How to Form an LLC for Non-US Residents Using Northwest Registered Agent

As a non-US resident, forming a Limited Liability Company (LLC) in the United States can open up significant opportunities. This guide will walk you through the process of how to form an LLC for non-US residents using Northwest Registered Agent, a service that simplifies the formation process for international entrepreneurs.

Benefits of Forming a US LLC for Non-Residents

Before diving into the process, it’s important to understand the advantages:

- Asset Protection: LLCs shield personal assets from business liabilities.

- Ease of Maintenance: Less paperwork compared to corporations.

- Economic Access: Gain a foothold in the US market.

- Pass-Through Taxation: Simplifies tax filing in most cases.

- Enhanced Credibility: A US-based business entity can boost your company’s reputation.

Related: How to Form a US LLC from Kenya

Step-by-Step on How to Form an LLC with Northwest Registered Agent

1. Navigate to the Northwest Registered Agent Website

Start by visiting the Northwest Registered Agent website and selecting “Start Your Business.”

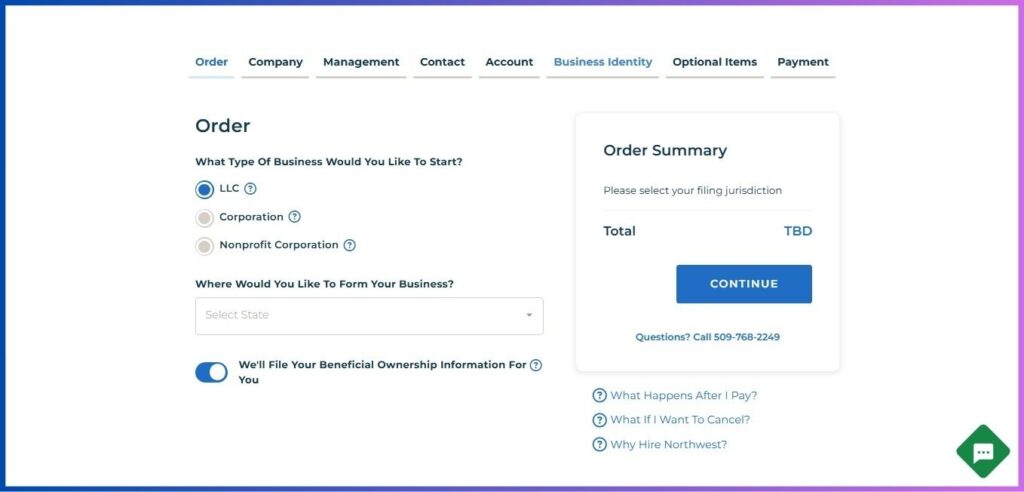

2. Choose Your Business Type

On the first page of the application:

- Select “LLC” as your business type.

- Choose the state where you want to form your LLC.

- Toggle on the option for Northwest to file your Beneficial Ownership Information.

- Click “Continue” to proceed.

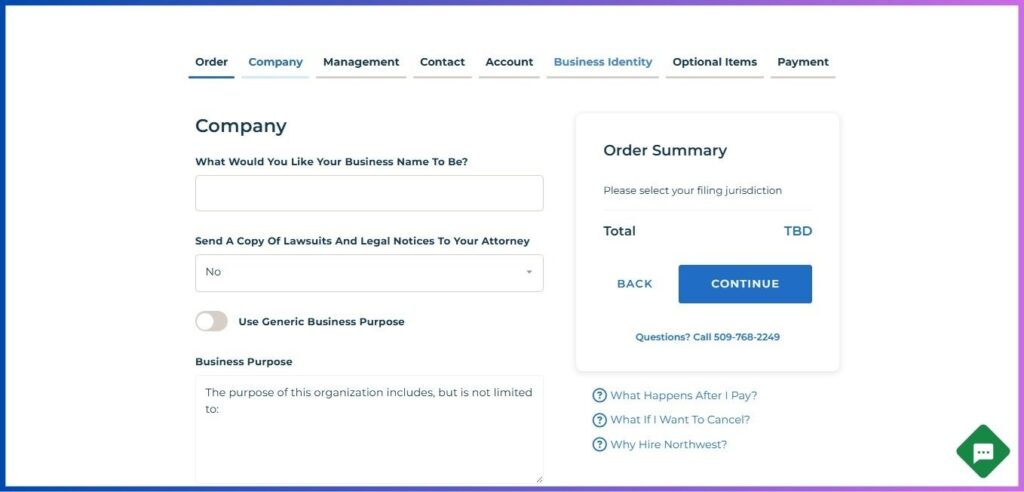

3. Provide Company Information

On the next page:

- Enter your desired business name.

