How to Form a US LLC from Seychelles

For entrepreneurs in Seychelles looking to expand their business horizons, forming a Limited Liability Company (LLC) in the United States presents a unique opportunity.

This comprehensive guide will walk you through the process of creating a US LLC while residing in Seychelles, leveraging Northwest Registered Agent’s services to simplify the international business formation process.

Why Seychelles Entrepreneurs Should Consider Forming a US LLC

The strategic advantages of forming a US LLC from Seychelles include:

Global Market Access

- Direct access to the world’s largest consumer market

- Easier integration with US-based suppliers and partners

- Enhanced ability to serve international clients

Financial Benefits

- Access to US payment processors and financial services

- Ability to accept multiple currencies

- Potential tax advantages through US-Seychelles business structures

Business Credibility

- Improved reputation with international clients

- Enhanced trust from US-based partners

- Professional US business presence

Digital Commerce Advantages

- Access to US-based e-commerce platforms

- Integration with major payment gateways

- Ability to sell on US marketplaces

Related: How to Form a US LLC from Rwanda

Prerequisites for Seychelles Residents

Before initiating the LLC formation process, ensure you have:

- Valid Seychelles passport

- Proof of residence in Seychelles

- International payment method (credit card or wire transfer capability)

- Stable internet connection for online documentation

- Basic understanding of US business requirements

- Budget for formation fees and ongoing services

Step-by-Step Guide: How to Form a US LLC from Seychelles

1. Select Your Registered Agent

Start with choosing Northwest Registered Agent as your registered agent service provider:

- They specialize in international business formations

- Offer comprehensive support for non-US residents

- Provide privacy protection services

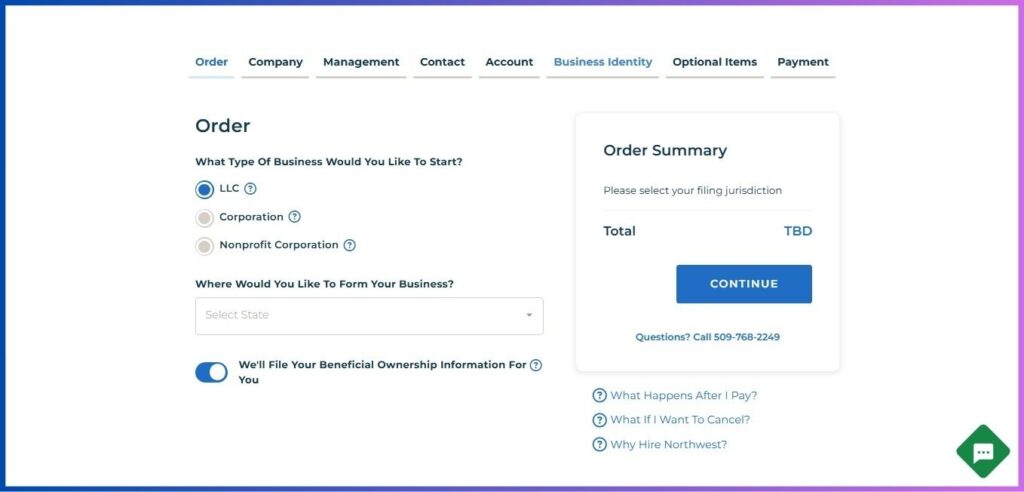

2. Begin the Formation Process

- Navigate to Northwest Registered Agent’s website

- Click “Start Your Business”

- Select “LLC” as your business structure

- Choose your preferred state for LLC formation

- Consider factors like:

- Tax implications

- Business regulations

- State filing fees

- Annual compliance requirements

- Consider factors like:

