How to Form a US LLC from Morocco

Are you a Moroccan entrepreneur dreaming of expanding your business horizons to the United States? Forming a US LLC from Morocco might be your gateway to global business success. This comprehensive guide will walk you through every step of establishing your American business presence while maintaining operations from beautiful Morocco.

Why Moroccan Entrepreneurs Should Consider a US LLC

Morocco’s strategic location between Europe and Africa has always made its entrepreneurs natural international business leaders. Here’s why forming a US LLC from Morocco makes perfect sense:

- Bridge Between Continents: Leverage Morocco’s unique position to connect US markets with African and European business opportunities

- Digital Business Evolution: Capitalize on Morocco’s growing digital economy by establishing a US presence

- Currency Advantages: Access USD-based transactions and reduce currency fluctuation risks

- Global Credibility: Enhance your business reputation with a US company structure

- E-commerce Opportunities: Easier access to US payment processors and marketplaces

Related: How to Form a US LLC from Mozambique

Essential Prerequisites for Moroccan Business Owners

Before starting your US LLC formation journey from Morocco, ensure you have:

- A valid Moroccan passport

- Proof of residence in Morocco

- International payment capability (credit card or wire transfer)

- Basic understanding of US business practices

- Digital copies of your identification documents

Step-by-Step Guide: How to Form a US LLC from Morocco

1. Choose Your Registered Agent

Northwest Registered Agent is our recommended choice for Moroccan entrepreneurs due to their:

- Experience with international clients

- Comprehensive support services

- Transparent pricing

- Privacy protection features

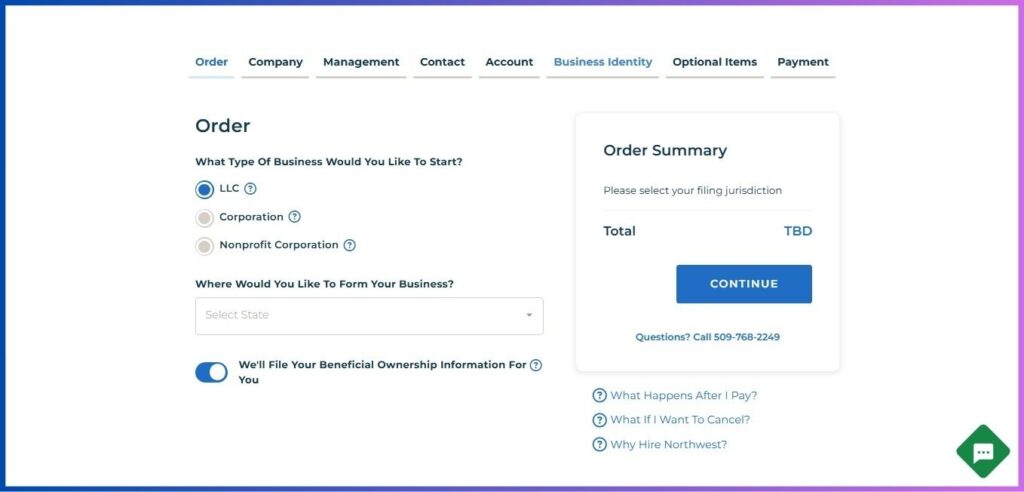

2. Begin Your LLC Formation

- Visit Northwest Registered Agent’s website

- Select “Start Your Business”

- Choose “LLC” as your business structure

- Pick your preferred state (Delaware, Montana, Wyoming, and Florida are popular choices among Moroccan entrepreneurs)

