How to Form a US LLC from Kenya: A Guide for Non-US Residents

As a Kenyan entrepreneur looking to expand your business horizons, forming a Limited Liability Company (LLC) in the United States can open up opportunities. This guide will walk you through the process of how to form a US LLC from Kenya using Northwest Registered Agent as your formation service.

Why Form a US LLC?

Before we dive into the process, let’s explore why a US LLC might be beneficial for a Kenyan business owner:

- Access to the US market

- Enhanced credibility with international clients

- Asset protection

- Potential tax benefits

- Easier access to US financial services

Related: How to form an LLC in Kenya

Prerequisites for Forming a US LLC from Kenya

Before starting the process, ensure you have:

- A valid passport

- Proof of address in Kenya

- Funds for LLC formation fees and registered agent services

- A basic understanding of your business goals in the US

Step-by-Step Guide on How to Form a US LLC from Kenya

1. Choose a Registered Agent Service

As a non-US resident, you’ll need a reliable registered agent service. We recommend Northwest Registered Agent for their comprehensive services tailored to international clients.

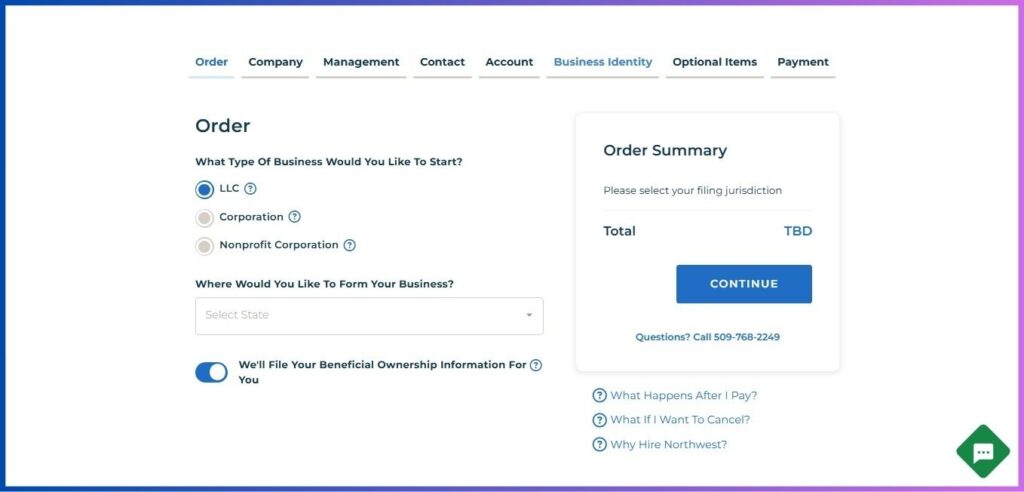

2. Begin the LLC Formation Process

- Visit the Northwest Registered Agent website

- Click on “Start Your Business”

- Select “LLC” as your business type

- Choose the state where you want to form your LLC (research which state best suits your business needs)

- Opt in for Northwest to file your Beneficial Ownership Information

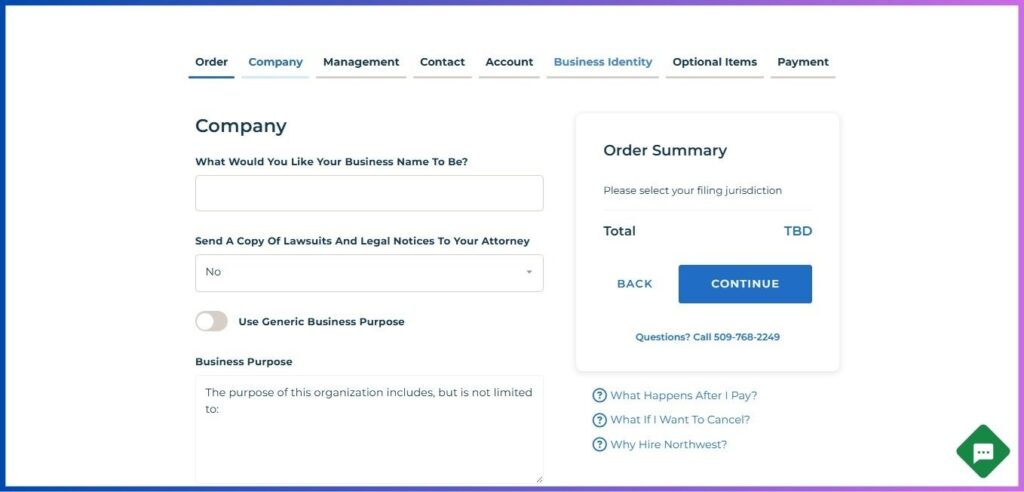

3. Provide Company Information

- Enter your desired LLC name (ensure it is unique and includes “LLC” or “Limited Liability Company”)