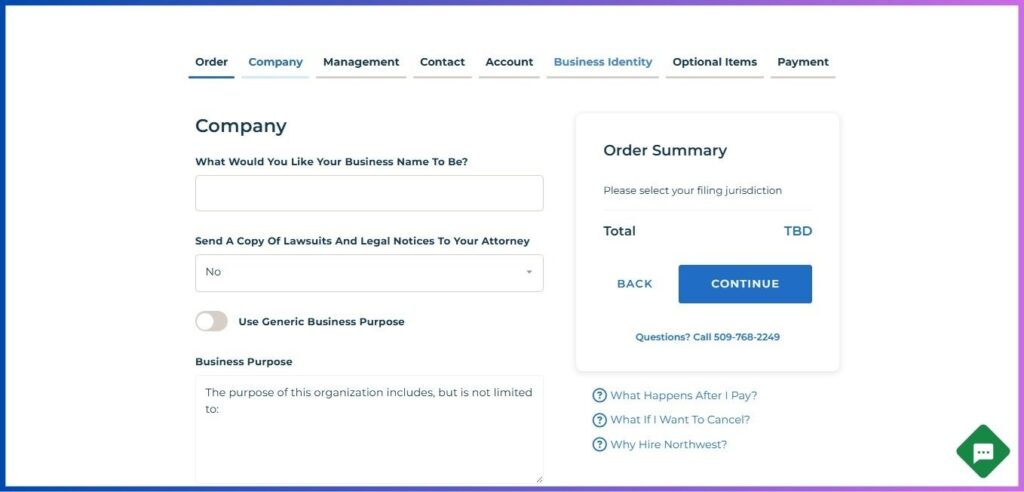

3. Company Information Setup

- Choose your LLC name

- Must be unique in your chosen state

- Include “LLC” or “Limited Liability Company”

- Avoid restricted words

- Specify your business purpose

- Use a general purpose clause for flexibility

- Or define specific business activities

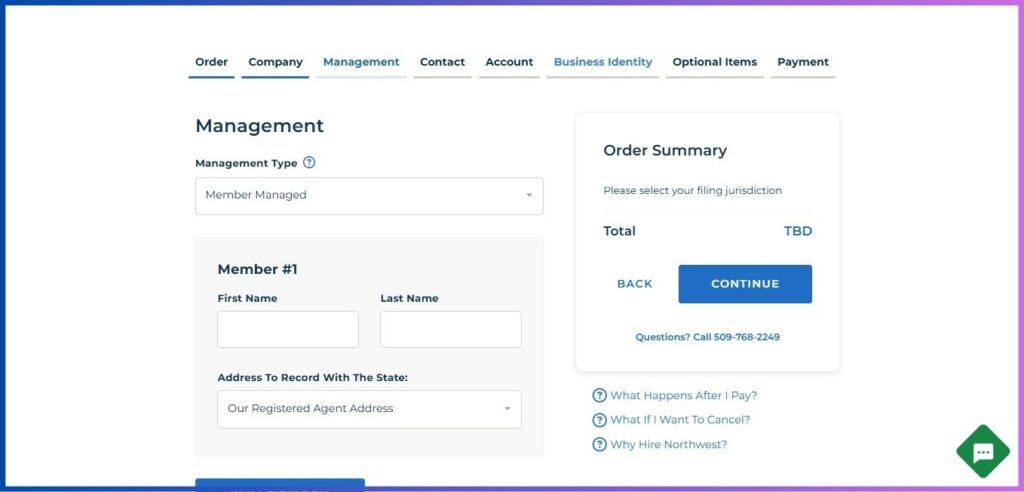

4. Management Structure

- Select “Member Managed” (recommended for most international LLCs)

- Enter member information:

- Use your Seychelles legal name

- Provide Northwest’s address for privacy

- Add additional members if applicable

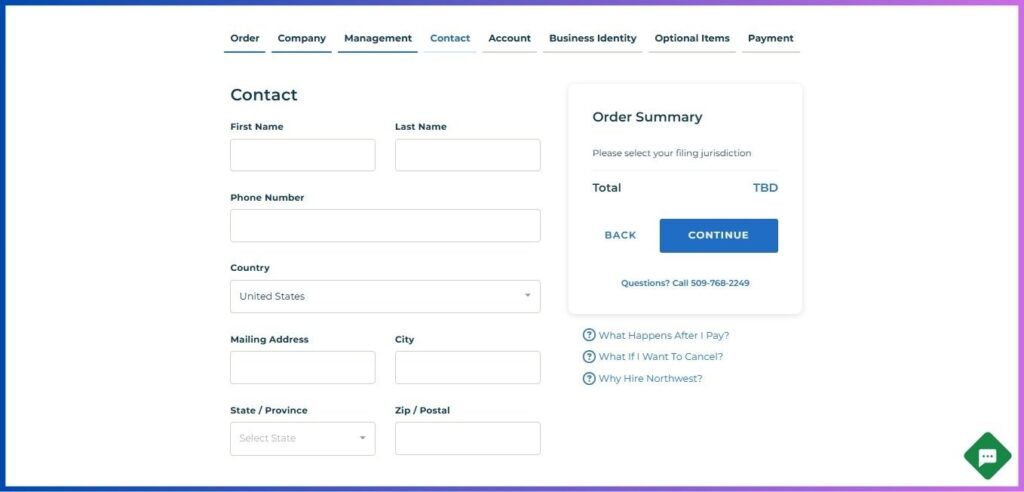

5. Contact Information

- Enter your Seychelles contact details:

- Full legal name

- Email address

- Phone number with country code (+248)

- Physical address in Seychelles

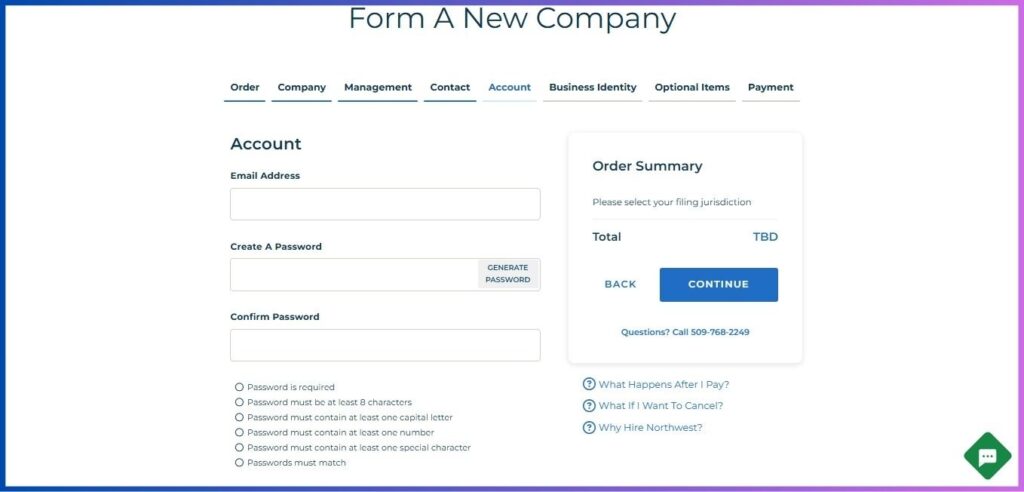

6. Account Creation

- Set up your Northwest account:

- Provide a valid email address

- Create a strong password meeting security requirements

- Enable two-factor authentication (recommended)

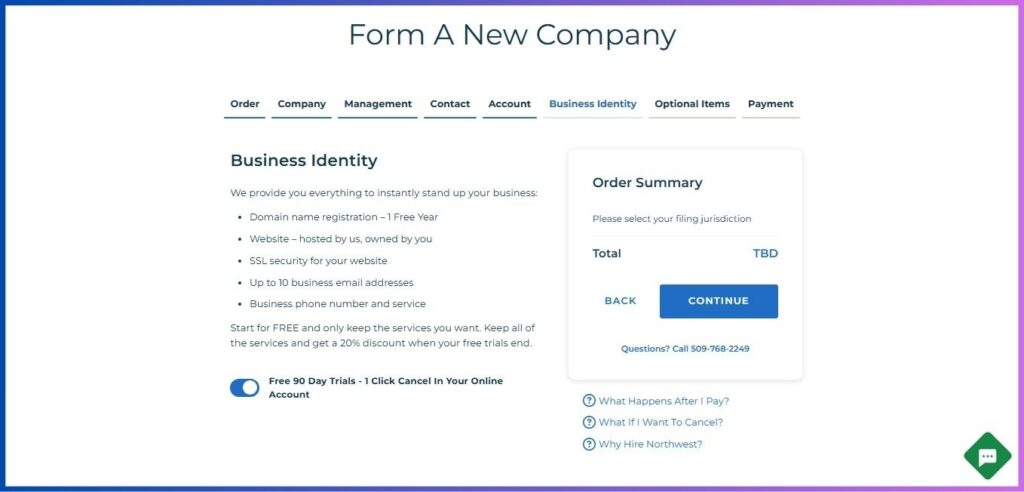

7. Business Identity Package

Consider Northwest’s comprehensive business identity services:

- Free domain name registration (1 year)

- Professional website hosting

- SSL security certificate

- Business email addresses (up to 10)