- Opt in for BOI filing assistance

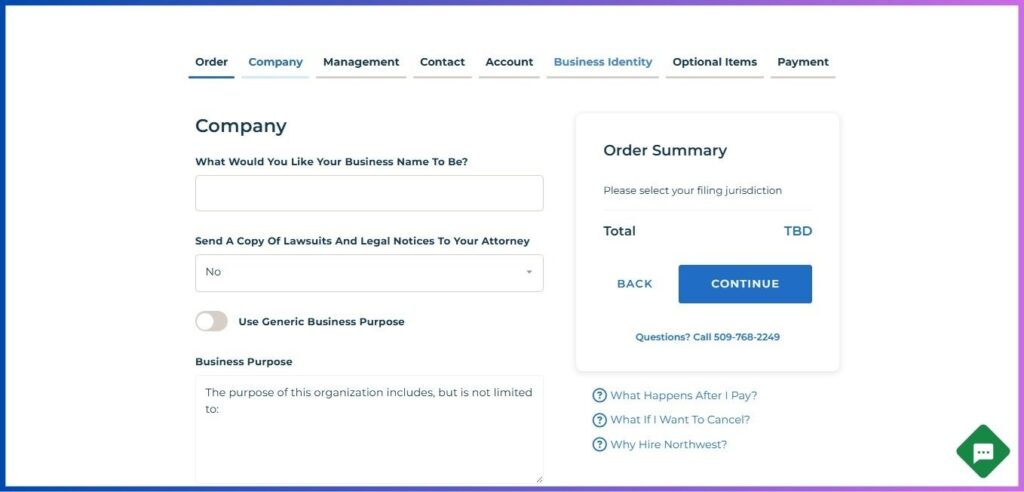

3. Company Information

- Choose a distinctive LLC name (include “LLC” or “Limited Liability Company”)

- Consider incorporating Arabic translation of your business name if relevant

- Define your business purpose or use the generic option

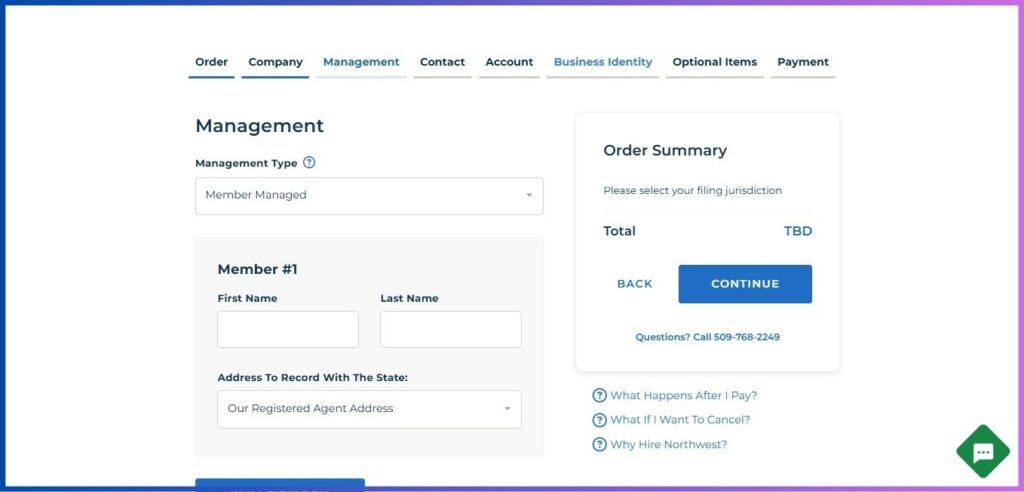

4. Management Structure

- Select “Member Managed” (recommended for most Moroccan entrepreneurs)

- Enter member details:

- Your name as shown in your Moroccan passport

- Use Northwest’s address for privacy

- Add additional Moroccan or international members if applicable

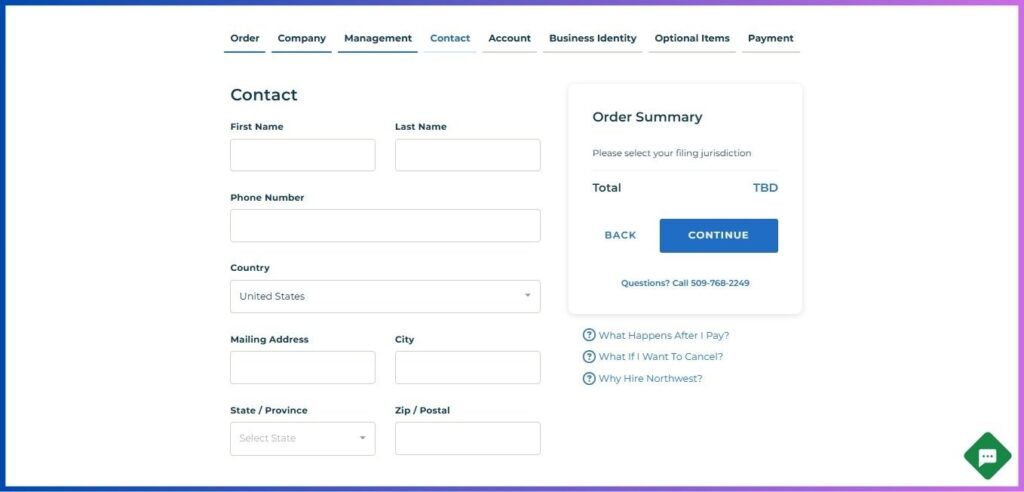

5. Contact Details

Provide your Morocco-based information:

