How to Form a US LLC from Ghana

Are you a Ghanaian entrepreneur dreaming of expanding your business horizons to the United States? Forming a US Limited Liability Company (LLC) from Ghana might be your golden ticket to international success. This comprehensive guide will walk you through the process of how to form a US LLC from Ghana, opening doors to new opportunities and markets.

Why Should a Ghanaian Entrepreneur Form a US LLC?

Before we dive into the nitty-gritty of how to form a US LLC from Ghana, let’s explore why this business move could be a game-changer for you:

- Access to the world’s largest economy

- Enhanced credibility with global clients

- Asset protection and limited liability

- Potential tax advantages

- Easier access to US financial services and payment systems

Related: How to Form a US LLC from Comoro

Step-by-Step Guide: How to Form a US LLC from Ghana

Step 1: Lay the Groundwork

Before you begin the process of how to form a US LLC from Ghana, ensure you have:

- A valid Ghanaian passport

- Proof of address in Ghana

- Funds for LLC formation fees and services

- A clear vision of your US business goals

Step 2: Choose Your US Business Ally

As a Ghanaian forming a US LLC, you’ll need a reliable registered agent service. We recommend Northwest Registered Agent for their expertise in helping international entrepreneurs like you.

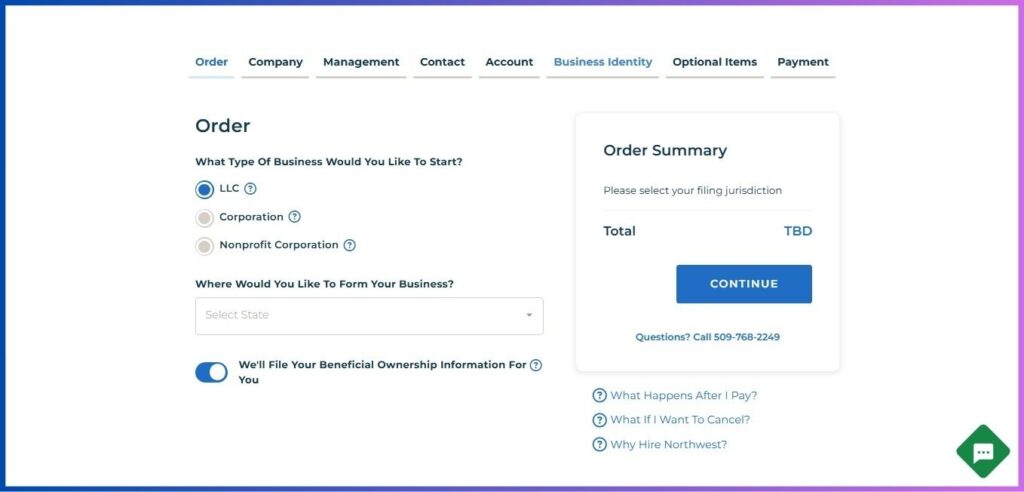

Step 3: Embark on Your LLC Formation Journey

- Visit the Northwest Registered Agent website

- Click “Start Your Business”

- Select “LLC” as your business structure

- Choose your preferred state (research which state best aligns with your business needs)