- Decide whether you want legal notices sent to an attorney (usually select “No” for most small businesses).

- Optionally, enter a specific business purpose or use the generic one provided.

- Click “Continue” to move forward.

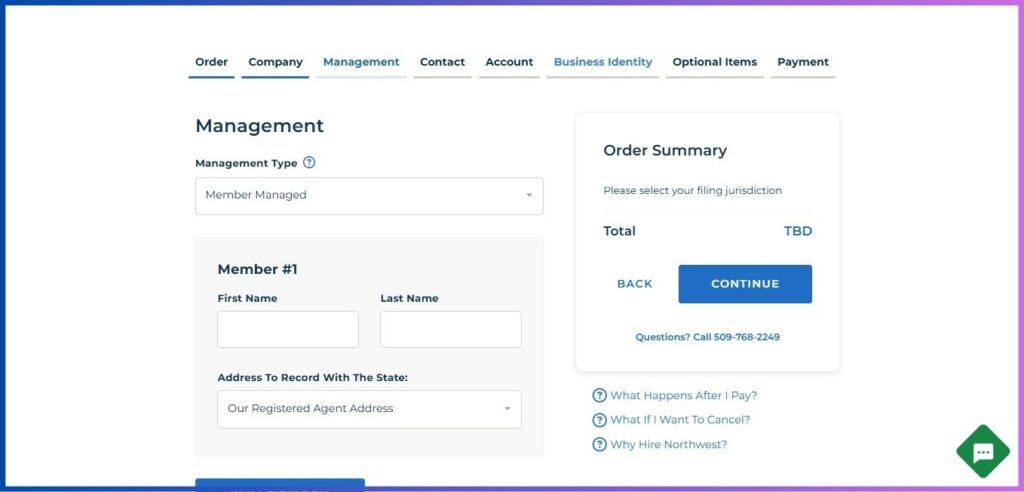

4. Set Up Management Structure

- Choose your management type (typically “Member Managed” for small LLCs).

- Enter the details for at least one member:

- First and last name

- Address (you can use Northwest’s address for privacy)

- Add additional members if necessary.

- Click “Continue” to proceed.

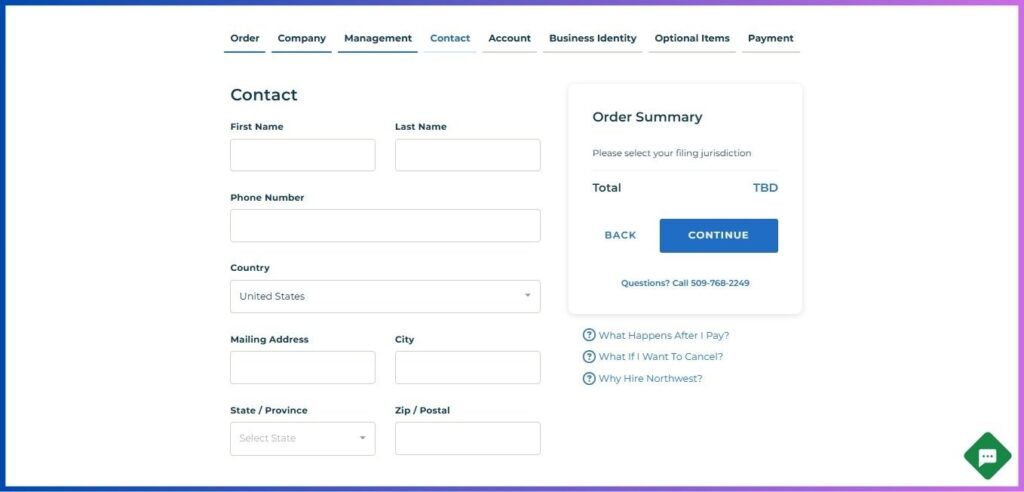

5. Enter Contact Information

Provide your personal contact details:

- Full name

- Email address

- Phone number

- Mailing address (can be international)