- Full legal name

- Moroccan phone number with country code (+212)

- Your physical address in Morocco

- Additional contact preferences

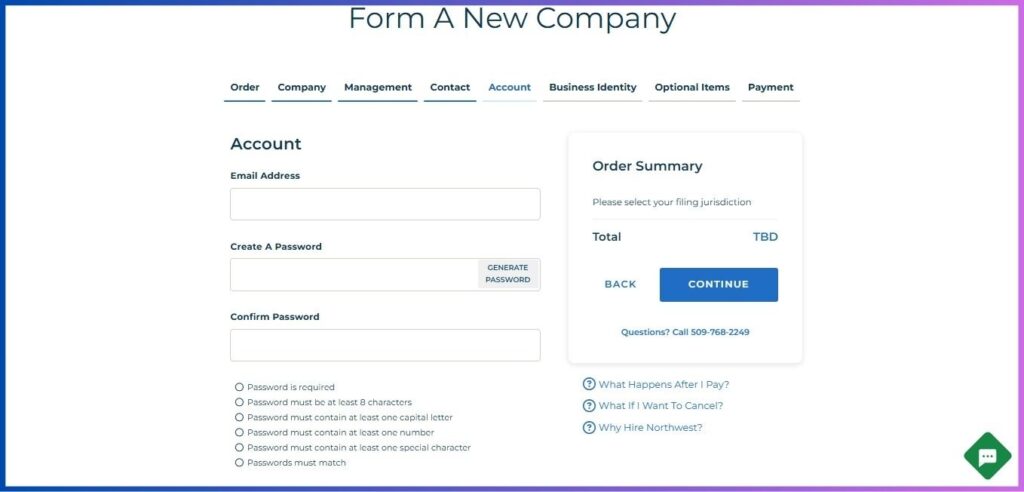

6. Create Your Account

Set up your secure Northwest account:

- Enter your email address

- Create a strong password meeting these requirements:

- Minimum 8 characters

- At least one capital letter

- At least one number

- One special character

- Confirm your password

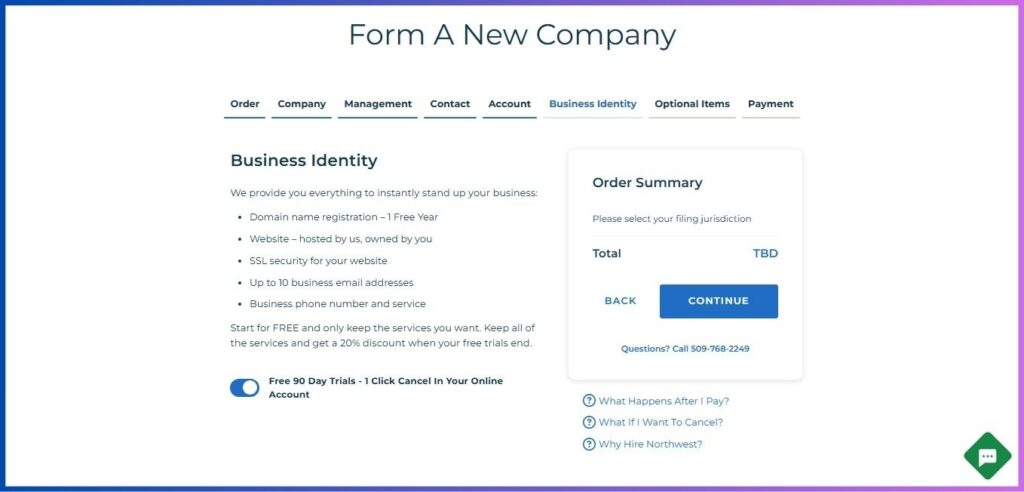

7. Business Identity Setup

Take advantage of Northwest’s Business Identity package:

- Free 1-year domain registration

- Professional website hosting

- SSL security certificate

- Up to 10 business email addresses

- US business phone service

Pro tip for Moroccan entrepreneurs: These services help establish a professional US presence while operating from Morocco.

