How to Form a US LLC from Togo

For entrepreneurs in Togo looking to expand their business horizons, forming a Limited Liability Company (LLC) in the United States represents a significant opportunity. This comprehensive guide will walk you through the process of how to form a US LLC from Togo using Northwest Registered Agent, making your international business dreams a reality.

Why Should Togolese Entrepreneurs Form a US LLC?

Before diving into the formation process, let’s explore the unique benefits of forming a US LLC from Togo:

Market Access

- Tap into the world’s largest consumer market

- Access to US-based suppliers and distributors

- Easier integration with US e-commerce platforms

Financial Advantages

- Access to US payment processors

- Ability to accept multiple currencies

- Potential for US business loans and credit

- Protection from CFA franc fluctuations

Business Credibility

- Enhanced reputation with international clients

- US business address and phone number

- Professional corporate image

Digital Commerce Benefits

- Access to US-based digital marketing platforms

- Integration with major e-commerce marketplaces

- US-based payment processing capabilities

Related: How to Form a US LLC from Sierra Leone

Prerequisites for Togolese Business Owners

Before starting your LLC formation journey, ensure you have:

- Valid Togolese passport

- Proof of physical address in Togo

- Funds for formation fees (in USD)

- Basic understanding of US business practices

- Access to international payment methods

- Reliable internet connection for managing your LLC

Step-by-Step Guide to Forming a US LLC from Togo

1. Select Your Registered Agent

Begin by choosing Northwest Registered Agent as your registered agent service. They offer comprehensive support for international business owners, including:

- Document handling

- Compliance monitoring

- Privacy protection

- Business address services

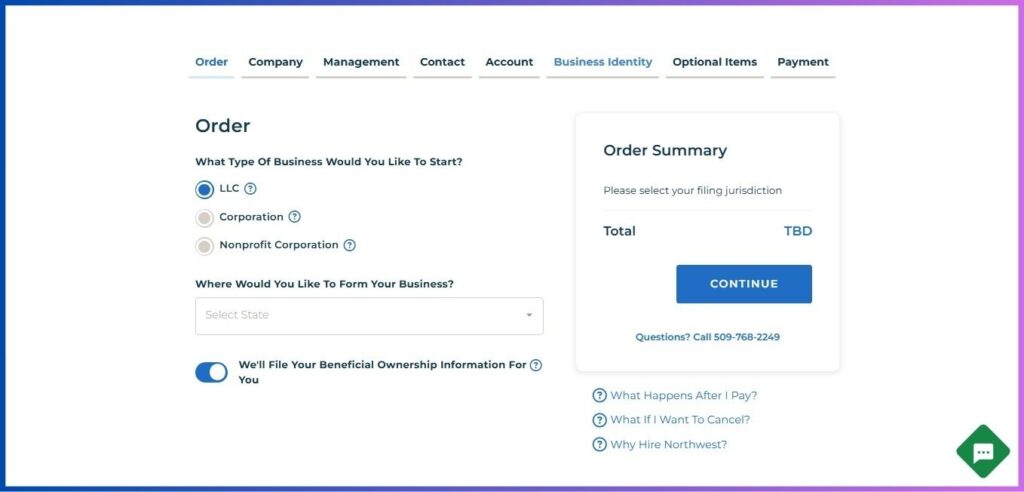

2. Start the Formation Process

- Navigate to Northwest Registered Agent’s website

- Click “Start Your Business”

- Choose “LLC” as your business structure

- Select your preferred state (consider factors like taxes and regulations)

