How to Form a US LLC from Tunisia

Looking to expand your business horizons beyond Tunisia? Forming a US LLC from Tunisia can be your gateway to the American market. This comprehensive guide will walk you through the process of establishing your US LLC while residing in Tunisia, using Northwest Registered Agent as your trusted formation service.

Why Should Tunisian Entrepreneurs Form a US LLC?

As a Tunisian business owner, forming a US LLC offers several strategic advantages:

Global Market Access

- Tap into the world’s largest consumer market

- Access US-based suppliers and distributors

- Leverage the strong US e-commerce infrastructure

Enhanced Business Credibility

- Build trust with international clients

- Access US-based payment processors

- Establish a recognized business structure

Financial Benefits

- Accept payments in USD

- Access US business banking services

- Potentially reduce currency exchange complications

Legal Advantages

- Asset protection through limited liability

- Clear legal framework

- Simplified business structure

Related: How to Form a US LLC from Togo

Prerequisites for Tunisian Residents

Before beginning the LLC formation process, ensure you have:

- Valid Tunisian passport

- Proof of residence in Tunisia

- Sufficient funds for formation fees

- International payment method (credit card or wire transfer capability)

- Basic understanding of US business operations

- Valid email address for business communications

Step-by-Step Guide to Forming a US LLC from Tunisia

1. Select Your Registered Agent

Northwest Registered Agent is recommended for their:

- Experience with international clients

- Comprehensive support services

- Privacy protection features

- Competitive pricing

- Excellent customer service

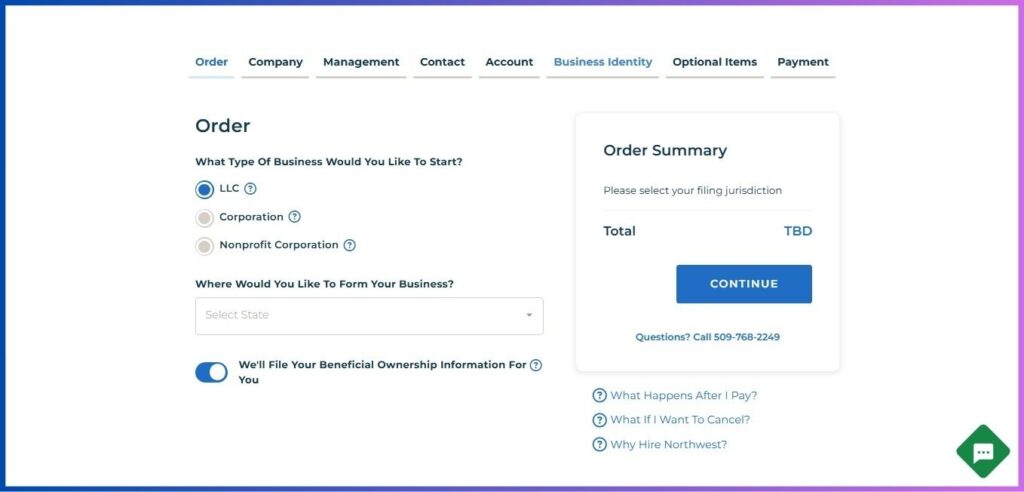

2. Begin the Formation Process

- Navigate to Northwest Registered Agent’s website

- Click “Start Your Business”

- Select “LLC” as your business structure

- Choose your formation state (consider factors like:)

- Tax implications

- Business regulations

- Formation costs

- Ongoing compliance requirements

- Opt in for BOI (Beneficial Ownership Information) filing service

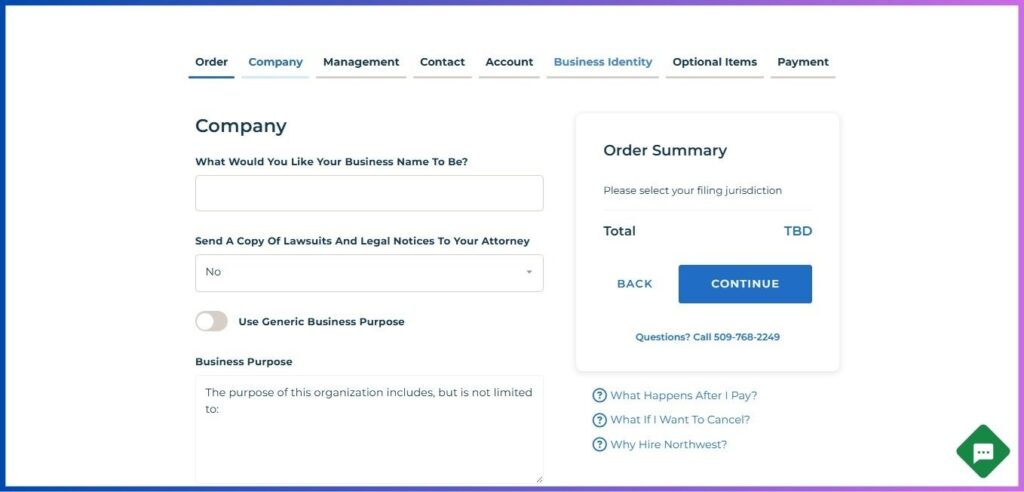

3. Name Your LLC

- Choose a unique business name that:

