How to Form a US LLC from Malawi: A Complete Guide

Looking to form a US LLC from Malawi? As a Malawian entrepreneur, establishing a Limited Liability Company (LLC) in the United States can be a game-changing move for your business aspirations.

This comprehensive guide will walk you through the process of how to form a US LLC from Malawi, using Northwest Registered Agent as your trusted formation service.

Why Malawian Entrepreneurs Should Consider Forming a US LLC

Before diving into how to form a US LLC from Malawi, let’s explore the key benefits:

- Tap into the world’s largest economy

- Accept payments globally through US payment processors

- Build credibility with international clients

- Protect personal assets through limited liability

- Leverage the stable US banking system

- Potentially reduce currency volatility risks for your business

Prerequisites for Malawian Business Owners

Before starting your US LLC formation process, ensure you have:

- A valid Malawian passport

- Proof of address in Malawi (utility bill or bank statement)

- Sufficient funds for formation fees (in USD)

- A clear business plan for your US operations

- Basic understanding of international business operations

Related: How to Form a US LLC from Mali

Step-by-Step Guide to Forming Your US LLC from Malawi

1. Select Your Registered Agent

As a Malawian business owner, you’ll need a US-based registered agent. Northwest Registered Agent offers comprehensive services tailored for international entrepreneurs.

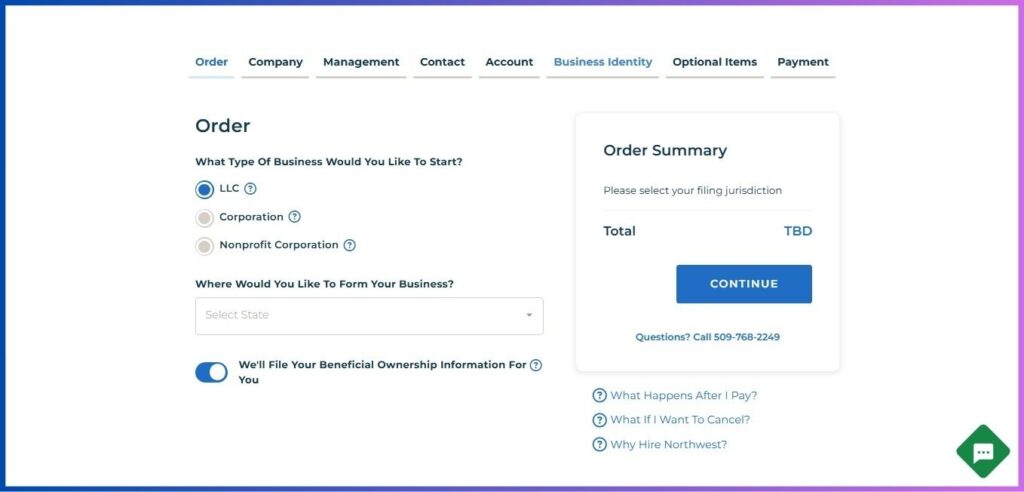

2. Start the Formation Process

- Navigate to Northwest Registered Agent’s website

- Click “Start Your Business”

- Select “LLC” as your business structure

- Choose your preferred state (consider tax implications and business requirements)

- Select the BOI filing service option

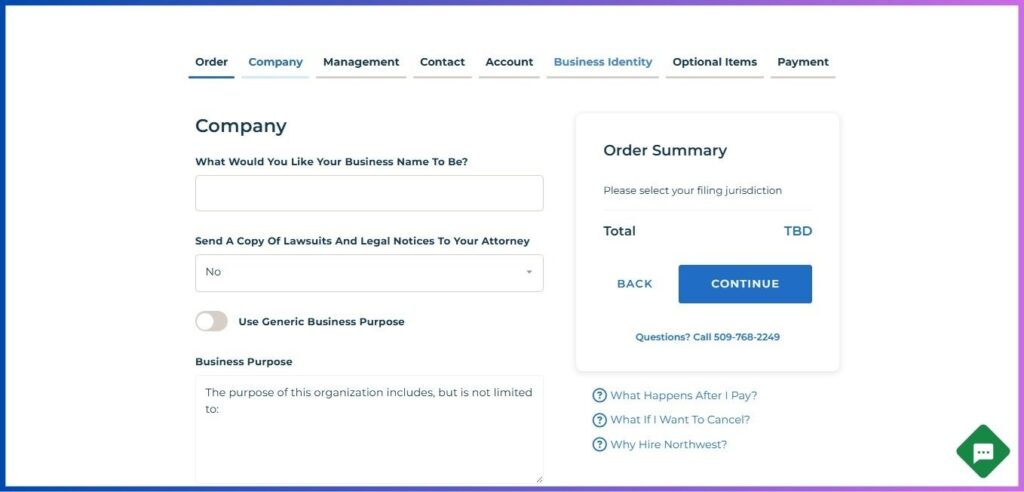

3. Company Information

- Choose a unique LLC name (must include “LLC” or “Limited Liability Company”)