- Decide on whether to use a generic business purpose or specify your own

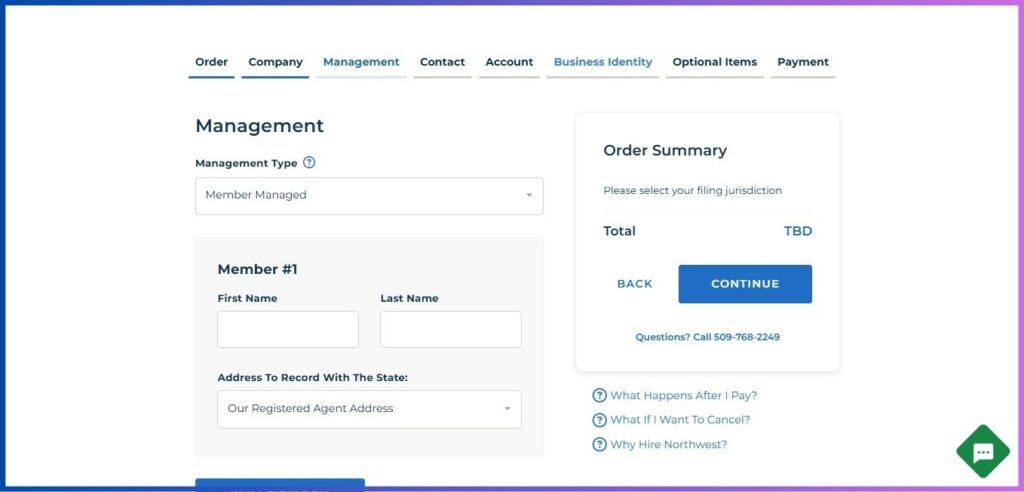

4. Set Up Management Structure

- Choose “Member Managed” (typical for small LLCs)

- Enter your details as the primary member:

- Use your Kenyan name as it appears on your passport

- You can use Northwest’s US address for state filings to maintain privacy

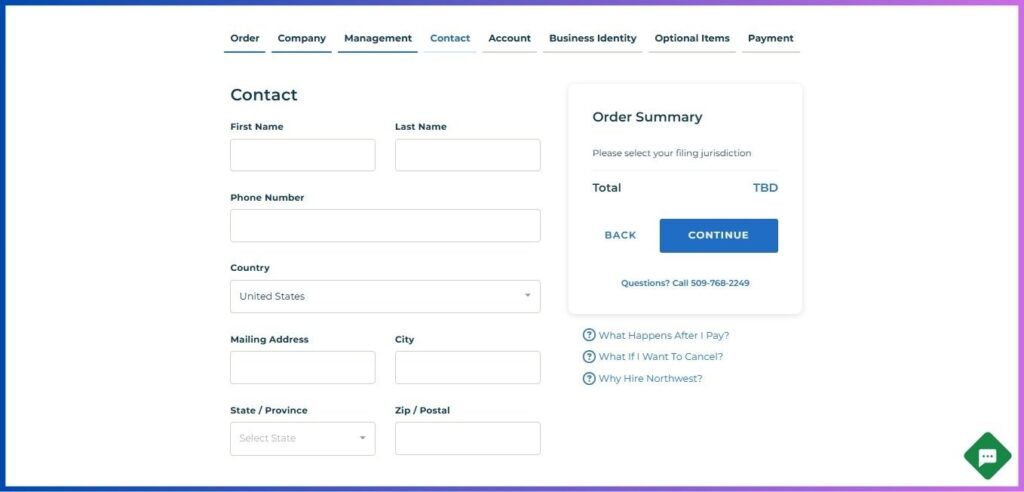

5. Enter Contact Information

Provide your Kenyan contact details:

- Full name

- Email address

- Phone number (including country code)

- Your physical address in Kenya

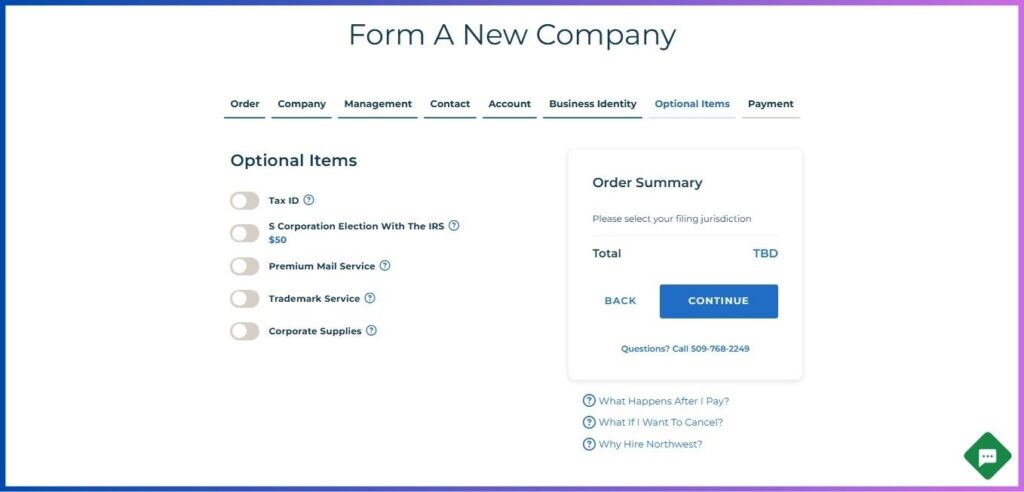

6. Select Additional Services

Consider these valuable services for international owners:

- Virtual business phone number (US-based)

- US business email address

- EIN obtainment service

- LLC Operating Agreement Template

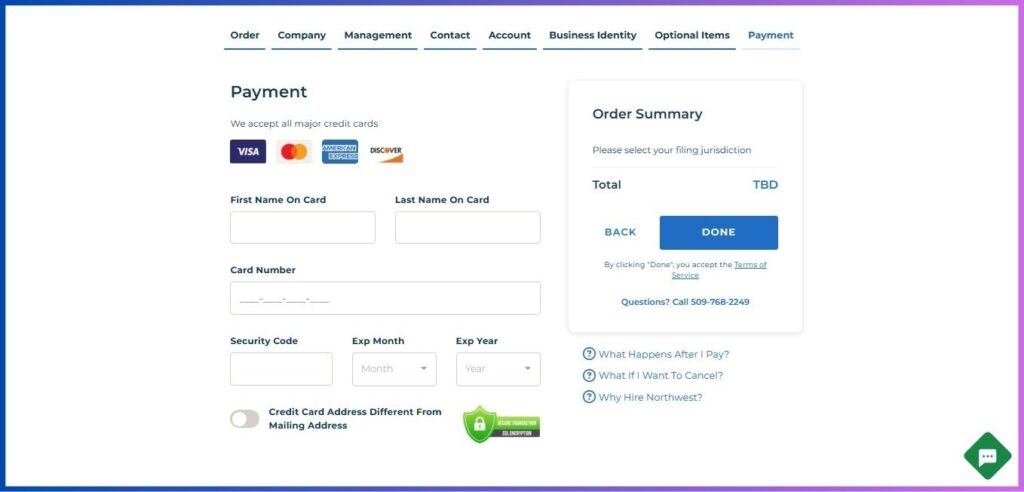

7. Review and make Payment

- Double-check all entered information

- Pay for the service using an international credit card or wire transfer

Steps for Post US LLC Formation from Kenya

After Northwest files your LLC formation documents:

1. Obtain an EIN

As a non-US resident, you’ll need an Employer Identification Number (EIN):

- Northwest can handle this for you if you selected their EIN service

- Otherwise, you’ll need to file Form SS-4 by mail or fax

2. Draft an Operating Agreement

While not mandatory in all states, an Operating Agreement is crucial for defining your LLC’s structure and operations, especially for international owners.

3. Open a US Bank Account

This can be challenging for non-residents but is essential for operating your US business:

- Research banks that offer services to non-resident LLC owners

- Be prepared to provide:

- LLC formation documents

- EIN

- Passport

- Proof of address in Kenya

- Possibly a notarized proof of identity

4. Understand Tax Obligations

As a Kenyan owning a US LLC:

- Your LLC may need to file an annual tax return (Form 1065)

- You may need to file Form 5472 and Form 1120 if you’re the sole owner

- Consult with a tax professional familiar with both US and Kenyan tax laws

5. File a Beneficial Ownership Information Report

From January 1, 2024:

- Most LLCs must file a BOI Report with FinCEN

- Northwest can handle this for you as part of their service

6. Maintain Compliance

Stay on top of ongoing requirements:

- Annual reports

- Franchise taxes (if applicable)

- Maintaining a registered agent

Considerations for Kenyan LLC Owners

- Time zone differences: Be prepared for communication delays with US-based clients or services

- Currency exchange: Factor in exchange rates when budgeting for US operations

- Travel: You may occasionally need to visit the US for business purposes (ensure you have appropriate visas)

- Local laws: Ensure your US LLC operations don’t conflict with Kenyan business regulations

Conclusion

Forming a US LLC from Kenya is an achievable goal that can significantly expand your business opportunities. While the process involves several steps, a service like Northwest Registered Agent can simplify much of the complexity.

Remember, creating an LLC doesn’t automatically grant you work authorization in the US – always ensure you comply with US and Kenyan laws in your business operations.

When you follow this guide, you will be well on your way to establishing your US business presence while managing operations from Kenya. This strategic move can open doors to new markets, enhance your global credibility, and potentially increase your business’s profitability.

Disclosure: We may earn commission for purchases that are made by visitors on this site at no additional cost on your end. All information is for educational purposes and is not intended for financial advice. Read our affiliate disclosure.