How to Form a US LLC from Mauritius

Looking to form a US LLC from Mauritius? As a Mauritian entrepreneur, establishing a Limited Liability Company (LLC) in the United States can be a strategic move to expand your business globally.

This guide will walk you through the process of forming a US LLC from Mauritius, helping you navigate the requirements and procedures specific to international business owners.

Why Mauritians Should Consider Forming a US LLC

As an entrepreneur based in Mauritius, forming a US LLC offers several unique advantages:

- Bridge between African and US markets

- Leverage Mauritius’s strategic position as a business hub

- Access to US payment processors and e-commerce platforms

- Enhanced credibility with international clients

- Asset protection through a limited liability structure

- Potential tax benefits under US-Mauritius business relations

Prerequisites for Mauritian Business Owners

Before starting your US LLC formation process, ensure you have:

- A valid Mauritian passport

- Proof of address in Mauritius

- Funds in USD for formation fees and services

- Basic understanding of US business requirements

- International payment method (credit card or wire transfer capability)

Related: How to Form a US LLC from Mauritania

Step-by-Step Guide to Forming Your US LLC from Mauritius

1. Select Your Registered Agent

For Mauritian entrepreneurs, Northwest Registered Agent is recommended for their experience with international clients and comprehensive service offerings.

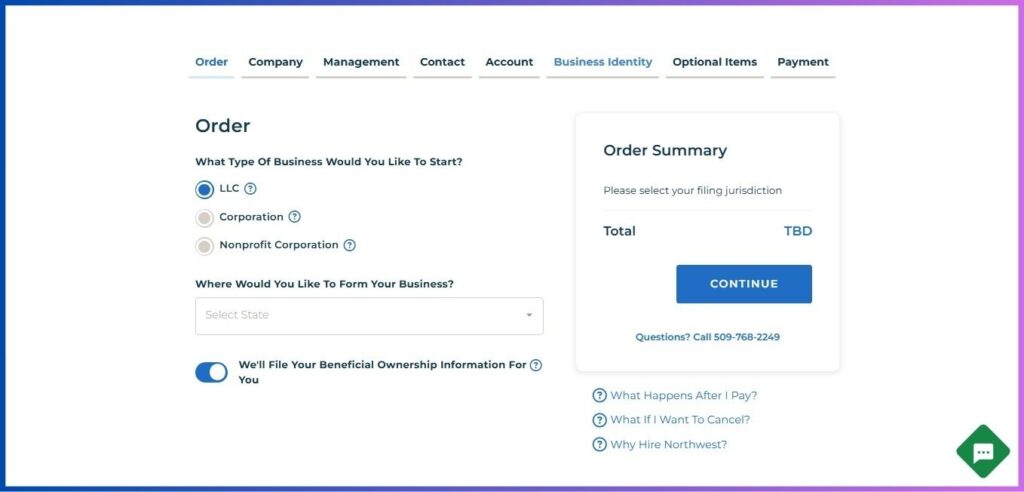

2. Begin the Formation Process

- Visit Northwest Registered Agent’s website

- Select “Start Your Business”

- Choose “LLC” as your business structure

- Select your preferred state for registration

- Opt in for BOI filing assistance

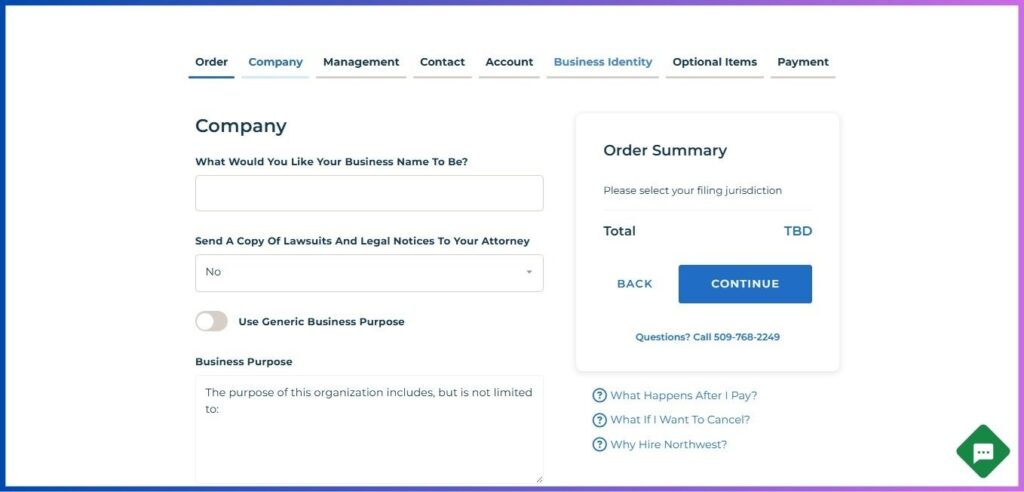

3. Company Details

- Choose a unique LLC name (must include “LLC” or “Limited Liability Company”)