- Consider using your existing Malawian business name with “US” or “America” added

- Specify your business purpose or use the generic option

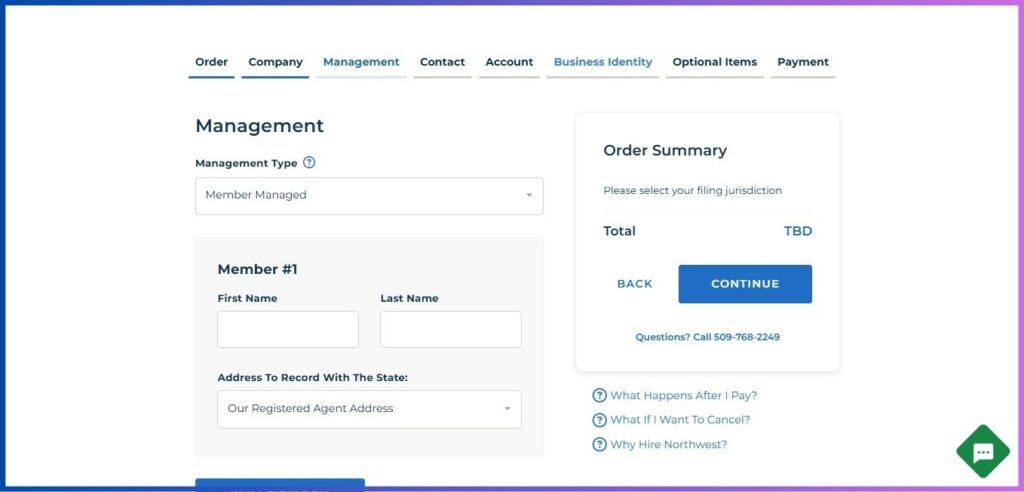

4. Management Structure

- Select “Member Managed” (recommended for most Malawian-owned LLCs)

- Enter member information:

- Your name as shown in your Malawian passport

- Option to use Northwest’s address for privacy

- Additional members if applicable

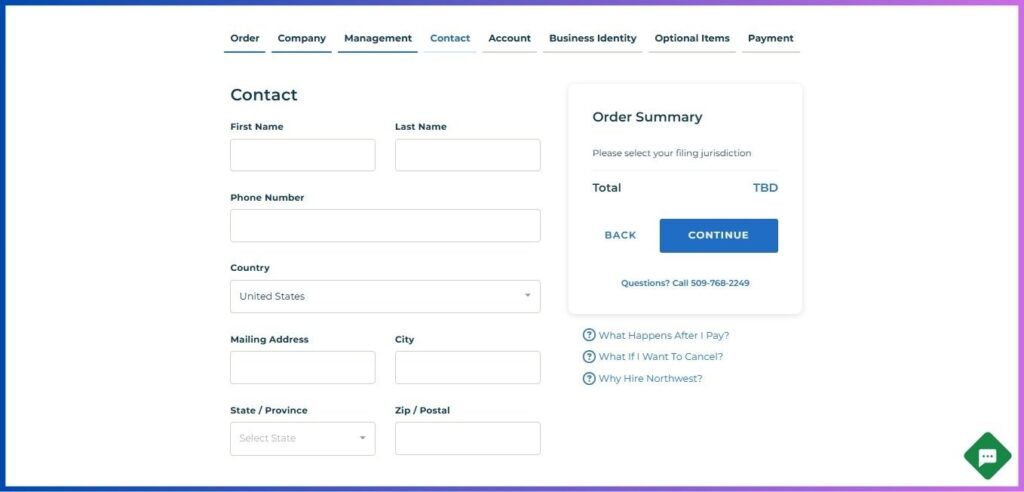

5. Contact Information

Provide your Malawian details:

- Full legal name

- Email address (consider creating a dedicated business email)

- Phone number (include Malawi’s country code +265)