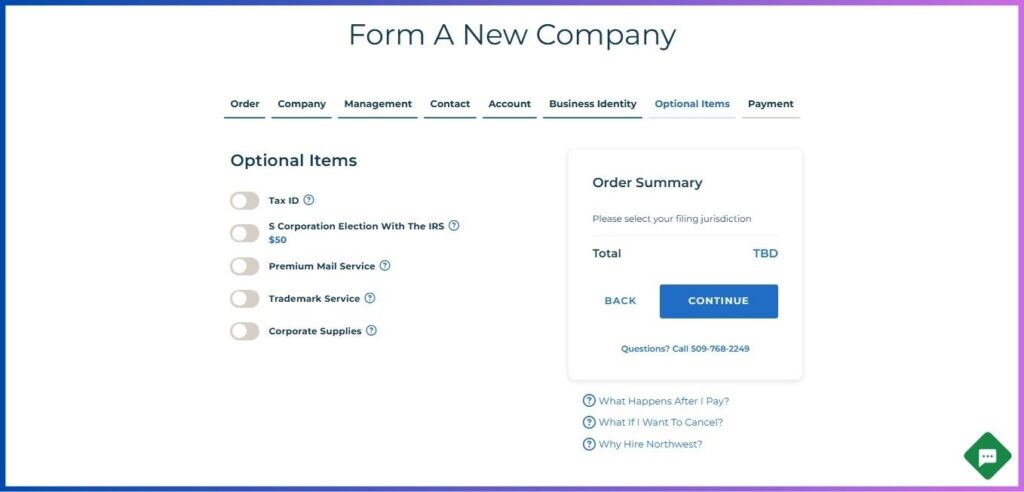

6. Choose Additional Services

Northwest offers several additional services:

- Business Phone Number

- Business Email Address

- LLC Operating Agreement

- EIN Obtainment Service

Select the services you need and continue.

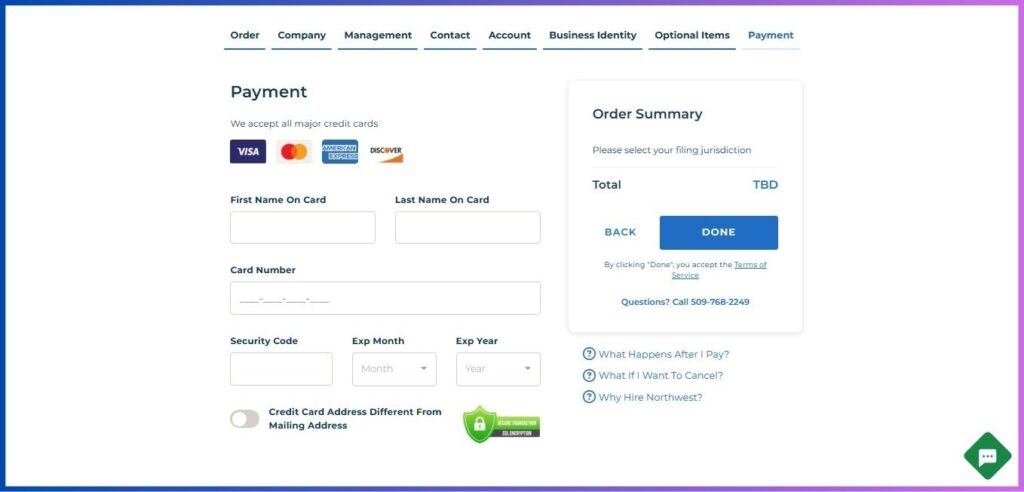

7. Review and Pay

- Review all the information you’ve entered.

- Choose your payment method.

- Complete the payment to submit your LLC formation order.

Post US LLC for Non-Residents Formation Steps

After Northwest files your LLC formation documents:

1. Obtain an EIN

As a non-US resident without a Social Security Number, you’ll need to apply for an Employer Identification Number (EIN) by mail or fax using Form SS-4. If you selected this service, Northwest will handle this for you.

Related: How to Form a US LLC from Africa

2. Create an Operating Agreement

While not required in all states, an operating agreement is crucial. Northwest provides a template as part of their service.

3. Open a US Bank Account

To operate your business, you’ll need a US bank account. This typically requires:

- Visiting a bank in person

- Bringing your LLC formation documents

- Providing your EIN

- Showing identification

4. Understand Tax Obligations

Consult with a tax professional familiar with international business taxation to ensure compliance with US tax laws.

5. File a Beneficial Ownership Information Report

Starting January 1, 2024, most LLCs must file a BOI Report with FinCEN. Northwest offers to file this report for you as part of their service.

6. Maintain Compliance

Stay informed about ongoing compliance requirements, such as annual reports or franchise taxes, which vary by state.

Conclusion

Forming an LLC in the US as a non-resident is a straightforward process when using a service like Northwest Registered Agent. They handle the complex paperwork and provide ongoing support, allowing you to focus on growing your business.

Remember, while forming an LLC grants you a business presence in the US, it doesn’t automatically provide work authorization. Ensure you understand and comply with all relevant visa requirements if you plan to work within the United States.

Disclosure: We may earn commission for purchases that are made by visitors on this site at no additional cost on your end. All information is for educational purposes and is not intended for financial advice. Read our affiliate disclosure.