- Ends with “LLC” or “Limited Liability Company”

- Is available in your chosen state

- Reflects your business identity

- Is easy for English speakers to pronounce

- Consider trademark availability

- Check domain name availability

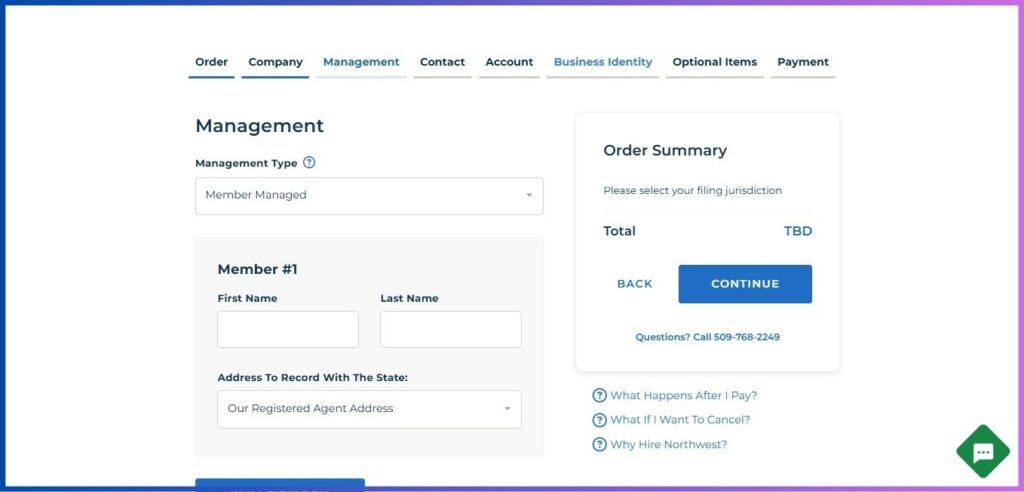

4. Set Up Management Structure

- Choose your management type:

- Member-managed (recommended for small businesses)

- Manager-managed (for larger operations)

- Enter member information:

- Name as it appears on your passport

- Address (can use Northwest’s address)

- Ownership percentage

- Role in the company

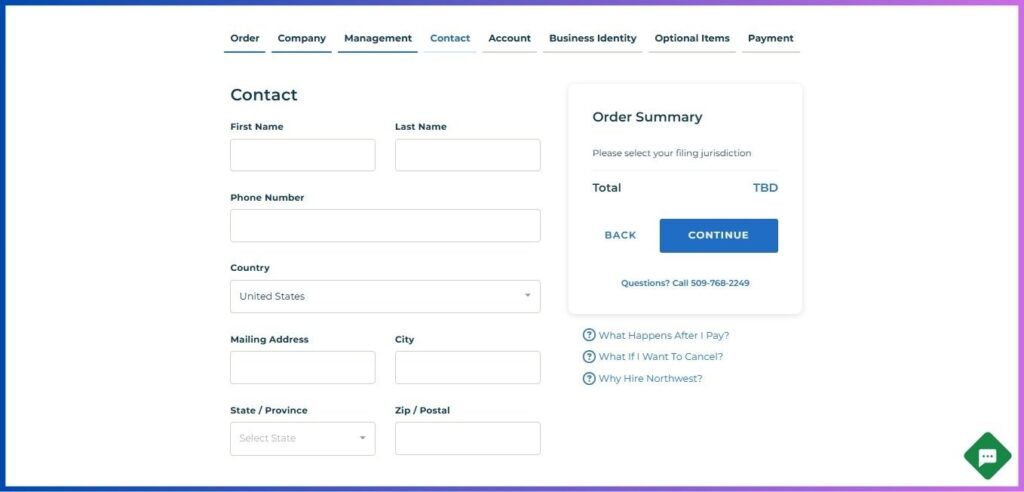

5. Provide Company Details

Enter your LLC information:

- Business purpose (specific or general)