- Your physical address in Malawi

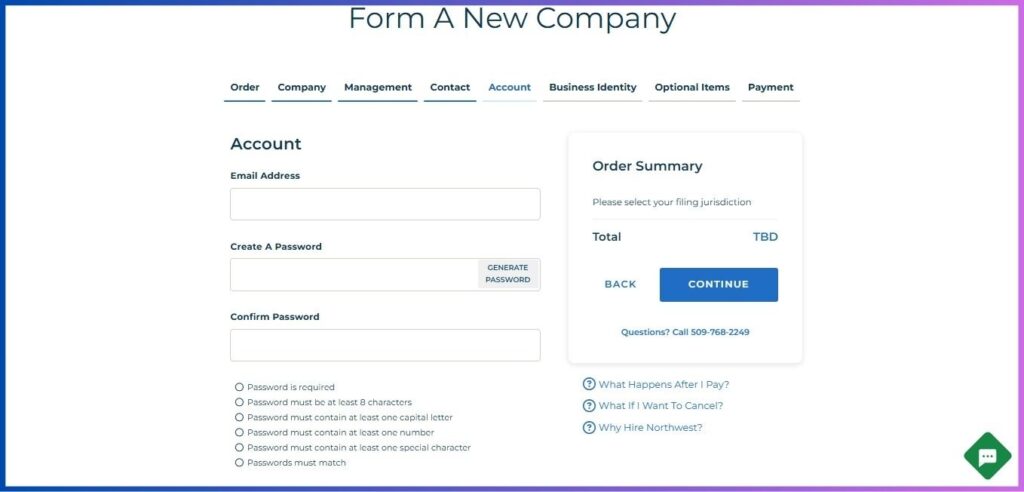

6. Create Your Account

Set up your Northwest account:

- Enter a reliable email address

- Create a strong password following the security requirements:

- Minimum 8 characters

- Include capital letters

- Add numbers

- Use special characters

- Verify your password

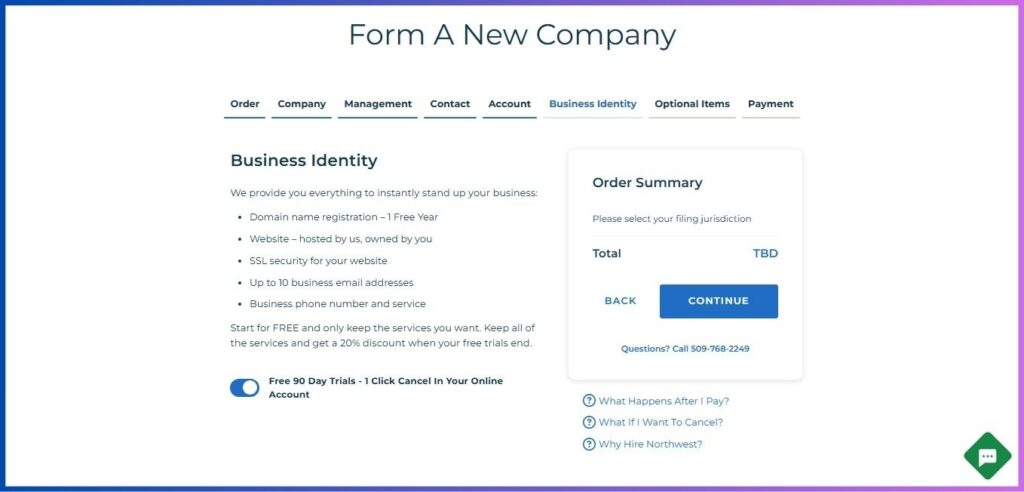

7. Business Identity Setup

Take advantage of Northwest’s business presence services:

- Free one-year domain registration

- Professional website hosting

- SSL security certificate

- Up to 10 business email addresses

- US business phone number

Consider the 90-day free trial to test these services, with a 20% discount if you keep all services afterward.

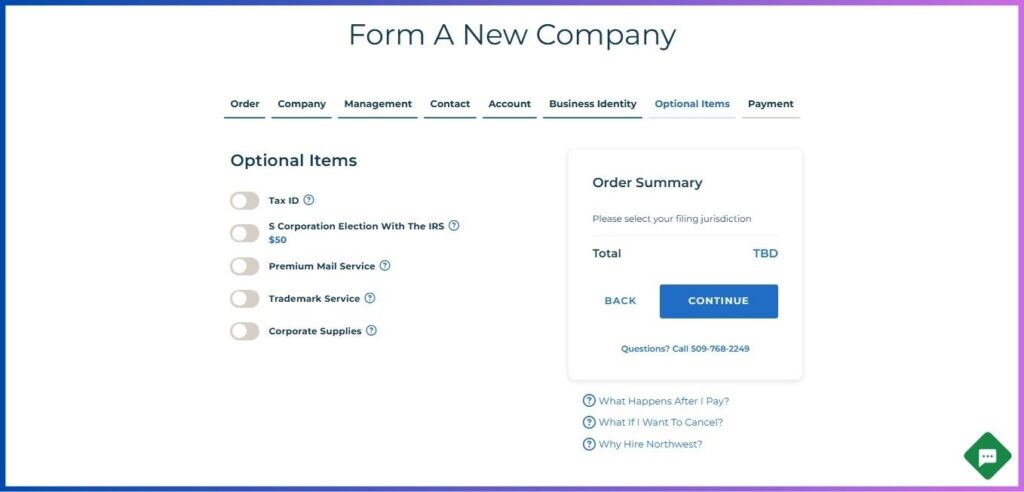

8. Choose Additional Services

Select services essential for Malawian business owners:

- EIN obtainment service (recommended)

- Operating Agreement customization

- Virtual office services

- Mail forwarding

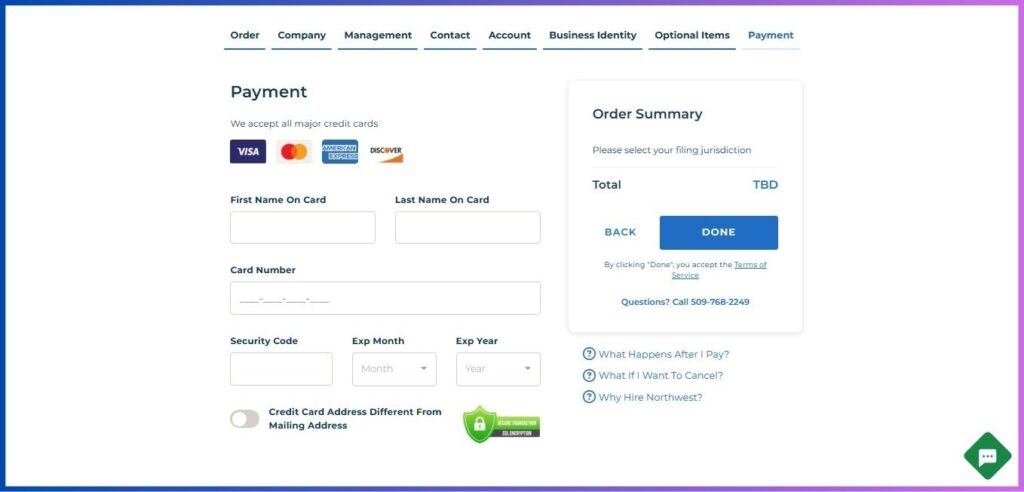

9. Complete Payment

- Review all information

- Process payment using an international credit card or wire transfer

- Ensure your bank allows international transactions

Post-Formation Steps for Malawian LLC Owners

1. Obtain Your EIN

As a Malawian business owner without a SSN:

- Use Northwest’s EIN service (recommended)

- Or file Form SS-4 directly with the IRS

- Keep all EIN documentation secure

2. Establish Your Operating Agreement

Create a comprehensive operating agreement that:

- Defines ownership structure

- Establishes management procedures

- Outlines profit distribution

- Includes provisions for international management

3. Open a US Bank Account

Navigate this crucial step:

- Research banks experienced with international LLC owners

- Prepare required documentation:

- LLC formation documents

- EIN confirmation

- Malawian passport

- Proof of address

- Banking reference letters

4. Understand Tax Obligations

Manage your tax responsibilities:

- Learn about US-Malawi tax treaties

- Understand filing requirements:

- Annual LLC tax returns

- Foreign owner reporting

- State-specific requirements

- Consider hiring a tax professional familiar with both US and Malawian tax systems

5. File BOI Report

Meet new 2024 requirements:

- Submit Beneficial Ownership Information to FinCEN

- Let Northwest handle this filing

- Keep ownership information updated

6. Maintain Compliance

Stay compliant through:

- Timely annual report filing

- Regular registered agent fee payment

- Proper record-keeping

- State-specific requirement fulfillment

Special Considerations for Malawian LLC Owners

Time Management:

- Navigate the 7-hour time difference with EST

- Plan communication windows with US clients

- Schedule virtual meetings appropriately

Banking Operations:

- Consider currency exchange fluctuations

- Plan for international transfer fees

- Maintain both US and Malawian bank accounts

Cultural Bridge:

- Understand US business culture

- Adapt communication styles

- Build relationships with US partners

Legal Compliance:

- Follow both US and Malawian business laws

- Maintain proper documentation

- Consider dual-jurisdiction compliance

Tips for Success

- Join US-Malawi business networks

- Connect with other Malawian entrepreneurs running US LLCs

- Consider visiting the US periodically for business development

- Keep detailed records of all transactions

- Stay informed about changes in both US and Malawian business laws

Conclusion

Learning how to form a US LLC from Malawi might seem daunting, but with the right guidance and support, it’s an achievable goal that can transform your business prospects.

Related: How to Form a US LLC from Madagascar

Remember that while forming a US LLC opens many doors, it requires ongoing attention to maintain compliance and achieve success. Stay committed to understanding both markets, maintain professional relationships, and leverage the unique advantages of operating between Malawi and the United States.

For Malawian entrepreneurs ready to take this step, your US LLC journey starts here. Begin your application process with Northwest Registered Agent today and join the growing community of successful international business owners operating in the US market.

Disclosure: We may earn commission for purchases that are made by visitors on this site at no additional cost on your end. All information is for educational purposes and is not intended for financial advice. Read our affiliate disclosure.