How to Form a US LLC from Sierra Leone

Are you a visionary entrepreneur from Sierra Leone looking to expand your business horizons to the United States? Forming a US LLC from Sierra Leone can be a game-changer, unlocking new markets, opportunities, and credibility for your venture.

This comprehensive guide is tailored specifically for Sierra Leonean business owners, walking you through every essential step to successfully establish your US Limited Liability Company (LLC) from West Africa.

Why Sierra Leonean Entrepreneurs Should Consider a US LLC

- Gateway to Global Markets: Tap into the vast US consumer market and leverage Sierra Leone’s strategic position for pan-African trade.

- Enhanced Credibility: A US LLC boosts your company’s international reputation, attracting more clients and investors.

- Diversified Income Streams: Mitigate risks by operating in multiple currencies (USD, SLL) and economies.

- Access to Advanced Technology and Resources: Elevate your business with cutting-edge US tech and innovative solutions.

- Streamlined E-commerce Opportunities: Easily integrate with major US e-commerce platforms, selling Sierra Leonean products globally.

Related: How to Form a US LLC from Sudan

Essential Prerequisites for Sierra Leonean Business Owners

Before embarking on your US LLC formation from Sierra Leone, ensure you have:

- A valid Sierra Leonean passport

- Proof of residence in Sierra Leone

- International payment capability (credit card or wire transfer)

- Basic understanding of US business practices

- Digital copies of your identification documents

Step-by-Step Guide: How to Form a US LLC from Sierra Leone

1. Choose Your Trusted Registered Agent

Select Northwest Registered Agent for their:

- Expertise in supporting international clients

- Comprehensive, privacy-focused services

- Transparent, competitive pricing

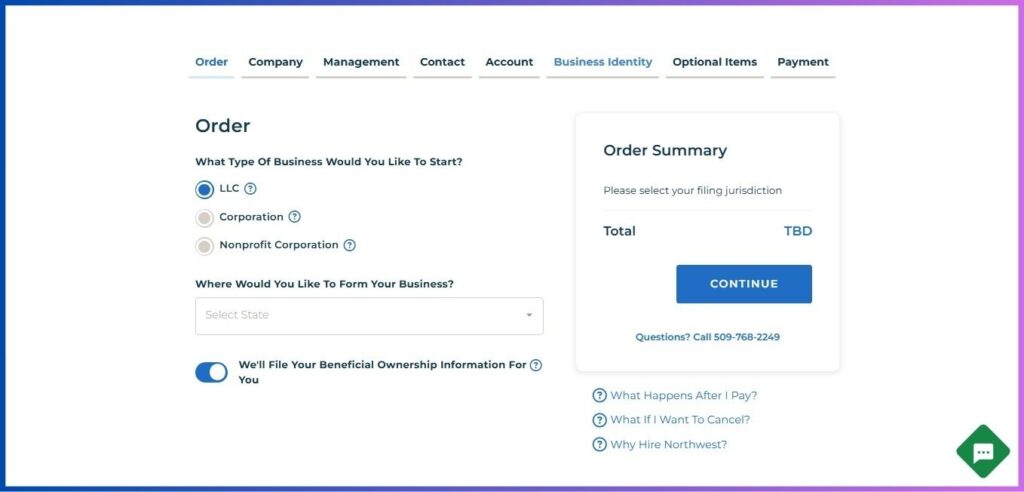

2. Initiate Your LLC Formation

- Visit Northwest Registered Agent’s website

- Click “Start Your Business”

- Select “LLC” as your business structure

- Choose a favorable state (e.g., Delaware, Wyoming, Florida)