- Principal business address

- Mailing address

- Management structure selection

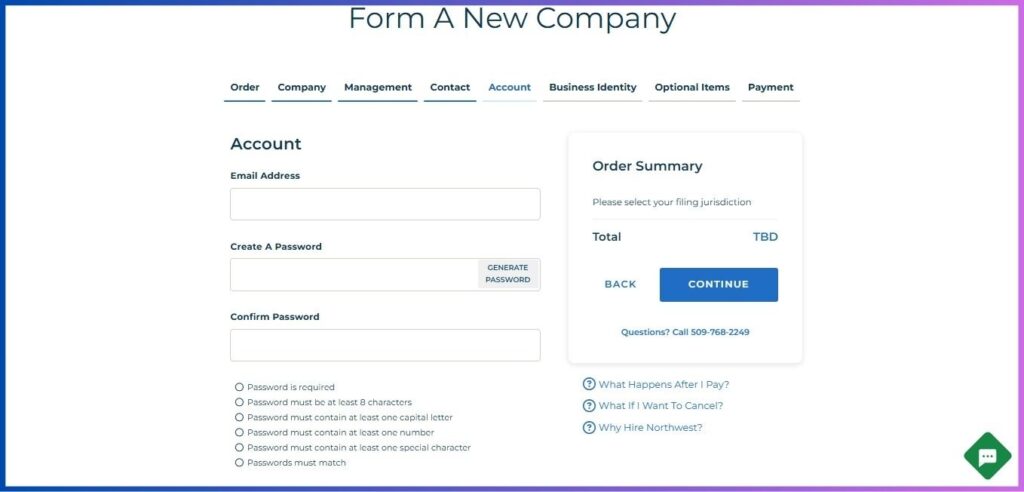

6. Create Your Account

Set up your Northwest account:

- Enter your email address

- Create a strong password meeting these requirements:

- Minimum 8 characters

- At least one capital letter

- At least one number

- At least one special character

- Verify your password

- Enable two-factor authentication (recommended)

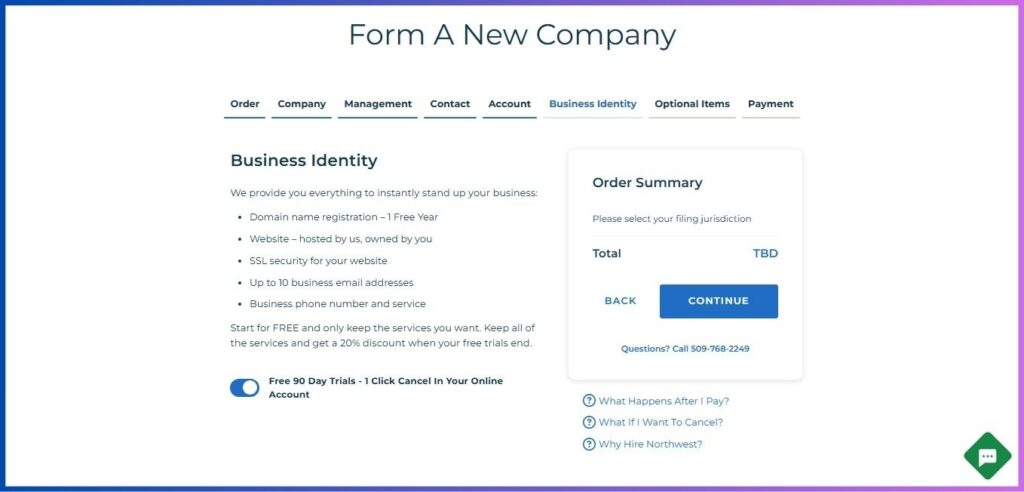

7. Configure Business Identity

Take advantage of Northwest’s Business Identity package:

- Free domain name registration (1 year)

- Professional website hosting

- SSL security certificate

- Business email addresses (up to 10)