- Opt in for BOI filing assistance

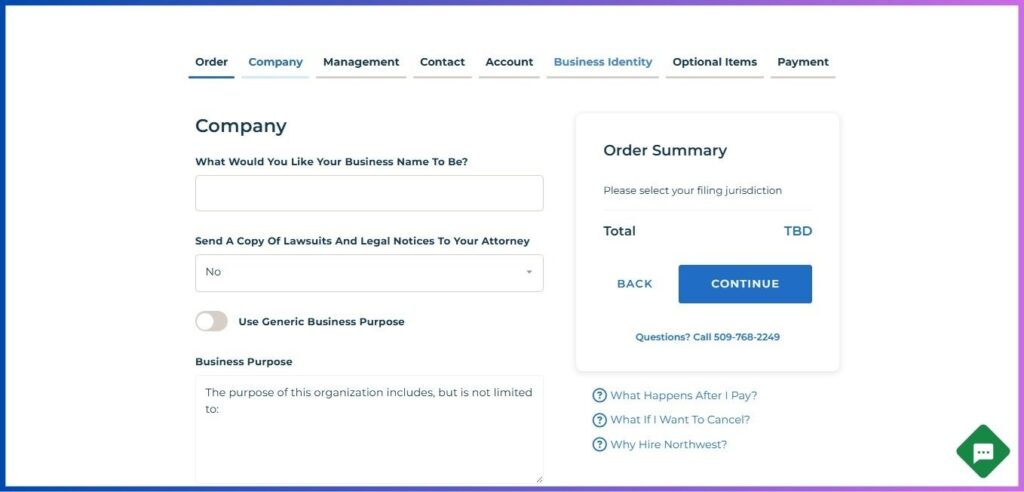

3. Enter Company Details

- Choose your LLC name (ensure it’s unique and includes “LLC”)

- Specify your business purpose

- Consider using Northwest’s address for privacy

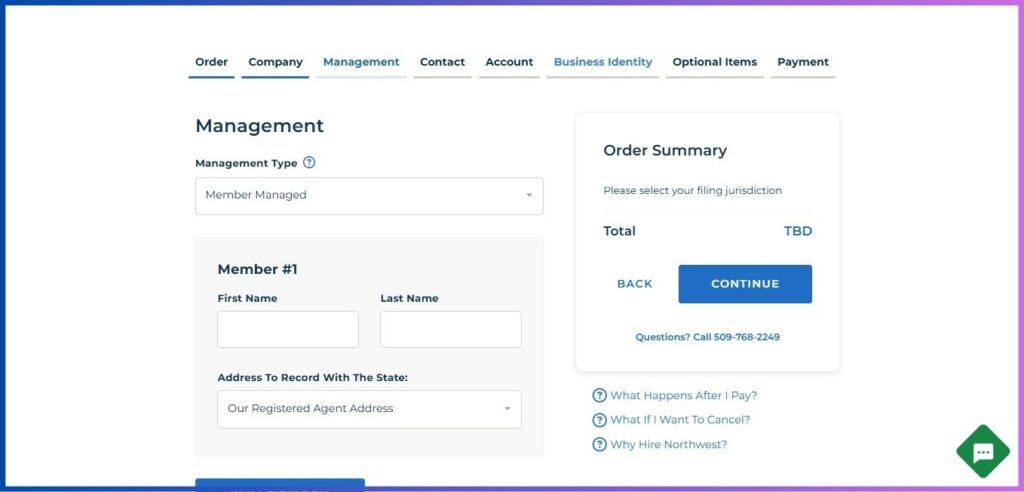

4. Set Up Management Structure

- Select “Member Managed” (recommended for most Togolese entrepreneurs)

- Enter member information:

- Name as shown on passport

- Address (can use Northwest’s address)

- Role in the company

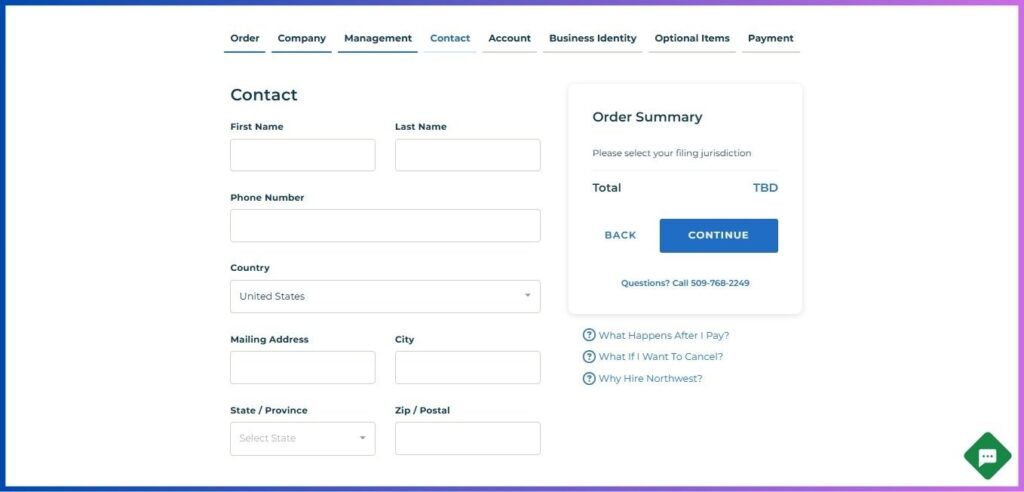

5. Provide Contact Information

- Enter your full name

- Provide your Togolese address

- Include your phone number with country code (+228)