- Opt for BOI filing assistance

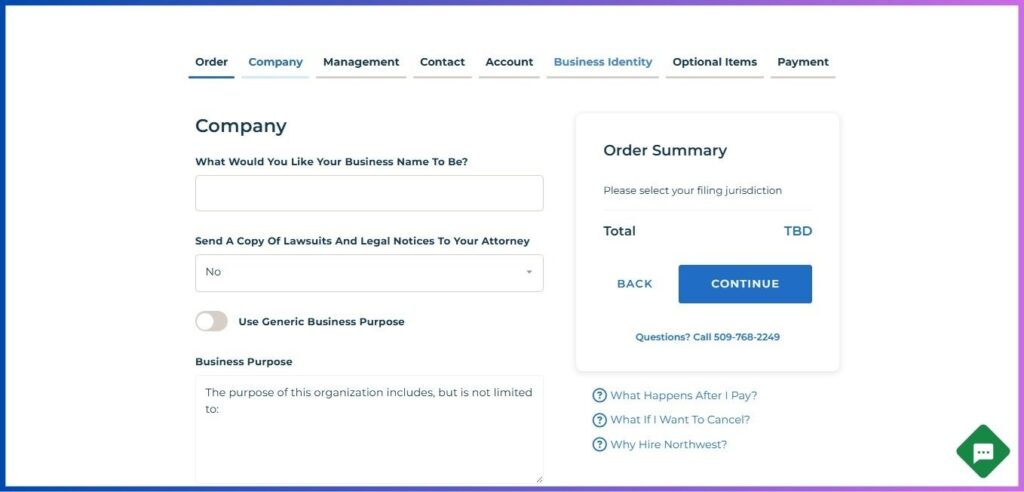

3. Define Your Company Identity

- Pick a unique LLC name (including “LLC” or “Limited Liability Company”)

- Consider adding a Krio or local language translation for cultural relevance

- Outline your business purpose (or use the generic option)

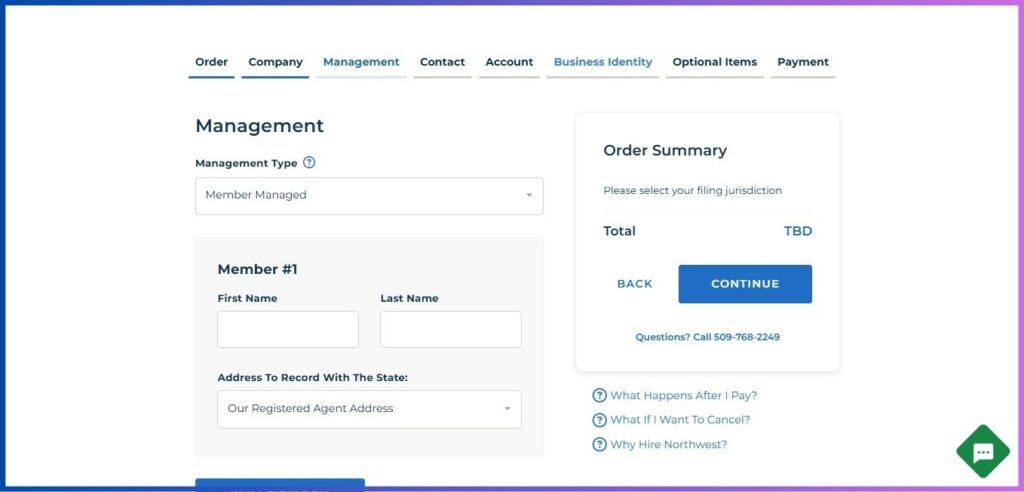

4. Establish Your Management Structure

- Select “Member Managed” (ideal for most Sierra Leonean entrepreneurs)

- Enter your details:

- Name as it appears on your Sierra Leonean passport

- Utilize Northwest’s address for enhanced privacy

- Add other Sierra Leonean or international members if applicable

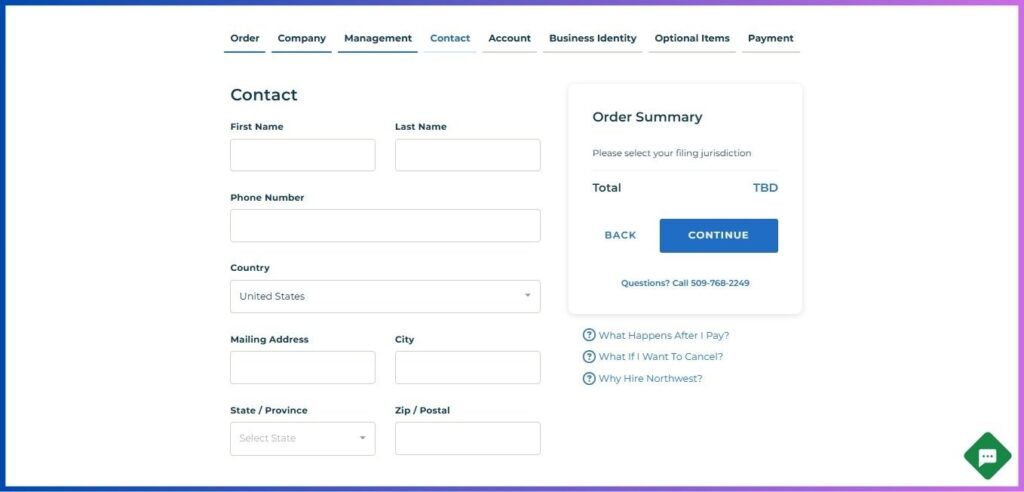

5. Provide Contact Information

- Full legal name

- Sierra Leonean phone number (+232 country code)

- Physical address in Sierra Leone

- Additional contact preferences

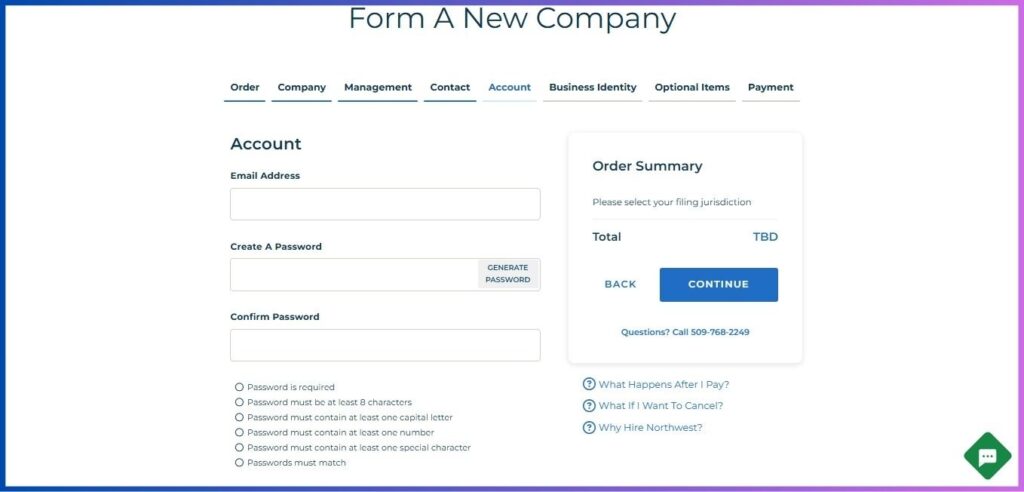

6. Secure Your Northwest Account

- Enter your email address

- Create a strong, compliant password

- Confirm your password

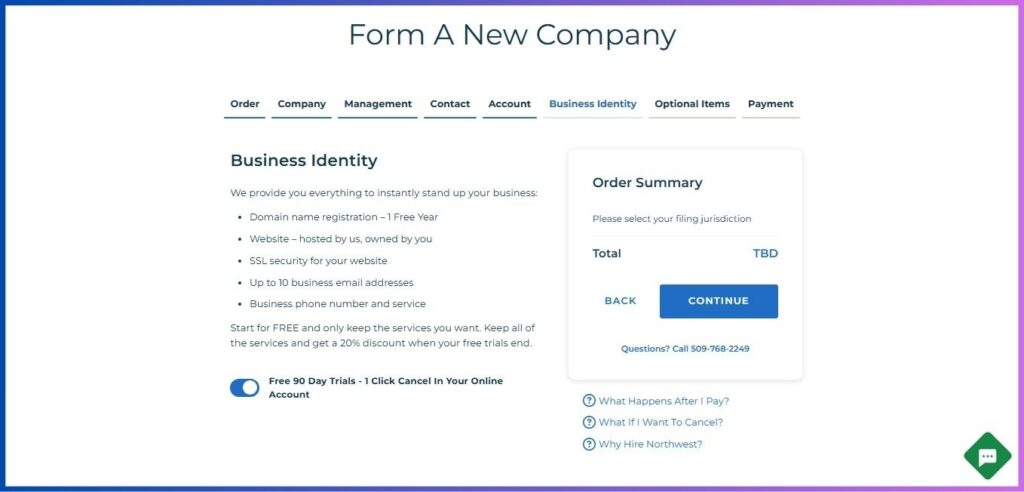

7. Enhance Your US Business Presence

Leverage Northwest’s Business Identity package for:

- Free 1-year domain registration

- Professional website hosting

- SSL security certificate

- Up to 10 business email addresses

- US business phone service

Pro Tip for Sierra Leonean Entrepreneurs: These services are crucial for projecting a professional US image while operating from Sierra Leone.