- Opt for Northwest to handle your Beneficial Ownership Information filing

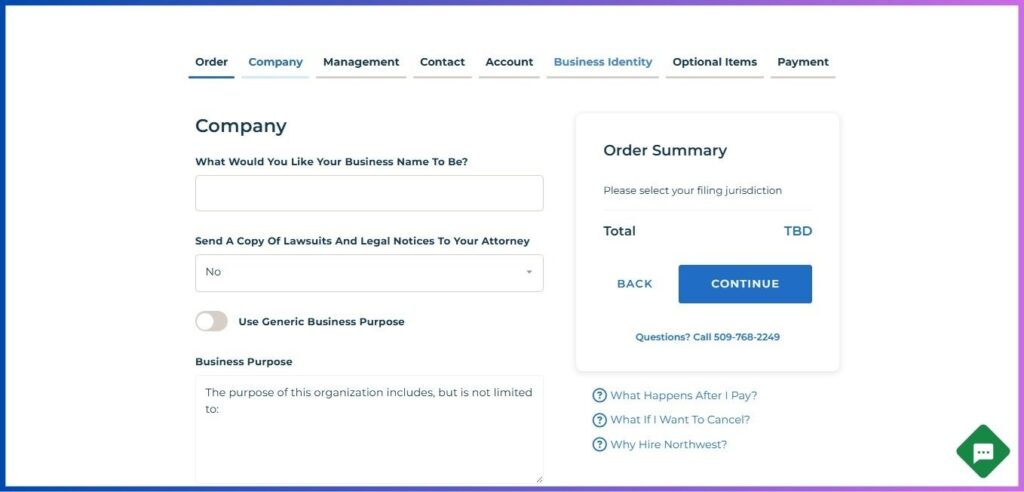

Step 4: Name Your American Dream

- Choose a unique LLC name that reflects your Ghanaian roots and American ambitions

- Ensure it includes “LLC” or “Limited Liability Company”

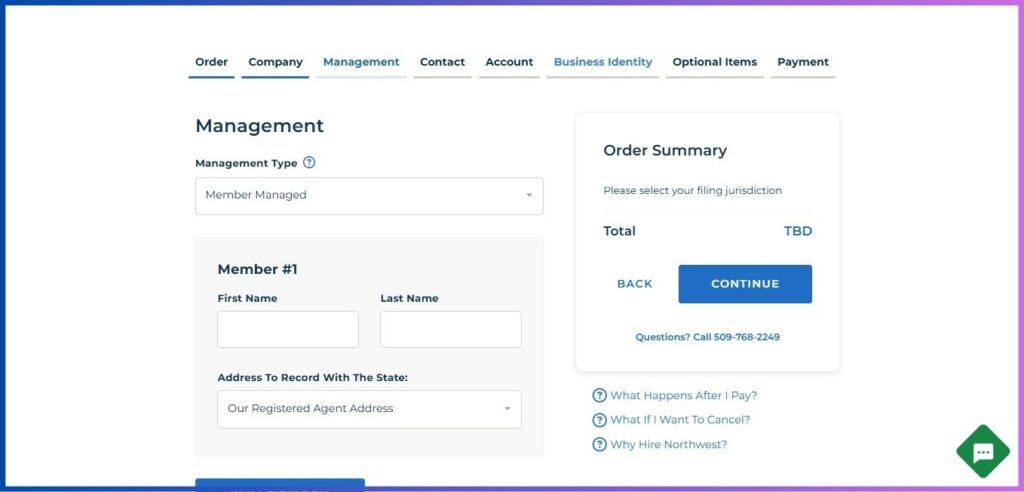

Step 5: Set Up Your LLC’s Management

- Typically, choose “Member Managed” for small LLCs

- Enter your details as the primary member:

- Use your Ghanaian name as it appears on your passport

- Consider using Northwest’s US address for privacy

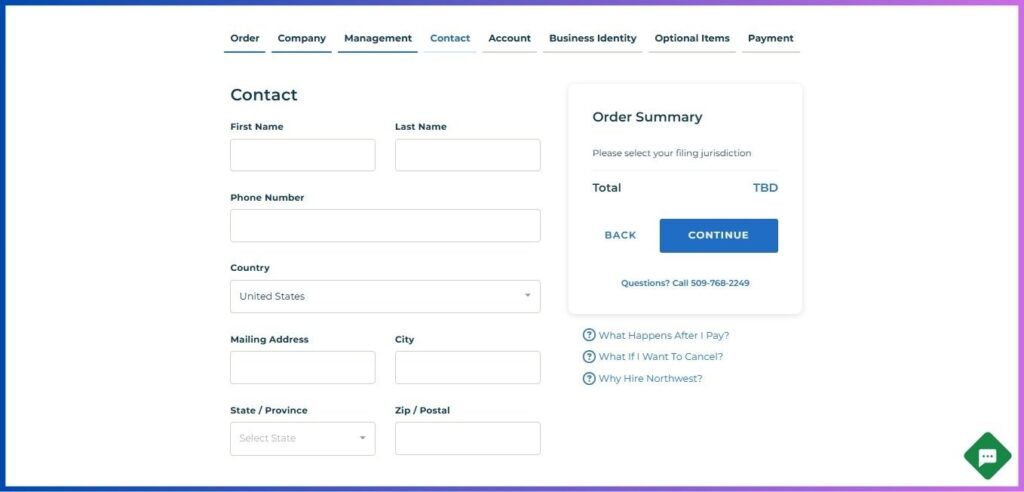

Step 6: Bridge Ghana and the US with Your Contact Info

Provide your Ghana-based contact details:

- Full name

- Email address

- Phone number (including Ghana’s country code: +233)

- Your physical address in Ghana

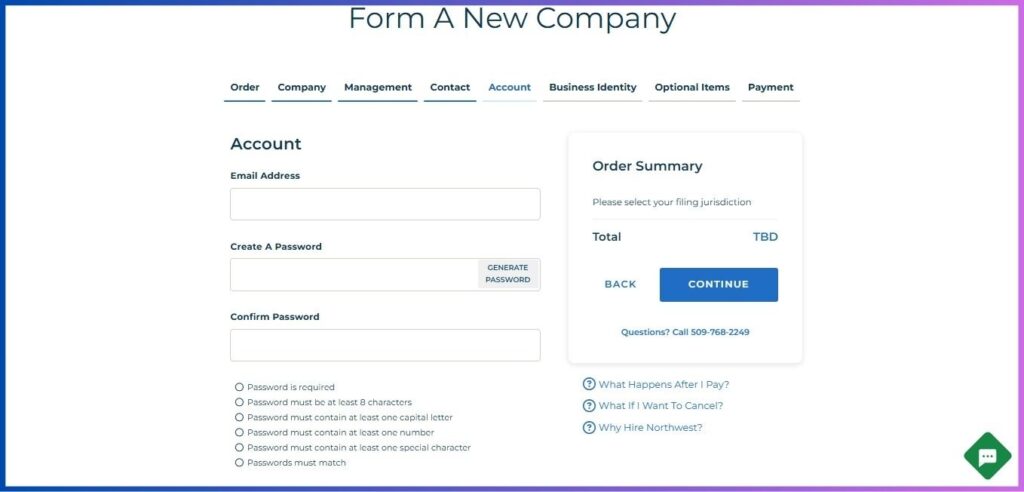

Step 7: Create Your Northwest Account

- Enter a valid email address

- Create a strong password that meets these requirements:

- At least 8 characters

- Includes a capital letter, a number, and a special character

- Confirm your password

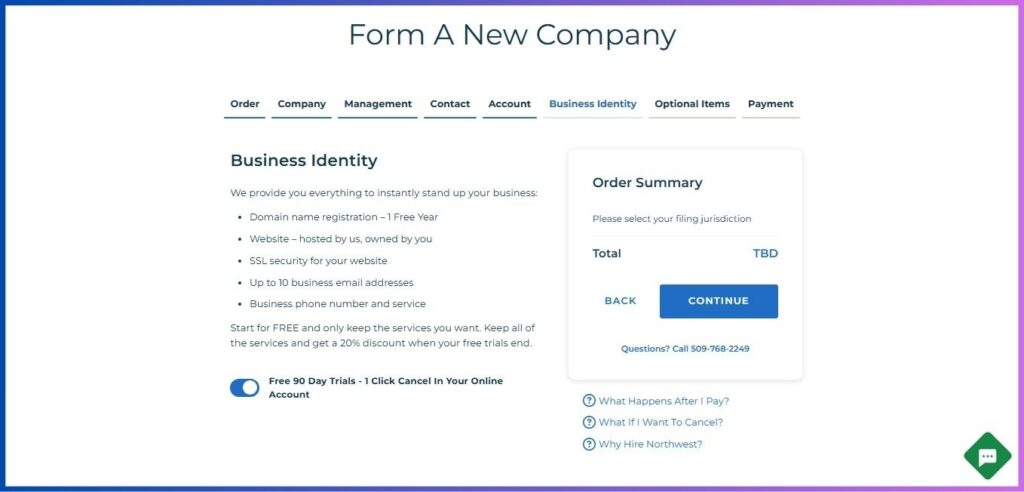

Step 8: Establish Your US Business Identity

Take advantage of Northwest’s Business Identity package to cement your US presence:

- Free domain name registration for 1 year

- Website hosting (owned by you, hosted by Northwest)

- SSL security for your website

- Up to 10 business email addresses

- US business phone number and service

These services start FREE, allowing you to test the waters of the US market.