- Use a reliable email address

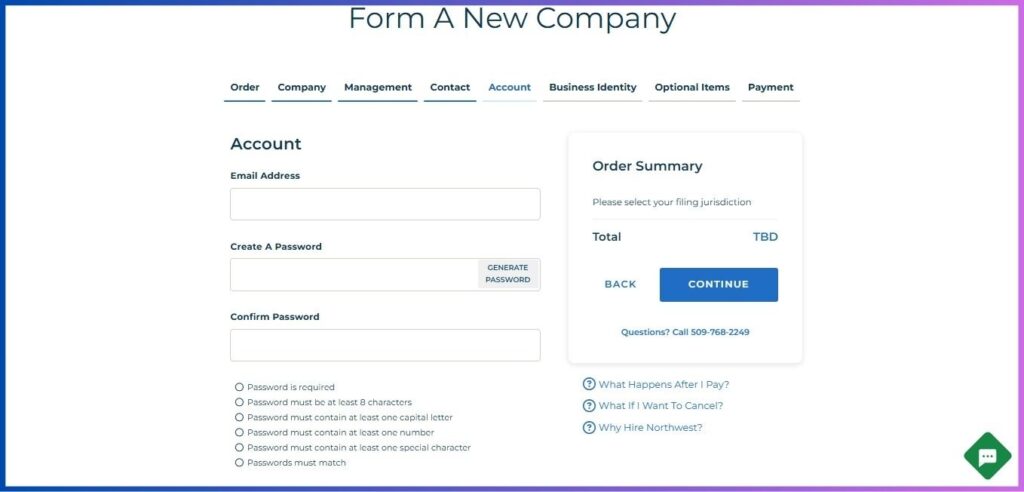

6. Create Your Account

- Enter a valid email address

- Create a strong password meeting these requirements:

- Minimum 8 characters

- At least one capital letter

- At least one number

- One special character

- Confirm your password

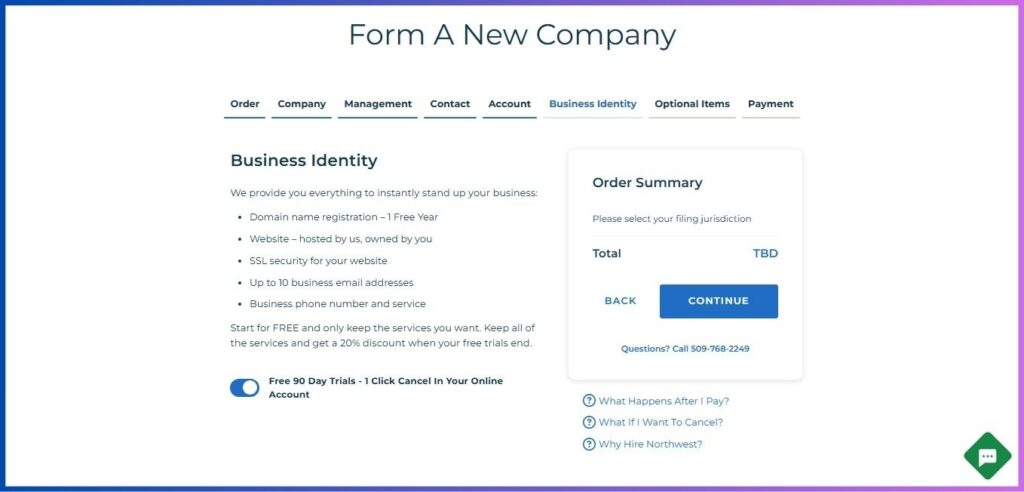

7. Choose Business Identity Package

Take advantage of Northwest’s Business Identity services:

- Free domain name (1 year)

- Custom website hosting

- SSL security certificate

- Business email addresses (up to 10)