- Specify your business purpose or use the generic option

- Ensure your company name complies with US state regulations

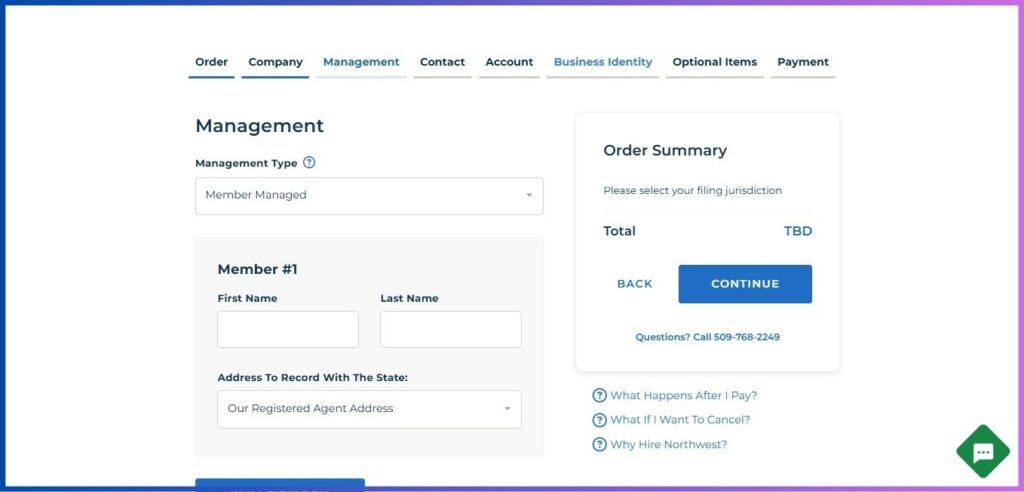

4. Management Structure Setup

- Select “Member Managed” (recommended for most Mauritian-owned LLCs)

- Enter member information:

- Your Mauritian legal name

- Choose between using your Mauritius address or Northwest’s US address

- Add any additional members if applicable

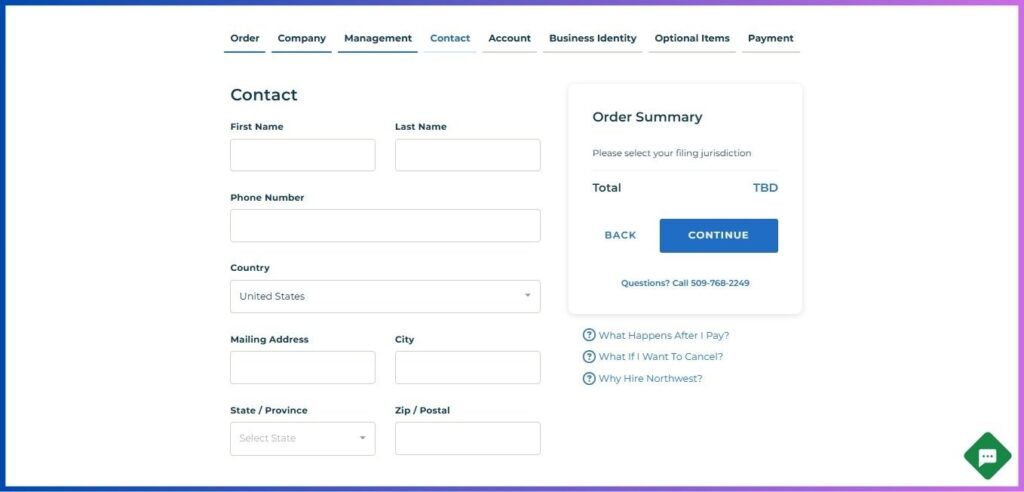

5. Contact Information

Provide your Mauritian details:

- Full legal name as per passport

- Email address

- Phone number (including Mauritius country code +230)