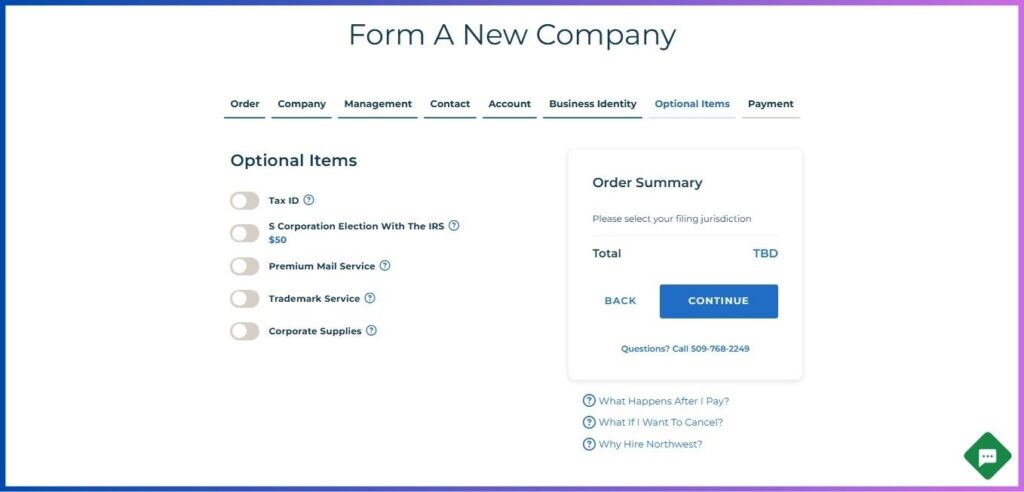

Step 9: Consider Additional Services

As a Ghanaian entrepreneur learning how to form a US LLC from Ghana, consider these valuable add-ons:

- EIN obtainment service

- US business address

- Virtual office services

Post-Formation Steps: Bringing Your US LLC to Life

Now that you know how to form a US LLC from Ghana, let’s look at the crucial next steps:

1. Obtain Your EIN

As a non-US resident, you’ll need to:

- Apply for an Employer Identification Number (EIN) by mail or fax using Form SS-4

- Or let Northwest handle this for you (recommended for ease)

2. Draft Your Operating Agreement

While not mandatory in all states, an Operating Agreement is crucial for defining your LLC’s structure and operations.

3. Open a US Bank Account

This can be challenging but is essential for your US operations:

- Research banks that cater to non-resident LLC owners

- Prepare to provide:

- LLC formation documents

- EIN

- Your Ghanaian passport

- Proof of address in Ghana

- Possibly a notarized proof of identity

4. Navigate the Tax Landscape

As a Ghanaian owning a US LLC:

- Your LLC may need to file an annual US tax return

- You may need to file additional forms if you’re the sole owner

- Consult with a tax professional familiar with both US and Ghanaian tax laws

5. Stay Compliant

Maintain your LLC’s good standing:

- File annual reports

- Pay any applicable franchise taxes

- Keep your registered agent service active

Bridging Ghana and the US: Special Considerations

As you embark on your journey of how to form a US LLC from Ghana, keep in mind:

- Time zone differences: Plan for communication gaps with US-based contacts

- Currency exchange: Factor in cedi-to-dollar conversions in your budgeting

- Travel planning: You may need to visit the US occasionally (secure appropriate visas)

- Dual compliance: Ensure your US LLC doesn’t conflict with Ghanaian regulations

From Accra to New York: Your US LLC Success Story

Learning how to form a US LLC from Ghana is your first step towards international business success. While the process may seem complex, with the right guidance and services like Northwest Registered Agent, you can navigate this journey smoothly.

Related: How to Form a US LLC from Gambia

Remember, forming a US LLC doesn’t automatically grant you work authorization in the US. Always ensure you’re complying with both US and Ghanaian laws in your business operations.

By following this guide on how to form a US LLC from Ghana, you’re not just creating a business entity; you’re building a bridge between two continents, cultures, and economies. Your US LLC can be the vehicle that drives your entrepreneurial dreams to new heights, combining Ghanaian ingenuity with American opportunity.

Disclosure: We may earn commission for purchases that are made by visitors on this site at no additional cost on your end. All information is for educational purposes and is not intended for financial advice. Read our affiliate disclosure.