How to Form a US LLC from Philippines

Are you a Filipino entrepreneur eager to tap into the vast US market, diversify your revenue streams, and elevate your business to the global stage? Forming a US LLC from Philippines is a strategic move that can catapult your success.

This comprehensive, step-by-step guide is tailored specifically for non-US residents from the Philippines, walking you through the process of establishing a US Limited Liability Company (LLC) from the comfort of your own country.

Why Filipinos Should Consider a US LLC

The Philippines, with its thriving economy and strategic location in Southeast Asia, positions Filipino entrepreneurs perfectly for international expansion. Here’s why forming a US LLC from Philippines makes compelling business sense:

- Gateway to the US Market: Tap into the world’s largest consumer market, accessing millions of potential customers.

- Diversify Your Income: Reduce dependence on local market fluctuations by generating revenue in USD.

- Enhanced Global Credibility: A US LLC can significantly boost your business reputation worldwide.

- E-commerce and Digital Opportunities: Seamlessly integrate with US e-commerce platforms and leverage the country’s robust digital infrastructure.

- Tax Efficiency: Potentially benefit from favorable tax treatments under the US-Philippines tax treaty.

Related: How to Form a US LLC from Australia

Essential Prerequisites for Filipino Business Owners

Before embarking on your US LLC formation journey from Philippines, ensure you have:

- A valid Philippine passport

- Proof of residence in the Philippines

- International payment capability (credit card or wire transfer)

- Basic understanding of US business practices

- Digital copies of your identification documents

Step-by-Step Guide: How to Form a US LLC from Philippines

1. Choose Your Registered Agent

For Filipino entrepreneurs, Northwest Registered Agent is highly recommended due to their:

- Extensive experience with international clients

- Comprehensive support tailored for non-US residents

- Transparent, competitive pricing

- Robust privacy protection features

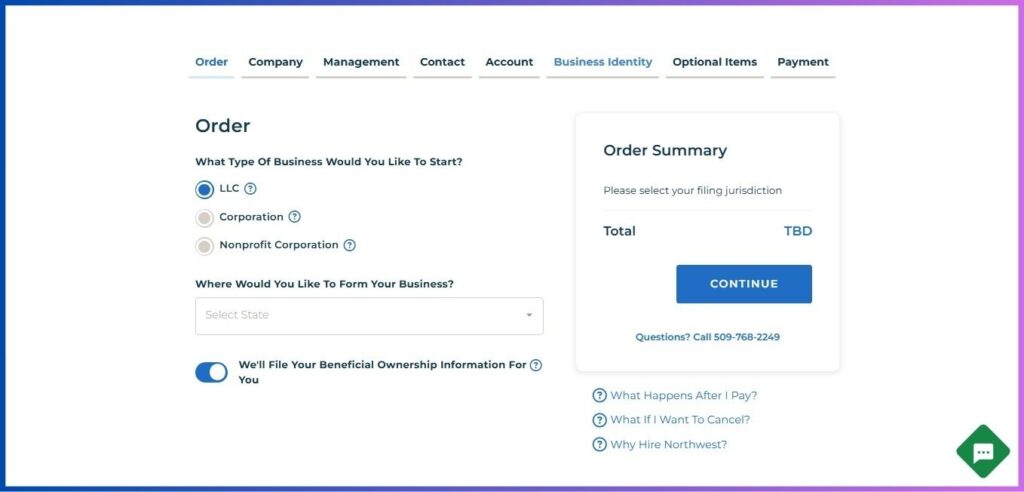

2. Begin Your LLC Formation

- Visit Northwest Registered Agent’s website

- Select “Start Your Business”

- Choose “LLC” as your business structure

- Pick your preferred state (Delaware, Wyoming, and Florida are popular among Filipino entrepreneurs)