- Physical address in Mauritius

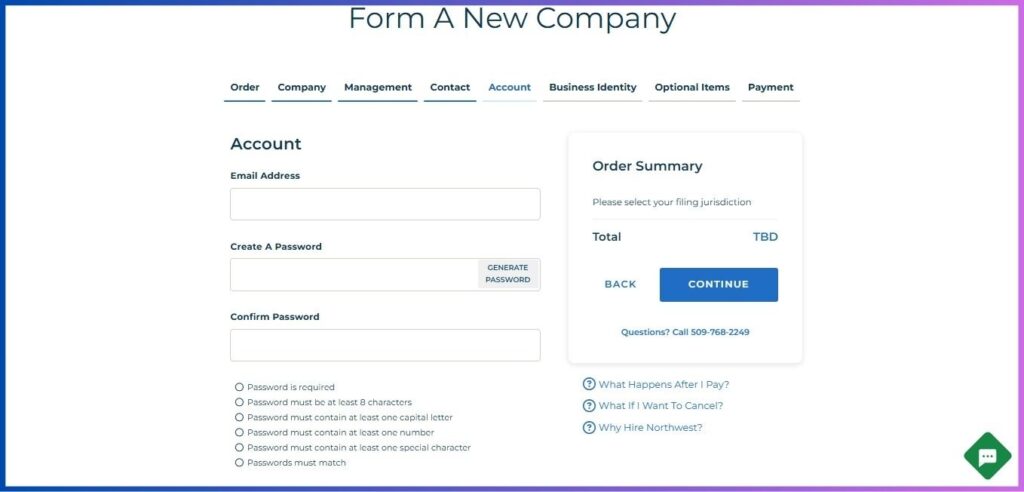

6. Account Creation

- Enter your email address

- Create a strong password following requirements:

- Minimum 8 characters

- Include capital letters

- Add numbers

- Use special characters

- Verify your password

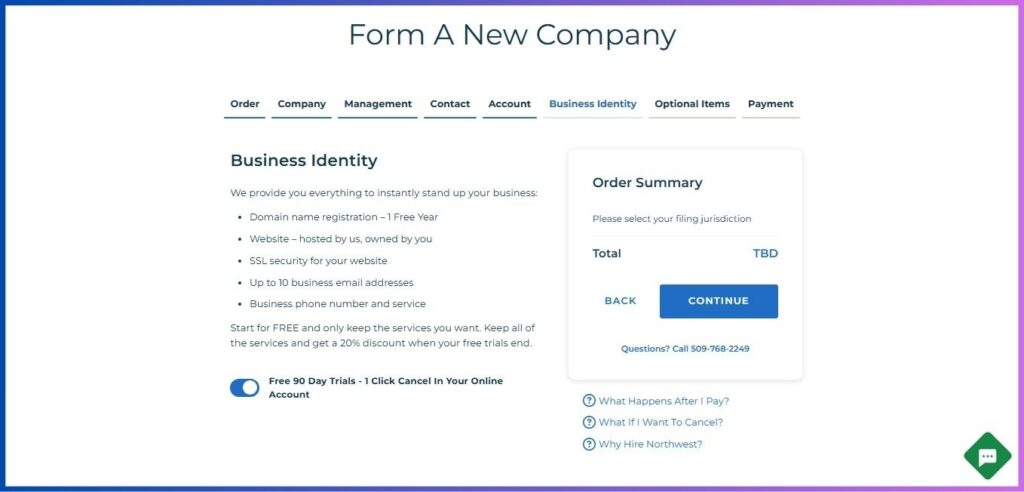

7. Business Identity Package

Consider Northwest’s comprehensive business identity services:

- Free one-year domain registration

- Professional website hosting

- SSL security certificate

- Up to 10 business email addresses

- US business phone number

Take advantage of the 90-day free trial with a 20% discount if you keep all services.

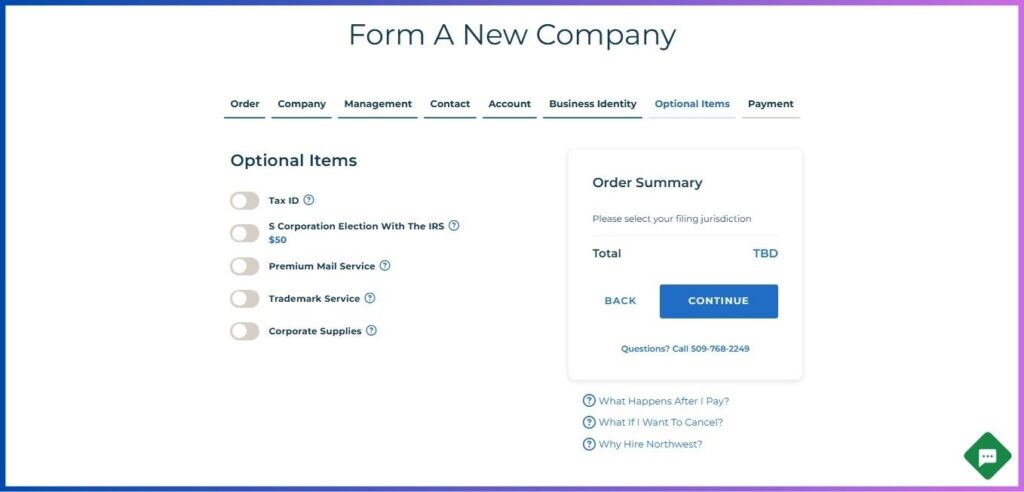

8. Additional Services Selection

Choose services essential for Mauritian business owners:

- Virtual US phone number

- EIN filing assistance

- Operating Agreement customization

- Business banking introduction services

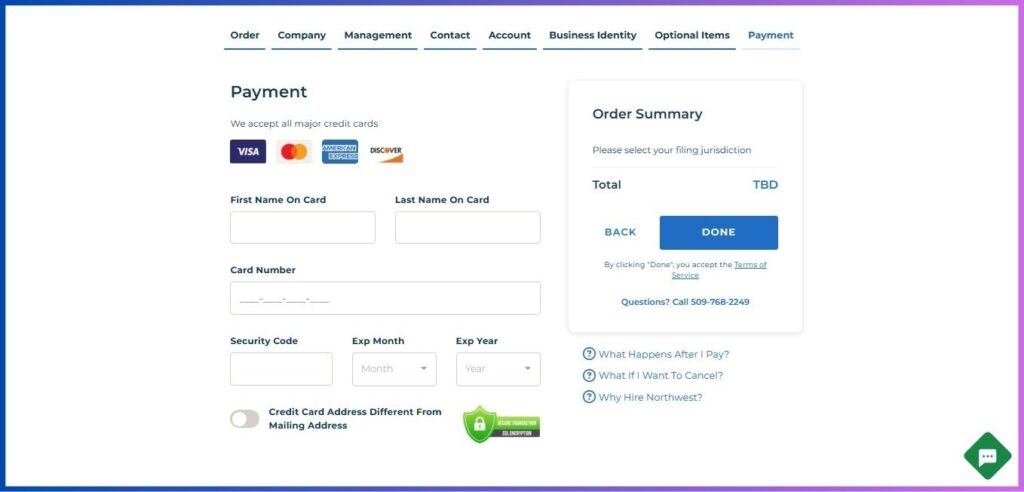

9. Review and Payment

- Verify all information

- Complete payment using an international credit card or wire transfer

- Save all confirmation details

Post-Formation Steps for Mauritian LLC Owners

1. EIN Application

As a Mauritian business owner:

- Use Northwest’s EIN service (recommended)

- Or file Form SS-4 directly with the IRS

2. Business Documentation

Prepare essential documents:

- Operating Agreement

- Business licenses (if required)

- Corporate records

- Business plan for US operations

3. Banking Setup

For Mauritian entrepreneurs:

- Research US banks accepting international LLC owners

- Prepare required documentation:

- LLC formation documents

- EIN confirmation

- Mauritian passport

- Proof of Mauritius address

- Bank reference letters (if available)

4. Tax Compliance

Understand obligations as a Mauritian LLC owner:

- US tax filing requirements

- Mauritius-US tax treaty implications

- International tax reporting obligations

- Consider engaging a tax professional familiar with both jurisdictions

5. FinCEN Requirements

From 2024 onwards:

- File Beneficial Ownership Information (BOI) Report

- Maintain accurate ownership records

- Update information as needed

Special Considerations for Mauritian LLC Owners

Time Zone Management

- Plan for EST/EDT business hours

- Schedule meetings considering the 8-9 hour time difference

- Use scheduling tools for efficient communication

Banking Operations

- Consider maintaining both USD and MUR accounts

- Plan for international transfer fees

- Understand currency exchange implications

Business Culture

- Leverage Mauritius’s multicultural business experience

- Understand US business etiquette

- Build on Mauritius’s reputation for international business

Digital Infrastructure

- Utilize Mauritius’s strong internet infrastructure

- Set up reliable communication channels

- Implement virtual meeting solutions

Maintaining Your US LLC from Mauritius

Annual Compliance

- File required reports on time

- Maintain registered agent services

- Keep corporate records updated

Business Operations

- Establish efficient payment systems

- Create clear communication protocols

- Develop remote management procedures

Growth Strategy

- Plan for US market expansion

- Consider hiring US-based representatives

- Explore business partnerships

Conclusion

Forming a US LLC from Mauritius is a strategic move that can significantly expand your business opportunities. While the process requires careful attention to detail, the benefits of accessing the US market make it a worthwhile endeavor for Mauritian entrepreneurs.

Related: How to Form a US LLC from Nigeria

By following this guide and working with Northwest Registered Agent, you can establish your US business presence while maintaining operations from Mauritius.

Remember that while forming a US LLC opens many doors, it’s important to maintain compliance with both US and Mauritian regulations. With proper planning and execution, your US LLC can serve as a powerful platform for international business growth and success.

Disclosure: We may earn commission for purchases that are made by visitors on this site at no additional cost on your end. All information is for educational purposes and is not intended for financial advice. Read our affiliate disclosure.