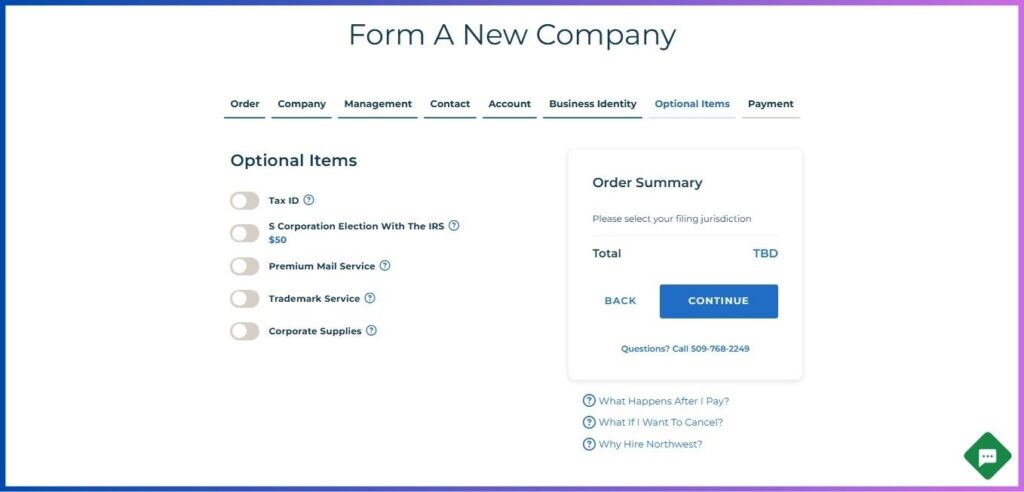

8. Select Additional Essential Services

Consider:

- EIN obtainment assistance

- Customized Operating Agreement

- Virtual office solutions

- Mail forwarding services

Post-Formation Essentials for Your Sierra Leone-Based US LLC

1. Obtain Your EIN

- Use Northwest’s EIN service for streamlined processing

- Alternatively, file Form SS-4 directly with the IRS

- Be prepared to address potential IRS inquiries about international ownership

2. Banking and Financial Setup

For Sierra Leonean LLC owners:

- Research US banks welcoming international clients

- Gather required documents:

- Sierra Leonean passport

- LLC formation documents

- EIN confirmation

- Proof of Sierra Leonean address

- Bank reference letters (if available)

Related: How to Form a US LLC from Togo

3. Compliance and Regulatory Adherence

Ensure ongoing compliance:

- File the mandatory BOI report (from 2024 onwards)

- Submit annual reports

- Maintain accurate, separate financial records for US operations

- Stay informed about US-Sierra Leone tax treaty implications

Strategic Growth Tips for Sierra Leonean US LLC Owners

Operational Efficiency

- Time Zone Management: Schedule US calls during Sierra Leone’s evening hours (GMT+0).

- Payment Solutions: Implement international payment gateways and consider multi-currency accounting.

- Cultural Ambassadorship: Leverage your unique position to bridge US and Sierra Leonean business cultures.

Tax Optimization

- US Tax Compliance: Understand and fulfill US tax obligations.

- Sierra Leonean Tax Requirements: Report foreign income accurately and understand currency repatriation rules.

- Consult Tax Experts: Work with professionals familiar with both US and Sierra Leonean tax systems.

Unlock Global Success: Form Your US LLC from Sierra Leone Today

Embarking on the journey to form a US LLC from Sierra Leone positions your business at the forefront of international trade and innovation. By following this tailored guide and partnering with Northwest Registered Agent, you’re not just establishing a US business entity – you’re forging a powerful link between Sierra Leone, the US, and the global marketplace.

Related: How to Form a US LLC from Tunisia

Ready to seize this opportunity? Start your US LLC formation process from Sierra Leone with Northwest Registered Agent now and pave the way for unparalleled business growth.

Disclosure: We may earn commission for purchases that are made by visitors on this site at no additional cost on your end. All information is for educational purposes and is not intended for financial advice. Read our affiliate disclosure.