Option to use Northwest’s address for privacy

- Additional members if applicable

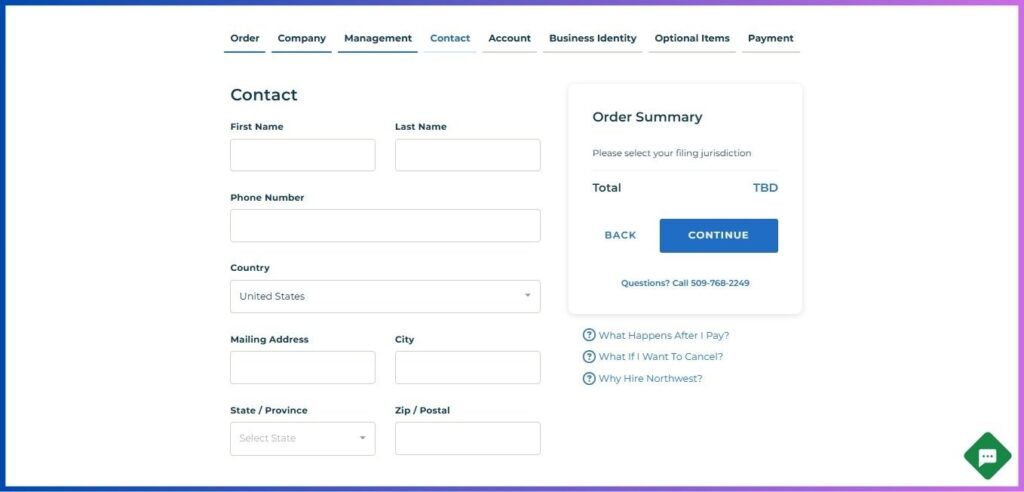

5. Contact Information

- Provide your Ethiopian details:

- Full legal name

- Email address

- Phone number (including Ethiopia’s +251 country code)

- Physical address in Ethiopia

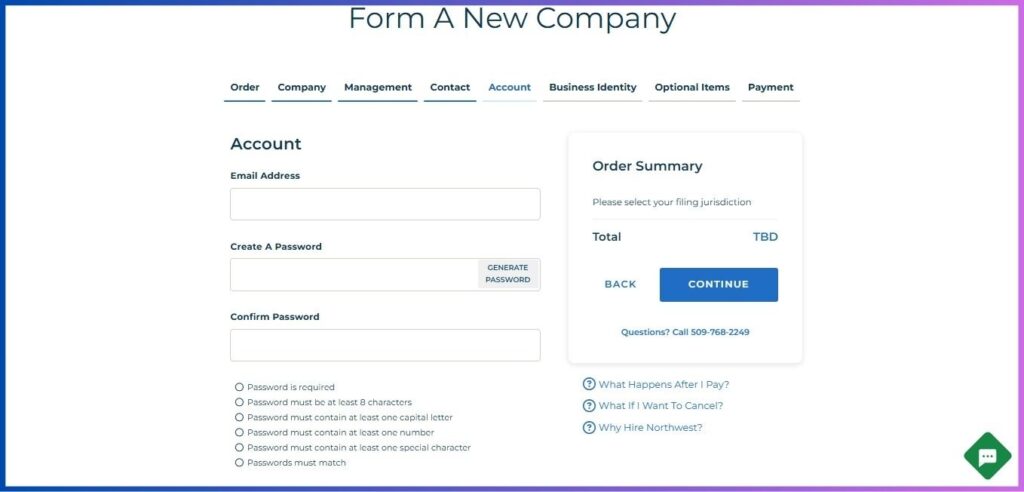

6. Account Creation

- Enter your email address

- Create a secure password meeting these requirements:

- Minimum 8 characters

- At least one capital letter

- At least one number

- One special character

- Verify password

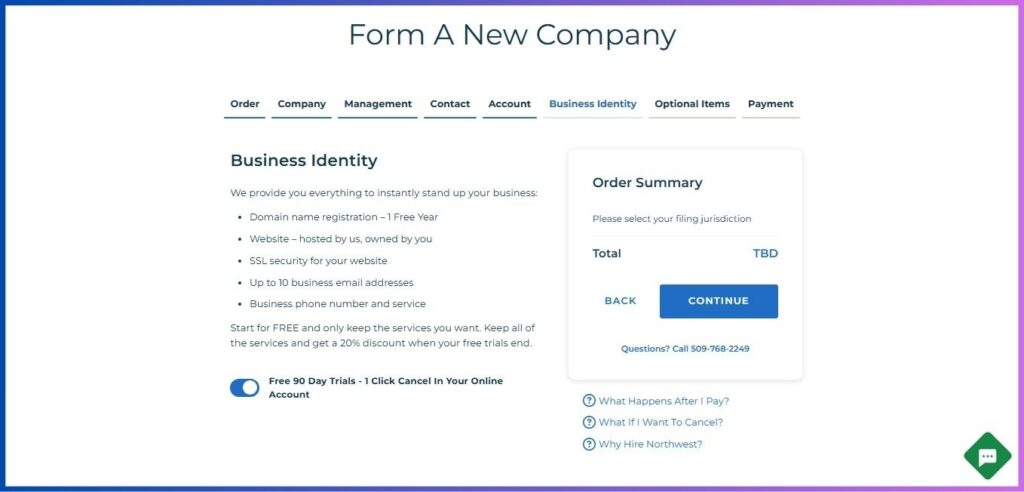

7. Business Identity Package

Consider Northwest’s comprehensive business identity services:

- Free one-year domain registration

- Professional website hosting

- SSL security certificate

- Up to 10 business email addresses

- US business phone number

Take advantage of the 90-day free trial with a 20% discount if you keep all services.

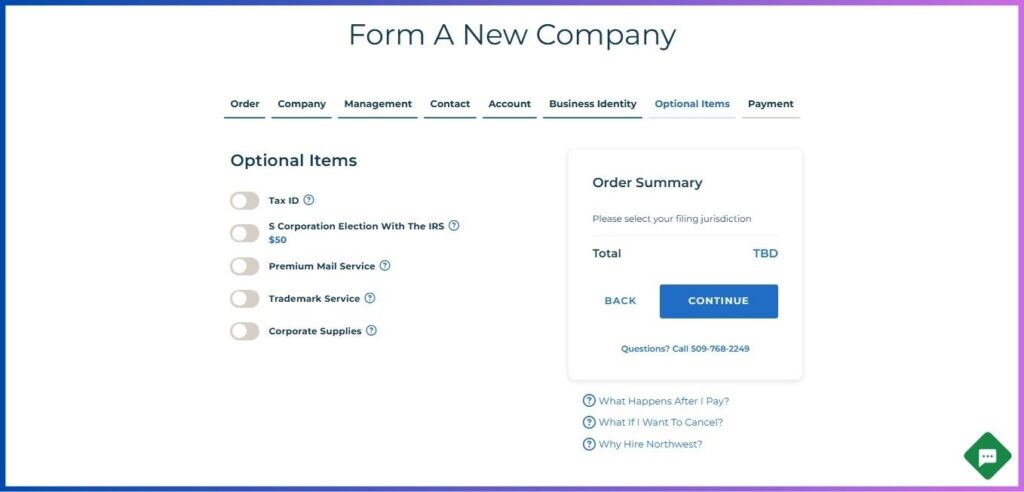

8. Additional Services Selection

Choose services essential for Ethiopian owners:

- Virtual US business address

- Phone service with US number

- EIN obtainment assistance

- Operating Agreement customization

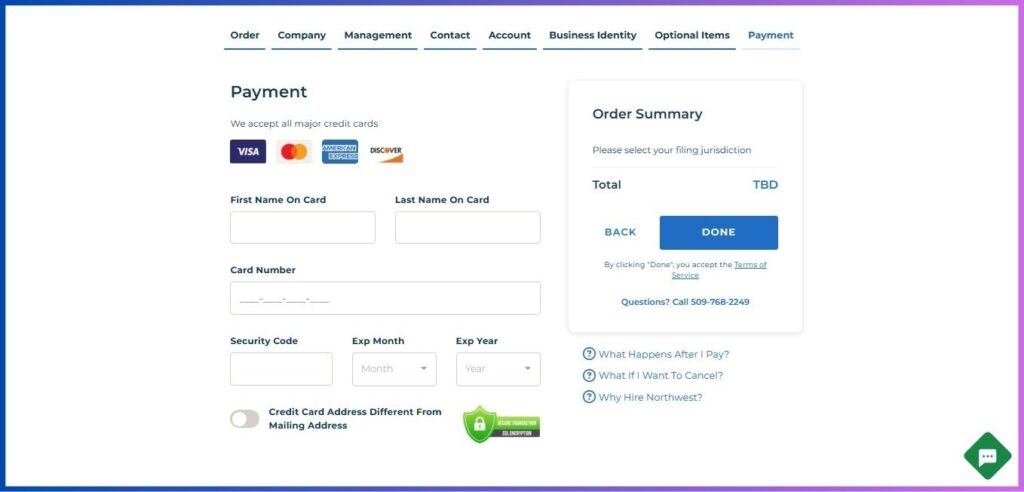

9. Review and Payment

- Verify all information

- Complete payment using an international credit card or wire transfer

Post-Formation Steps for Ethiopian LLC Owners

1. EIN Acquisition

As an Ethiopian business owner:

- Use Northwest’s EIN service (recommended)

- Or file Form SS-4 yourself via mail/fax

2. Operating Agreement

Create a comprehensive operating agreement that:

- Defines management structure

- Outlines ownership percentages

- Establishes operating procedures

- Details member responsibilities

3. US Banking Setup

For Ethiopian business owners:

- Research international-friendly banks

- Prepare required documentation:

- LLC formation documents

- EIN confirmation

- Ethiopian passport

- Proof of Ethiopian address

- Additional KYC documents

4. Tax Compliance

Understanding your tax obligations:

- US tax reporting requirements

- Ethiopian tax implications

- International tax treaties

- Annual filing obligations

5. BOI Report Filing

Recent requirement effective January 2024:

- Submit Beneficial Ownership Information

- Northwest handles this as part of their service

- Keep ownership information updated

6. Ongoing Compliance

Maintain your LLC’s good standing:

- Regular annual reports

- State-specific requirements

- Updated registered agent information

- Proper record-keeping

Special Considerations for Ethiopian LLC Owners

Time Zone Management

- Plan for the 7-8 hour time difference with US business hours

- Schedule meetings and communications accordingly

Banking Operations

- Consider digital banking solutions

- Plan for international wire transfer times

- Account for currency exchange fees

Communication Strategy

- Utilize your US business phone number

- Maintain professional email communications

- Consider virtual meeting platforms

Related: How to Form a US LLC from Eswatini

Conclusion

Learning how to form a US LLC from Ethiopia is an important step toward international business expansion. While the process requires careful attention to detail, the benefits of establishing a US business presence can significantly enhance your entrepreneurial opportunities.

With Northwest Registered Agent’s support and this guide’s framework, Ethiopian business owners can confidently navigate the LLC formation process.

Remember that while forming a US LLC from Ethiopia opens many doors, it’s essential to maintain compliance with both US and Ethiopian regulations. Consider consulting with legal and tax professionals familiar with both jurisdictions to ensure your business operates smoothly across borders.

Disclosure: We may earn commission for purchases that are made by visitors on this site at no additional cost on your end. All information is for educational purposes and is not intended for financial advice. Read our affiliate disclosure.