- US business phone number and service

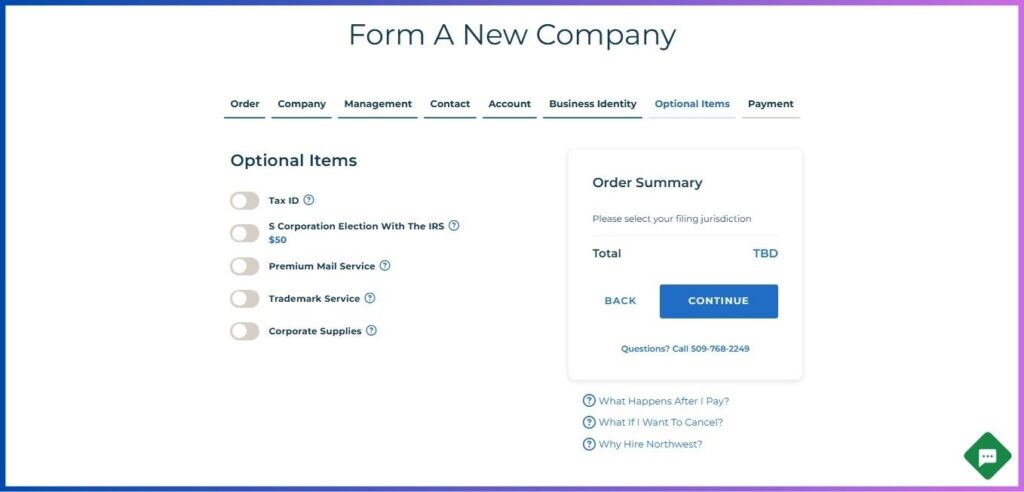

8. Select Additional Services

Consider these valuable add-ons:

- EIN obtainment service

- Operating Agreement customization

- Banking resolution

- Certified copies of formation documents

- Certificate of Good Standing

Post-Formation Essential Steps

1. Obtain Your EIN

As a Tunisian resident:

- Use Northwest’s EIN service (recommended)

- Or file Form SS-4 directly with the IRS

- Prepare for possible additional documentation requirements

2. Establish Banking Presence

Options for Tunisian LLC owners:

- Traditional US Banks:

- Research international-friendly banks

- Prepare required documentation

- Plan for possible in-person visits

- Digital Banking Solutions:

- Consider fintech alternatives

- Understand limitations and benefits

- Compare fees and services

Related: How to Form a US LLC from Zambia

3. Set Up Payment Processing

- Choose payment processors that:

- Accept international business owners

- Integrate with your business model

- Offer competitive rates

- Consider multiple options:

- PayPal

- Stripe

- Square

- International merchant accounts

4. Understand Tax Obligations

Critical considerations for Tunisian LLC owners:

- US Tax Requirements:

- Annual tax returns

- Quarterly estimated taxes

- State-specific requirements

- Tunisia-US Tax Implications:

- Double taxation agreements

- Foreign income reporting

- Currency conversion considerations

5. Maintain Compliance

Regular maintenance tasks:

- Annual reports

- Franchise tax payments

- BOI updates

- Registered agent renewal

- License renewals (if applicable)

Special Considerations for Tunisian Entrepreneurs

Cultural and Business Practices

- Time Zone Management:

- Plan for 6-7 hour time difference

- Set clear communication windows

- Use scheduling tools effectively

- Language Considerations:

- Ensure all official documents are in English

- Consider professional translation services

- Maintain clear communication channels

Banking and Finance

- Currency Management:

- Monitor exchange rates

- Plan for currency conversion costs

- Consider multi-currency accounts

- Payment Solutions:

- Setup international wire transfers

- Establish reliable payment channels

- Consider currency hedging strategies

Legal and Compliance

- Visa Requirements:

- Understand B1/B2 visa requirements

- Plan for possible US visits

- Maintain proper documentation

- Local Regulations:

- Comply with Tunisian foreign business laws

- Understand currency export regulations

- Maintain proper local registrations

Tips for Success

Documentation Management

- Keep digital copies of all documents

- Maintain organized records

- Use cloud storage solutions

Professional Network

- Connect with other Tunisian US LLC owners

- Join relevant business associations

- Build relationships with US partners

Business Operations

- Develop clear operating procedures

- Create efficient communication systems

- Implement robust accounting practices

Related: How to Form a US LLC from Zimbabwe

Conclusion

Forming a US LLC from Tunisia is a strategic move that can significantly expand your business opportunities. While the process requires careful planning and attention to detail, the benefits of accessing the US market make it a worthwhile investment for many Tunisian entrepreneurs.

Remember that success requires:

- Thorough preparation

- Attention to compliance requirements

- Professional support when needed

- Ongoing commitment to maintaining your LLC

By following this guide and working with Northwest Registered Agent, you can successfully establish your US business presence while managing operations from Tunisia. This expansion can open new doors, enhance your global credibility, and create exciting opportunities for growth in the American market.

Next Steps

Ready to start your US LLC formation journey from Tunisia? Begin by:

- Gathering required documents

- Researching optimal formation states

- Preparing your business plan

- Contacting Northwest Registered Agent

- Starting your LLC formation application

Take the first step toward expanding your business into the US market today!

Disclosure: We may earn commission for purchases that are made by visitors on this site at no additional cost on your end. All information is for educational purposes and is not intended for financial advice. Read our affiliate disclosure.