- US phone number with forwarding service

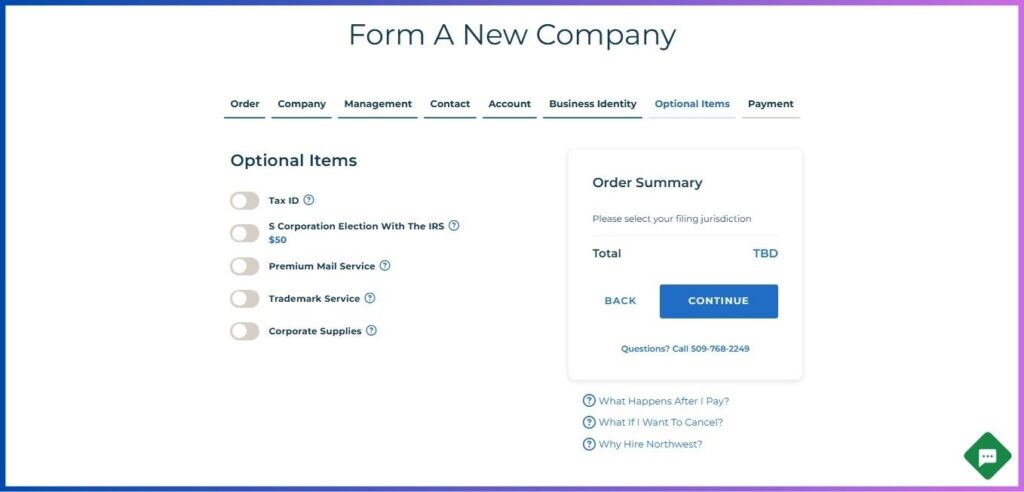

8. Select Additional Services

Consider these essential services:

- EIN obtainment assistance

- Operating Agreement customization

- Virtual office services

- Mail forwarding

- Business license research

Post-Formation Steps for Togolese LLC Owners

1. Obtain Your EIN

As a Togolese business owner:

- Use Northwest’s EIN service (recommended)

- Or file Form SS-4 directly with the IRS

- Maintain proper documentation for both US and Togolese authorities

2. Establish Your Business Presence

- Set up your digital presence:

- Configure your business email

- Set up your US phone number

- Launch your business website

- Create necessary business documents:

- Operating Agreement

- Business plans

- Banking resolutions

3. Open a US Bank Account

Navigate the banking requirements:

- Research banks accepting non-resident LLC owners

- Prepare required documentation:

- LLC formation documents

- EIN confirmation

- Passport

- Proof of address

- Business plan

Related: How to Form a US LLC from Tunisia

4. Understand Tax Obligations

Manage your tax responsibilities:

- US tax obligations:

- Annual LLC tax returns

- Form 5472 for foreign-owned LLCs

- State-specific requirements

- Togolese tax considerations:

- Income reporting requirements

- International business regulations

- Double taxation treaties

5. Maintain Compliance

Stay compliant in both jurisdictions:

- File Beneficial Ownership Information (BOI)

- Submit annual reports

- Keep registered agent active

- Maintain proper business records

Special Considerations for Togolese LLC Owners

1. Cultural Bridge

- Understand US business culture

- Navigate time zone differences (Togo to US)

- Develop effective communication strategies

2. Financial Management

- Plan for currency exchange fluctuations

- Establish reliable money transfer methods

- Consider international tax implications

3. Business Operations

- Implement remote management systems

- Utilize digital tools for communication

- Set up efficient payment processing

4. Legal Considerations

- Understand visa requirements for US visits

- Comply with both US and Togolese regulations

- Maintain proper documentation in both countries

Tips for Success

Language Considerations

- Consider English language training

- Use professional translation services

- Keep business documents bilingual

Time Management

- Plan around time zone differences

- Set clear communication schedules

- Use automation tools when possible

Banking Strategy

- Maintain accounts in both countries

- Use reliable international transfer services

- Consider multiple currency management

Growth Planning

- Start with essential services

- Scale gradually

- Monitor market opportunities

Conclusion

Forming a US LLC from Togo is a strategic move that can significantly expand your business opportunities. While the process requires careful planning and attention to detail, the potential benefits make it a worthwhile investment for Togolese entrepreneurs.

Related: How to Form a US LLC from Zambia

Remember that forming a US LLC is just the beginning of your international business journey. Success requires ongoing commitment to compliance, effective management, and strategic growth planning. With proper preparation and the right support services, your US LLC can become a powerful platform for achieving your international business goals.

Disclosure: We may earn commission for purchases that are made by visitors on this site at no additional cost on your end. All information is for educational purposes and is not intended for financial advice. Read our affiliate disclosure.