- US business phone number

- Particularly valuable for Seychelles businesses

- Helps maintain a professional US presence

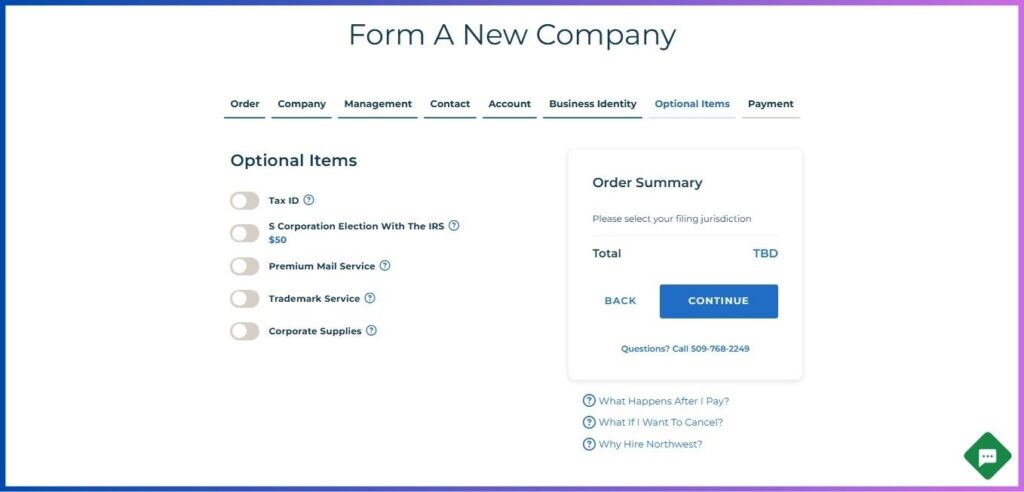

8. Additional Services Selection

Choose services essential for international operations:

- EIN obtainment assistance

- Virtual office services

- Mail forwarding

- Document apostille services

- Operating Agreement customization

Post-Formation Steps for Seychelles Business Owners

1. Obtain Your EIN

Special considerations for Seychelles residents:

- Use Northwest’s EIN service (recommended)

- Or file Form SS-4 directly with the IRS

- Prepare for potentially longer processing times

2. Banking Solutions

Options for Seychelles business owners:

- Traditional US banks (may require in-person visits)

- Digital banking solutions

- International business banking services

- Consider multi-currency accounts

Related: How to Form a US LLC from Senegal

3. Tax Compliance

Understanding your tax obligations:

- US tax requirements

- Annual LLC tax returns

- State-specific tax obligations

- International tax reporting

- Seychelles tax considerations

- Double taxation agreements

- International business reporting

- Local tax implications

4. Beneficial Ownership Information

New requirements from 2024:

- BOI filing requirements

- Northwest’s assistance with compliance

- Ongoing reporting obligations

Special Considerations for Seychelles-Based LLC Owners

1. Time Zone Management

- Seychelles is 8-11 hours ahead of US time zones

- Strategies for managing international operations:

- Set overlapping business hours

- Use automated systems

- Implement efficient communication protocols

2. Currency Management

- Managing SCR to USD conversions

- International payment solutions

- Currency risk mitigation strategies

3. Digital Operations

Tips for running your US LLC from Seychelles:

- Cloud-based management systems

- Virtual team collaboration tools

- Digital document signing services

- Remote banking solutions

4. Legal Compliance

Maintaining dual-jurisdiction compliance:

- US LLC requirements

- Seychelles business regulations

- International trade laws

- Foreign investment regulations

Related: How to Form a US LLC from Sudan

Building Success: Your US LLC from Seychelles

1. Marketing Strategies

- Leveraging your US presence

- Building trust with US customers

- International branding considerations

2. Growth Opportunities

- US market expansion strategies

- Cross-border business development

- Strategic partnerships

3. Operational Excellence

- Remote business management best practices

- Quality control across borders

- Customer service solutions

Conclusion

Forming a US LLC from Seychelles represents a strategic move toward international business expansion. While the process involves multiple steps, the benefits of establishing a US business presence can significantly outweigh the initial setup challenges.

With proper planning and the support of Northwest Registered Agent, Seychelles entrepreneurs can successfully establish and manage their US LLC while maintaining operations from their island nation.

Remember that while forming a US LLC opens many doors, it’s essential to maintain compliance with both US and Seychelles regulations. Consider working with legal and tax professionals familiar with both jurisdictions to ensure your business structure optimally serves your international business goals.

By following this comprehensive guide, you’ll be well-equipped to navigate the process of how to form a US LLC from Seychelles, setting the foundation for successful international business operations.

Disclosure: We may earn commission for purchases that are made by visitors on this site at no additional cost on your end. All information is for educational purposes and is not intended for financial advice. Read our affiliate disclosure.