- Opt in for EIN filing assistance

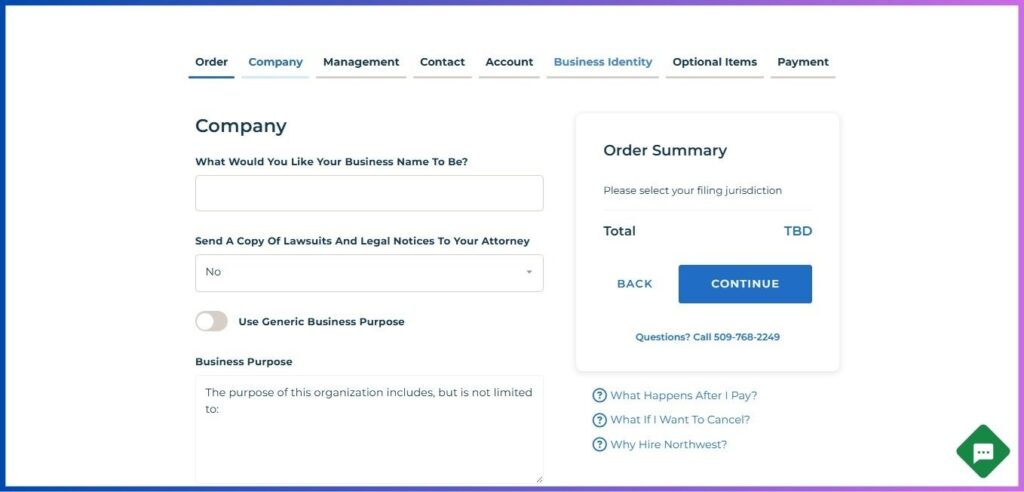

3. Company Information

- Select a unique LLC name (include “LLC” or “Limited Liability Company”)

- Consider adding a Filipino cultural twist or translation for brand identity

- Define your business purpose or use the generic option

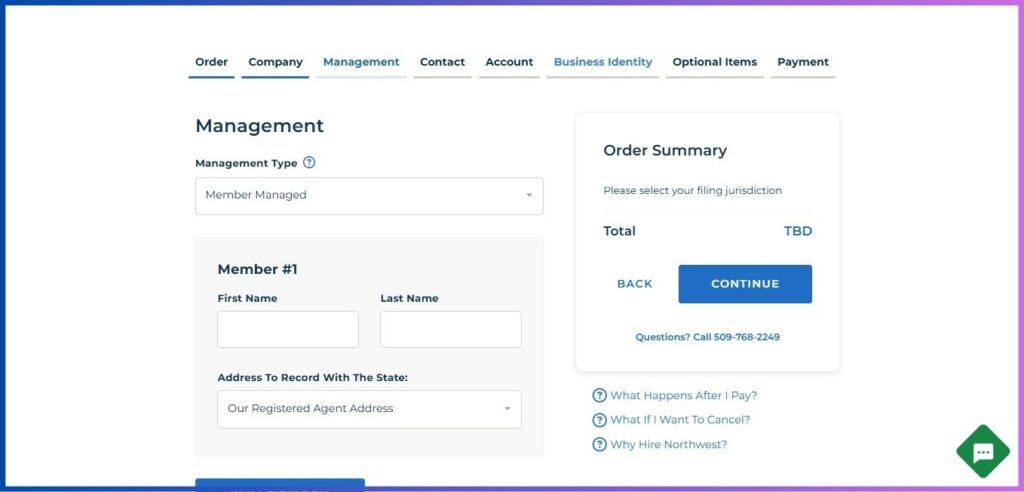

4. Management Structure

- Choose “Member Managed” (suitable for most Filipino entrepreneurs)

- Enter member details:

- Your name as it appears on your Philippine passport

- Utilize Northwest’s address for enhanced privacy

- Add additional Filipino or international members if applicable

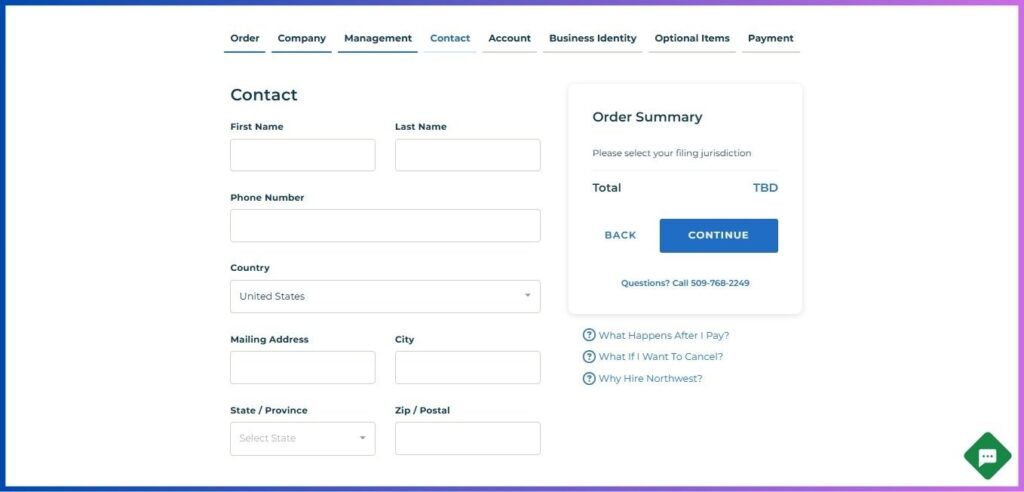

5. Contact Details

Provide your Philippines-based information:

- Full legal name

- Philippine phone number with country code (+63)

- Your physical address in the Philippines

- Additional contact preferences

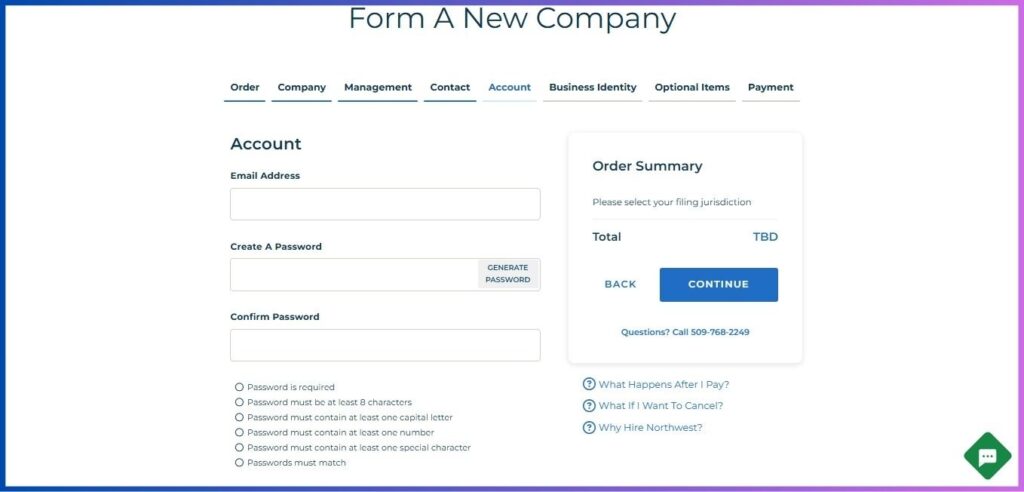

6. Create Your Secure Account

Set up your Northwest account:

- Enter your email address

- Create a strong password:

- Minimum 8 characters

- At least one capital letter

- At least one number

- One special character

- Confirm your password

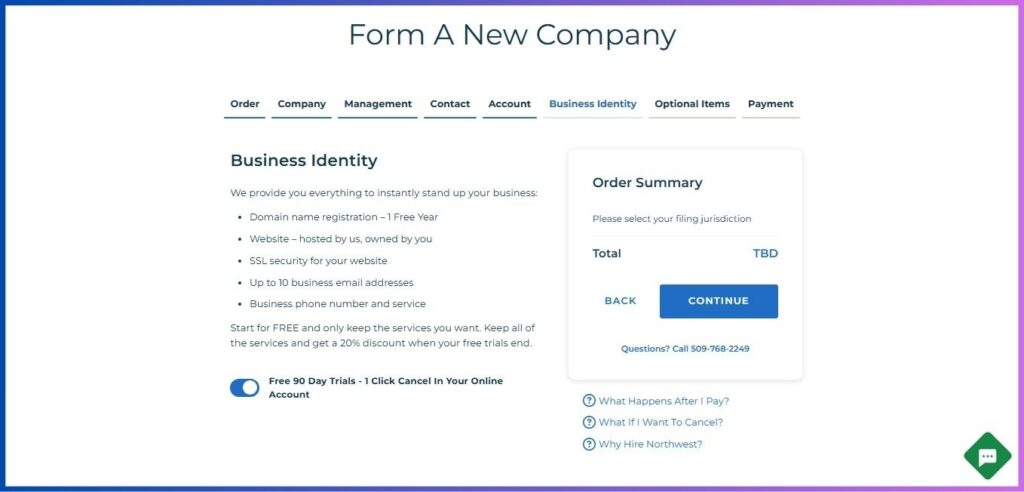

7. Business Identity Setup

Leverage Northwest’s Business Identity package:

- Free 1-year domain registration

- Professional website hosting

- SSL security certificate

- Up to 10 business email addresses

- US business phone service

Pro Tip for Filipino Entrepreneurs: These services are crucial for establishing a professional US presence while operating from the Philippines.

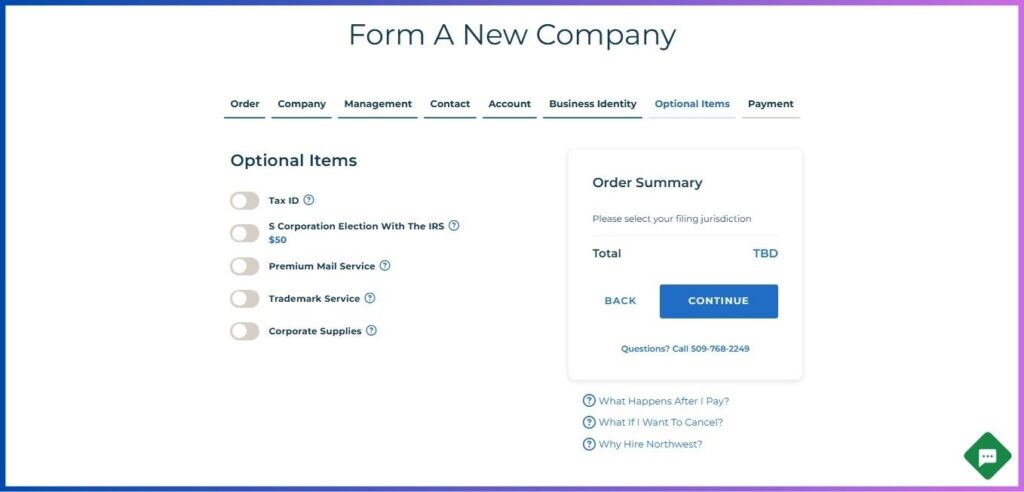

8. Additional Essential Services

Consider these for a seamless experience:

- EIN obtainment assistance

- Customized Operating Agreement

- Virtual office services for a US address

- Mail forwarding to your Philippine address

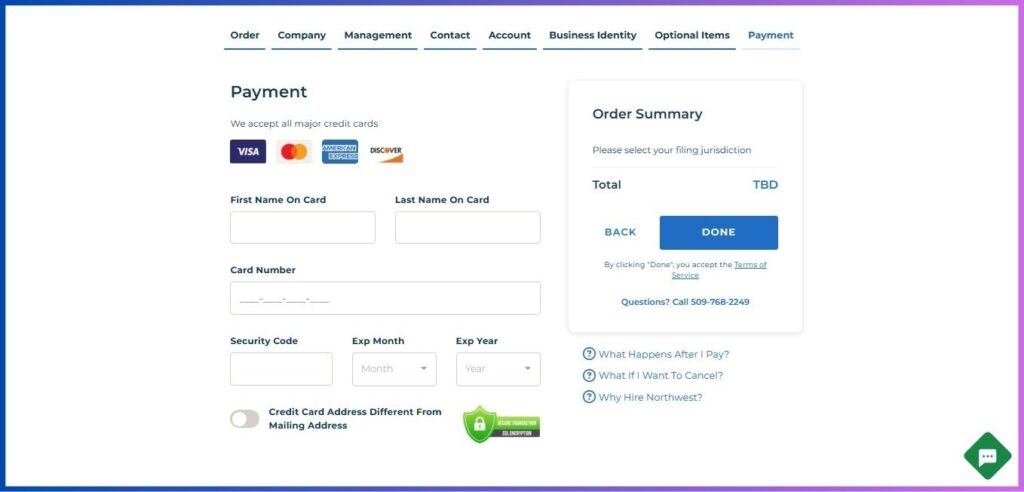

9. Review and Pay

- Thoroughly review all entered information

- Pay for the service using an international credit card or wire transfer

Post-Formation Steps for Your Philippines-Based US LLC

1. Obtain Your EIN

As a Filipino business owner:

- Utilize Northwest’s EIN service for convenience

- Alternatively, file Form SS-4 with the IRS

- Be prepared for potential IRS inquiries regarding international ownership

2. Banking Solutions

For Filipino LLC owners:

- Research US banks welcoming international LLC owners

- Prepare necessary documents:

- Philippine passport

- LLC formation documents

- EIN confirmation

- Proof of Philippine address

- Bank reference letters (if available)

Related: How to Form a US LLC from Asia

3. Compliance Requirements

Ensure ongoing compliance from the Philippines:

- File the Beneficial Ownership Information (BOI) report (mandatory from 2024)

- Submit annual reports to the state

- Maintain accurate, separate financial records for US operations

- Stay informed about US-Philippines tax treaty implications

Strategic Tips for Filipino US LLC Owners

Business Operations

Time Zone Management:

- Navigate the 13-16 hour time difference efficiently

- Schedule US calls during your evening or early morning

- Leverage automation for 24/7 business visibility

Payment Solutions:

- Establish international payment gateways

- Consider multi-currency accounting for ease

- Factor in currency conversion costs

Cultural Ambassadorship:

- Bridge the gap with your understanding of both Filipino and US business cultures

- Utilize your English proficiency as a competitive edge

- Craft unique value propositions blending Filipino creativity with US market insights

Tax Considerations

US Tax Obligations:

- Understand and comply with US tax requirements

- Explore benefits under the US-Philippines tax treaty

- Maintain separate accounting for US operations

Philippine Tax Requirements:

- Properly report foreign income

- Understand currency repatriation regulations

- Consult with tax experts familiar with both jurisdictions

Related: How to Form a US LLC from Singapore

Unlocking Growth: Opportunities for Your Philippines-Based US LLC

E-commerce Expansion:

- Integrate with major US e-commerce platforms

- Showcase Filipino products to the US market

- Leverage the Philippines’ rich cultural heritage in your branding

Service Excellence:

- Offer specialized consulting services

- Provide cultural liaison services between the US and Philippines

- Foster US-Philippines business connections

Innovation Hub:

- Tap into the Philippines’ growing tech sector

- Offer offshore development services to US clients

- Pave the way for US-Philippines tech collaborations

Conclusion: Embark on Your US Business Journey from Philippines

Forming a US LLC from Philippines is a visionary step, offering unparalleled access to the global market. By following this tailored guide, you’re not just establishing a business entity – you’re forging a pathway between two vibrant economies, poised to capitalize on the immense opportunities awaiting Filipino entrepreneurs in the US.

Ready to embark on your US LLC formation journey from Philippines? Start your application with Northwest Registered Agent today and transform your business landscape.

Disclosure: We may earn commission for purchases that are made by visitors on this site at no additional cost on your end. All information is for educational purposes and is not intended for financial advice. Read our affiliate disclosure.