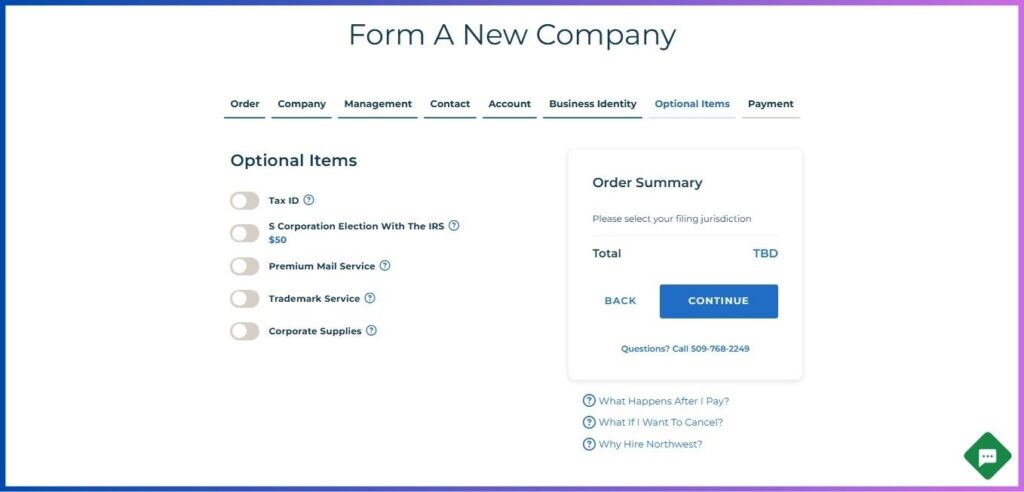

8. Additional Services Selection

Consider these essential services:

- EIN obtainment assistance

- Operating Agreement customization

- Virtual office services

- Mail forwarding

Post-Formation Steps for Your Morocco-Based US LLC

1. Obtain Your EIN

As a Moroccan business owner:

- Use Northwest’s EIN service (recommended)

- Or file Form SS-4 yourself

- Prepare for potential IRS questions about international ownership

2. Banking Solutions

Special considerations for Moroccan LLC owners:

- Research US banks accepting international LLC owners

- Prepare required documentation:

- Moroccan passport

- LLC formation documents

- EIN confirmation

- Proof of Moroccan address

- Bank reference letters (if available)

3. Compliance Requirements

Stay compliant while operating from Morocco:

- File BOI report (mandatory from 2024)

- Submit annual reports

- Maintain accurate financial records

- Track US-Morocco tax treaty implications

Related: How to Form a US LLC from Namibia

Smart Strategies for Moroccan LLC Owners

Business Operations

- Time Management:

- Plan around the 5-7 hour time difference

- Schedule US meetings during Morocco’s afternoon hours

- Use automation tools for 24/7 business presence

- Payment Processing:

- Set up international payment solutions

- Consider multi-currency accounting

- Plan for currency conversion costs

- Cultural Bridge:

- Leverage your understanding of both Moroccan and US business cultures

- Use your multilingual skills (Arabic, French, English) as a competitive advantage

- Create unique value propositions combining Moroccan and US market insights

Tax Considerations

- US Tax Obligations:

- Understand US tax requirements

- Track Morocco-US tax treaty benefits

- Maintain separate books for US operations

- Moroccan Requirements:

- Report foreign income properly

- Understand currency repatriation rules

- Consult with tax experts familiar with both systems

Growth Opportunities for Your Morocco-Based US LLC

E-commerce Integration:

- Access US marketplaces

- Sell Moroccan products to US consumers

- Leverage Morocco’s craftsmanship reputation

Service Industry:

- Offer consulting services

- Provide cultural liaison services

- Develop US-Morocco business connections

Tech Opportunities:

- Tap into Morocco’s growing tech talent

- Offer offshore development services

- Create US-Morocco tech bridges

Conclusion: Your Morocco-US Business Success

Forming a US LLC from Morocco is more than just a business decision – it’s a strategic move that positions you at the intersection of multiple thriving markets. While the process requires attention to detail and careful planning, the potential rewards make it an exciting venture for Moroccan entrepreneurs.

Remember that your unique position as a Moroccan business owner gives you distinct advantages in the global marketplace. Use your understanding of both cultures, your multilingual capabilities, and your international perspective to create a truly distinctive business presence.

By adhering to this guide to establish your US LLC from Morocco, you are not merely setting up a business entity; you are forging a connection between continents and cultures, unlocking doors to unparalleled opportunities for expansion and achievement.

Ready to start your US LLC formation journey from Morocco? Begin your application with Northwest Registered Agent today and take the first step toward your international business success.

Disclosure: We may earn commission for purchases that are made by visitors on this site at no additional cost on your end. All information is for educational purposes and is not intended for financial advice. Read our affiliate disclosure.